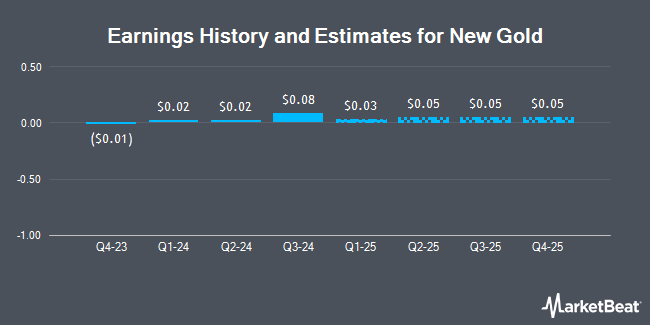

New Gold Inc. (NYSE:NGD - Free Report) - Stock analysts at Raymond James decreased their FY2025 earnings estimates for shares of New Gold in a research report issued to clients and investors on Monday, October 21st. Raymond James analyst F. Hamed now expects that the company will post earnings per share of $0.24 for the year, down from their prior estimate of $0.25. The consensus estimate for New Gold's current full-year earnings is $0.15 per share.

Several other brokerages have also weighed in on NGD. CIBC raised their price objective on shares of New Gold from $3.00 to $3.40 and gave the stock an "outperformer" rating in a report on Wednesday, July 10th. Scotiabank raised their price target on shares of New Gold from $2.75 to $3.25 and gave the stock a "sector outperform" rating in a research report on Tuesday, September 17th. StockNews.com downgraded shares of New Gold from a "buy" rating to a "hold" rating in a research report on Thursday, October 17th. Royal Bank of Canada raised their price target on shares of New Gold from $3.00 to $3.50 and gave the stock an "outperform" rating in a research report on Tuesday, September 10th. Finally, Cibc World Mkts upgraded shares of New Gold to a "strong-buy" rating in a research report on Wednesday, July 10th. Three research analysts have rated the stock with a hold rating, three have issued a buy rating and two have given a strong buy rating to the company. According to MarketBeat, New Gold currently has a consensus rating of "Moderate Buy" and a consensus target price of $2.74.

Read Our Latest Stock Analysis on New Gold

New Gold Trading Up 0.3 %

NGD stock traded up $0.01 during mid-day trading on Thursday, hitting $2.93. 8,837,875 shares of the company were exchanged, compared to its average volume of 8,059,456. The firm has a market cap of $2.32 billion, a P/E ratio of -29.25 and a beta of 1.30. The company has a debt-to-equity ratio of 0.52, a current ratio of 1.50 and a quick ratio of 0.98. New Gold has a twelve month low of $1.03 and a twelve month high of $3.25. The stock's fifty day moving average is $2.78.

New Gold (NYSE:NGD - Get Free Report) last announced its quarterly earnings data on Tuesday, July 30th. The company reported $0.02 earnings per share for the quarter, topping the consensus estimate of $0.01 by $0.01. The company had revenue of $218.20 million during the quarter. New Gold had a negative net margin of 2.53% and a positive return on equity of 5.22%.

Institutional Trading of New Gold

Hedge funds have recently bought and sold shares of the company. Allworth Financial LP lifted its position in New Gold by 941.8% in the 3rd quarter. Allworth Financial LP now owns 10,418 shares of the company's stock valued at $30,000 after purchasing an additional 9,418 shares during the last quarter. Eastern Bank bought a new stake in New Gold in the 3rd quarter valued at about $33,000. Scientech Research LLC bought a new stake in New Gold in the 2nd quarter valued at about $28,000. Coppell Advisory Solutions Corp. bought a new stake in New Gold in the 1st quarter valued at about $30,000. Finally, Rathbones Group PLC bought a new stake in New Gold in the 2nd quarter valued at about $36,000. 42.82% of the stock is currently owned by institutional investors.

New Gold Company Profile

(

Get Free Report)

New Gold Inc, an intermediate gold mining company, develops and operates of mineral properties in Canada. It primarily explores for gold, silver, and copper deposits. The company's principal operating properties include 100% interest in the Rainy River mine located in Northwestern Ontario, Canada; and New Afton project situated in South-Central British Columbia.

Further Reading

Before you consider New Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Gold wasn't on the list.

While New Gold currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.