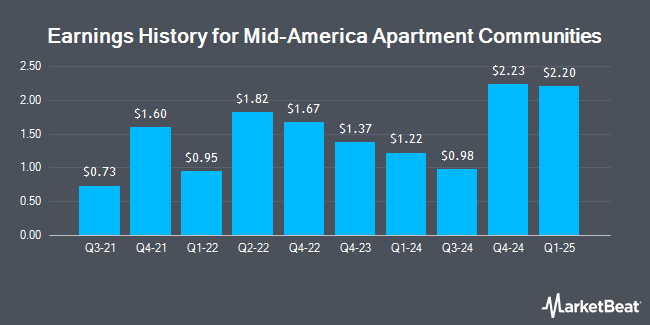

Mid-America Apartment Communities (NYSE:MAA - Get Free Report) announced its quarterly earnings results on Wednesday. The real estate investment trust reported $0.98 earnings per share for the quarter, missing analysts' consensus estimates of $2.18 by ($1.20), Zacks reports. Mid-America Apartment Communities had a net margin of 23.84% and a return on equity of 8.38%. The firm had revenue of $551.13 million during the quarter, compared to analysts' expectations of $548.53 million. During the same quarter in the prior year, the business earned $2.29 EPS. The company's quarterly revenue was up 1.7% compared to the same quarter last year.

Mid-America Apartment Communities Trading Down 1.4 %

Shares of MAA traded down $2.17 during mid-day trading on Friday, reaching $149.17. The company had a trading volume of 1,027,700 shares, compared to its average volume of 578,456. Mid-America Apartment Communities has a fifty-two week low of $118.68 and a fifty-two week high of $167.39. The firm has a fifty day simple moving average of $158.10 and a 200-day simple moving average of $145.93. The stock has a market cap of $17.43 billion, a price-to-earnings ratio of 33.67, a price-to-earnings-growth ratio of 2.44 and a beta of 0.88. The company has a current ratio of 0.09, a quick ratio of 0.12 and a debt-to-equity ratio of 0.80.

Mid-America Apartment Communities Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Tuesday, October 15th were given a dividend of $1.47 per share. This represents a $5.88 annualized dividend and a yield of 3.94%. The ex-dividend date was Tuesday, October 15th. Mid-America Apartment Communities's dividend payout ratio (DPR) is 132.73%.

Analysts Set New Price Targets

A number of equities analysts have issued reports on the stock. The Goldman Sachs Group started coverage on shares of Mid-America Apartment Communities in a research report on Wednesday, September 4th. They set a "buy" rating and a $187.00 target price for the company. Deutsche Bank Aktiengesellschaft lifted their price objective on Mid-America Apartment Communities from $139.00 to $163.00 and gave the stock a "hold" rating in a research report on Tuesday, September 10th. Wells Fargo & Company upgraded Mid-America Apartment Communities from an "equal weight" rating to an "overweight" rating and increased their target price for the company from $138.00 to $174.00 in a report on Monday, August 26th. JMP Securities raised their price target on Mid-America Apartment Communities from $145.00 to $160.00 and gave the stock a "market outperform" rating in a research report on Friday, August 2nd. Finally, Wedbush upped their price objective on Mid-America Apartment Communities from $154.00 to $184.00 and gave the company an "outperform" rating in a research report on Monday, August 5th. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, Mid-America Apartment Communities currently has an average rating of "Moderate Buy" and an average target price of $161.69.

View Our Latest Stock Report on Mid-America Apartment Communities

Mid-America Apartment Communities Company Profile

(

Get Free Report)

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Featured Stories

Before you consider Mid-America Apartment Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mid-America Apartment Communities wasn't on the list.

While Mid-America Apartment Communities currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.