Rice Hall James & Associates LLC lowered its position in Stride, Inc. (NYSE:LRN - Free Report) by 3.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 831,850 shares of the company's stock after selling 32,068 shares during the quarter. Stride makes up approximately 3.8% of Rice Hall James & Associates LLC's portfolio, making the stock its biggest position. Rice Hall James & Associates LLC owned about 1.92% of Stride worth $70,965,000 at the end of the most recent quarter.

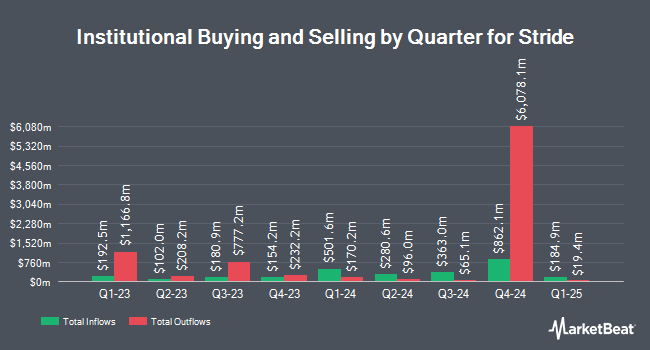

A number of other institutional investors and hedge funds have also bought and sold shares of LRN. Mirae Asset Global Investments Co. Ltd. lifted its position in Stride by 17.0% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 31,262 shares of the company's stock valued at $1,971,000 after purchasing an additional 4,546 shares during the last quarter. Nordea Investment Management AB boosted its position in Stride by 48.9% during the 1st quarter. Nordea Investment Management AB now owns 105,630 shares of the company's stock valued at $6,698,000 after buying an additional 34,682 shares during the period. Texas Permanent School Fund Corp grew its holdings in Stride by 1.4% in the 1st quarter. Texas Permanent School Fund Corp now owns 34,831 shares of the company's stock worth $2,196,000 after acquiring an additional 496 shares during the last quarter. ClariVest Asset Management LLC increased its position in shares of Stride by 67.3% in the first quarter. ClariVest Asset Management LLC now owns 30,794 shares of the company's stock valued at $1,942,000 after acquiring an additional 12,393 shares during the period. Finally, Swiss National Bank raised its stake in shares of Stride by 1.0% during the first quarter. Swiss National Bank now owns 81,300 shares of the company's stock valued at $5,126,000 after acquiring an additional 800 shares during the last quarter. 98.24% of the stock is currently owned by institutional investors.

Insider Activity

In related news, Director Todd Goldthwaite sold 8,028 shares of the company's stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $91.54, for a total value of $734,883.12. Following the sale, the director now owns 85,058 shares in the company, valued at $7,786,209.32. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Company insiders own 2.76% of the company's stock.

Analysts Set New Price Targets

Several analysts recently issued reports on LRN shares. StockNews.com cut Stride from a "buy" rating to a "hold" rating in a research note on Wednesday, October 23rd. BMO Capital Markets lifted their price objective on Stride from $84.00 to $88.00 and gave the stock an "outperform" rating in a research report on Thursday, October 24th. Citigroup upped their target price on Stride from $90.00 to $94.00 and gave the company a "neutral" rating in a report on Tuesday. Canaccord Genuity Group began coverage on shares of Stride in a report on Thursday, August 8th. They issued a "buy" rating and a $94.00 price target on the stock. Finally, Barrington Research upped their price objective on shares of Stride from $90.00 to $100.00 and gave the stock an "outperform" rating in a report on Wednesday, October 23rd. Three investment analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $90.17.

Check Out Our Latest Stock Report on Stride

Stride Stock Up 0.1 %

LRN traded up $0.09 during trading on Friday, reaching $93.37. The stock had a trading volume of 1,404,111 shares, compared to its average volume of 844,340. The company has a current ratio of 5.60, a quick ratio of 5.50 and a debt-to-equity ratio of 0.38. The company has a market capitalization of $4.07 billion, a price-to-earnings ratio of 16.98, a P/E/G ratio of 0.71 and a beta of 0.26. The stock's 50 day moving average is $80.60 and its two-hundred day moving average is $73.91. Stride, Inc. has a one year low of $54.74 and a one year high of $96.07.

Stride (NYSE:LRN - Get Free Report) last issued its quarterly earnings results on Tuesday, October 22nd. The company reported $0.94 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.22 by $0.72. Stride had a net margin of 11.38% and a return on equity of 21.23%. The company had revenue of $551.08 million during the quarter, compared to analyst estimates of $504.29 million. During the same period last year, the business earned $0.11 EPS. Stride's quarterly revenue was up 14.8% compared to the same quarter last year. As a group, analysts expect that Stride, Inc. will post 6.66 earnings per share for the current year.

About Stride

(

Free Report)

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

Further Reading

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.