Tectonic Advisors LLC grew its holdings in shares of Mplx Lp (NYSE:MPLX - Free Report) by 13.9% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 189,370 shares of the pipeline company's stock after buying an additional 23,086 shares during the period. Tectonic Advisors LLC's holdings in Mplx were worth $8,419,000 as of its most recent filing with the Securities and Exchange Commission.

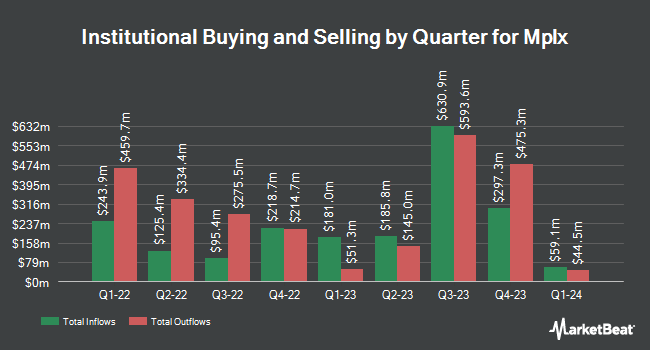

Other hedge funds also recently made changes to their positions in the company. Strategic Financial Concepts LLC raised its holdings in Mplx by 4,274.2% during the second quarter. Strategic Financial Concepts LLC now owns 811,371 shares of the pipeline company's stock worth $346,000 after purchasing an additional 792,822 shares in the last quarter. BNP Paribas Financial Markets raised its holdings in Mplx by 53.9% during the first quarter. BNP Paribas Financial Markets now owns 1,826,484 shares of the pipeline company's stock worth $75,909,000 after purchasing an additional 639,851 shares in the last quarter. Tortoise Capital Advisors L.L.C. raised its holdings in Mplx by 2.4% during the second quarter. Tortoise Capital Advisors L.L.C. now owns 14,825,905 shares of the pipeline company's stock worth $631,435,000 after purchasing an additional 353,324 shares in the last quarter. Energy Income Partners LLC raised its holdings in Mplx by 5.1% during the first quarter. Energy Income Partners LLC now owns 5,224,918 shares of the pipeline company's stock worth $217,148,000 after purchasing an additional 255,211 shares in the last quarter. Finally, CUSHING ASSET MANAGEMENT LP dba NXG INVESTMENT MANAGEMENT raised its holdings in Mplx by 17.0% during the third quarter. CUSHING ASSET MANAGEMENT LP dba NXG INVESTMENT MANAGEMENT now owns 1,498,796 shares of the pipeline company's stock worth $66,636,000 after purchasing an additional 217,674 shares in the last quarter. Institutional investors own 24.25% of the company's stock.

Mplx Price Performance

Shares of Mplx stock remained flat at $43.94 on Friday. 925,509 shares of the stock traded hands, compared to its average volume of 1,817,344. The stock's 50-day moving average is $43.61 and its 200-day moving average is $42.24. The company has a debt-to-equity ratio of 1.41, a quick ratio of 0.95 and a current ratio of 0.99. Mplx Lp has a fifty-two week low of $35.06 and a fifty-two week high of $45.24. The company has a market cap of $44.84 billion, a P/E ratio of 10.67, a PEG ratio of 1.21 and a beta of 1.37.

Mplx (NYSE:MPLX - Get Free Report) last posted its quarterly earnings results on Tuesday, August 6th. The pipeline company reported $1.15 EPS for the quarter, beating the consensus estimate of $0.98 by $0.17. Mplx had a net margin of 35.95% and a return on equity of 32.68%. The business had revenue of $3.05 billion for the quarter, compared to analysts' expectations of $2.96 billion. During the same period in the previous year, the company posted $0.91 EPS. Mplx's revenue was up 13.5% on a year-over-year basis. Equities research analysts anticipate that Mplx Lp will post 4.3 EPS for the current year.

Mplx Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, August 16th. Stockholders of record on Friday, August 9th were issued a dividend of $0.85 per share. This represents a $3.40 annualized dividend and a dividend yield of 7.74%. The ex-dividend date was Friday, August 9th. Mplx's dividend payout ratio is currently 82.52%.

Analyst Upgrades and Downgrades

Several equities research analysts recently commented on MPLX shares. Wells Fargo & Company boosted their target price on Mplx from $47.00 to $50.00 and gave the stock an "overweight" rating in a report on Wednesday, August 7th. Royal Bank of Canada upped their price target on Mplx from $47.00 to $50.00 and gave the company an "outperform" rating in a report on Wednesday, October 16th. StockNews.com raised Mplx from a "buy" rating to a "strong-buy" rating in a report on Thursday, October 10th. UBS Group upped their price target on Mplx from $49.00 to $51.00 and gave the company a "buy" rating in a report on Wednesday, September 18th. Finally, Bank of America initiated coverage on Mplx in a report on Thursday, October 17th. They issued an "underperform" rating and a $43.00 price target on the stock. One research analyst has rated the stock with a sell rating, eight have issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, Mplx currently has a consensus rating of "Moderate Buy" and an average target price of $47.67.

Check Out Our Latest Report on MPLX

Mplx Company Profile

(

Free Report)

MPLX LP owns and operates midstream energy infrastructure and logistics assets primarily in the United States. It operates in two segments, Logistics and Storage, and Gathering and Processing. The company is involved in the gathering, processing, and transportation of natural gas; gathering, transportation, fractionation, storage, and marketing of natural gas liquids; gathering, storage, transportation, and distribution of crude oil and refined products, as well as other hydrocarbon-based products and renewables; and sale of residue gas and condensate.

Featured Articles

Before you consider Mplx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mplx wasn't on the list.

While Mplx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.