VELA Investment Management LLC trimmed its position in Vail Resorts, Inc. (NYSE:MTN - Free Report) by 80.6% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 1,772 shares of the company's stock after selling 7,383 shares during the quarter. VELA Investment Management LLC's holdings in Vail Resorts were worth $309,000 as of its most recent SEC filing.

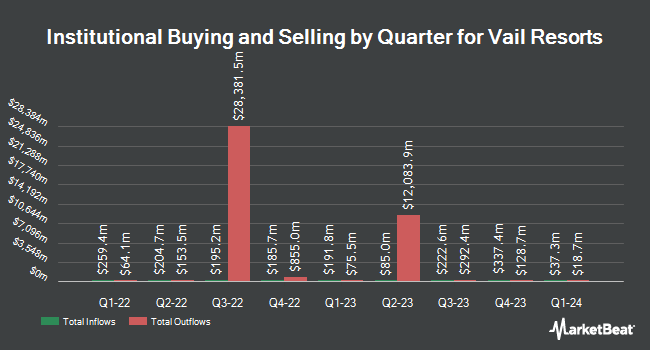

Other institutional investors have also recently modified their holdings of the company. Allspring Global Investments Holdings LLC acquired a new position in shares of Vail Resorts in the 1st quarter valued at about $118,000. State of Michigan Retirement System boosted its position in Vail Resorts by 2.2% in the 1st quarter. State of Michigan Retirement System now owns 9,300 shares of the company's stock worth $2,072,000 after purchasing an additional 200 shares in the last quarter. First Trust Direct Indexing L.P. purchased a new stake in Vail Resorts in the 1st quarter worth approximately $202,000. Mirae Asset Global Investments Co. Ltd. purchased a new position in shares of Vail Resorts during the 1st quarter valued at approximately $3,218,000. Finally, Tokio Marine Asset Management Co. Ltd. lifted its stake in shares of Vail Resorts by 15.8% in the 1st quarter. Tokio Marine Asset Management Co. Ltd. now owns 1,712 shares of the company's stock valued at $381,000 after purchasing an additional 233 shares during the period. 94.94% of the stock is currently owned by hedge funds and other institutional investors.

Vail Resorts Price Performance

Shares of MTN stock traded up $0.10 on Friday, reaching $165.79. 370,242 shares of the company were exchanged, compared to its average volume of 447,804. The company has a market cap of $6.22 billion, a price-to-earnings ratio of 27.49, a P/E/G ratio of 1.59 and a beta of 1.13. The business has a 50-day moving average price of $176.69 and a 200 day moving average price of $182.62. The company has a debt-to-equity ratio of 2.62, a quick ratio of 0.71 and a current ratio of 0.82. Vail Resorts, Inc. has a 1 year low of $165.00 and a 1 year high of $236.92.

Vail Resorts (NYSE:MTN - Get Free Report) last released its earnings results on Thursday, September 26th. The company reported ($4.67) EPS for the quarter, missing analysts' consensus estimates of ($4.28) by ($0.39). The company had revenue of $265.39 million for the quarter, compared to analysts' expectations of $264.84 million. Vail Resorts had a return on equity of 20.76% and a net margin of 7.99%. The firm's revenue for the quarter was down 1.6% on a year-over-year basis. During the same period in the prior year, the firm earned ($3.35) EPS. Equities research analysts forecast that Vail Resorts, Inc. will post 7.27 earnings per share for the current fiscal year.

Vail Resorts Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, October 24th. Stockholders of record on Tuesday, October 8th were paid a dividend of $2.22 per share. The ex-dividend date was Tuesday, October 8th. This represents a $8.88 dividend on an annualized basis and a dividend yield of 5.36%. Vail Resorts's dividend payout ratio is currently 147.26%.

Wall Street Analyst Weigh In

A number of analysts recently issued reports on the stock. Macquarie reissued a "neutral" rating and set a $180.00 price target on shares of Vail Resorts in a report on Wednesday, October 2nd. Deutsche Bank Aktiengesellschaft cut their price objective on shares of Vail Resorts from $218.00 to $194.00 and set a "hold" rating for the company in a report on Monday, September 16th. Barclays cut their price objective on shares of Vail Resorts from $161.00 to $155.00 and set an "underweight" rating for the company in a report on Friday, September 27th. Morgan Stanley lifted their price objective on shares of Vail Resorts from $179.00 to $182.00 and gave the company an "equal weight" rating in a report on Wednesday, September 25th. Finally, StockNews.com cut shares of Vail Resorts from a "hold" rating to a "sell" rating in a report on Friday, September 27th. Three research analysts have rated the stock with a sell rating, four have assigned a hold rating and three have given a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $208.22.

Read Our Latest Report on MTN

Insider Buying and Selling

In other Vail Resorts news, CFO Angela A. Korch acquired 165 shares of the business's stock in a transaction on Thursday, October 3rd. The stock was bought at an average price of $173.09 per share, for a total transaction of $28,559.85. Following the acquisition, the chief financial officer now owns 2,187 shares in the company, valued at approximately $378,547.83. The trade was a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is available through the SEC website. In related news, CFO Angela A. Korch bought 165 shares of the company's stock in a transaction on Thursday, October 3rd. The stock was bought at an average cost of $173.09 per share, for a total transaction of $28,559.85. Following the acquisition, the chief financial officer now directly owns 2,187 shares in the company, valued at $378,547.83. This represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, insider Robert A. Katz sold 9,296 shares of Vail Resorts stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $175.98, for a total value of $1,635,910.08. Following the transaction, the insider now owns 245,961 shares in the company, valued at approximately $43,284,216.78. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 1.20% of the stock is currently owned by company insiders.

Vail Resorts Profile

(

Free Report)

Vail Resorts, Inc, through its subsidiaries, operates mountain resorts and regional ski areas in the United States. It operates through three segments: Mountain, Lodging, and Real Estate. The Mountain segment operates 41 destination mountain resorts and regional ski areas. This segment is also involved in the ancillary activities, including ski school, dining, and retail/rental operations, as well as real estate brokerage activities.

See Also

Before you consider Vail Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vail Resorts wasn't on the list.

While Vail Resorts currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.