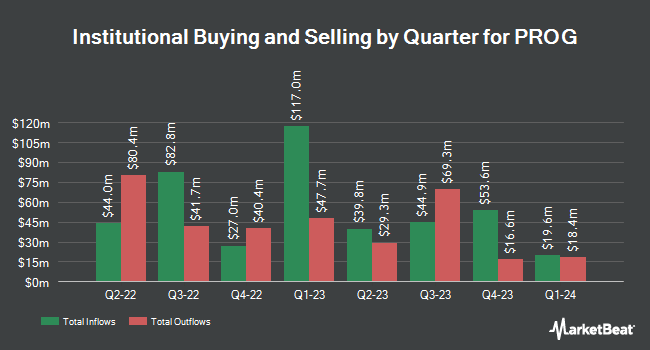

Assenagon Asset Management S.A. acquired a new position in PROG Holdings, Inc. (NYSE:PRG - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 393,455 shares of the company's stock, valued at approximately $19,079,000. Assenagon Asset Management S.A. owned 0.91% of PROG as of its most recent SEC filing.

Several other large investors have also recently bought and sold shares of the stock. International Assets Investment Management LLC bought a new position in PROG during the 3rd quarter valued at $3,080,000. Whittier Trust Co. acquired a new stake in shares of PROG in the third quarter valued at $26,000. Blue Trust Inc. boosted its stake in PROG by 35.4% during the third quarter. Blue Trust Inc. now owns 2,664 shares of the company's stock valued at $129,000 after buying an additional 697 shares in the last quarter. Inspire Advisors LLC grew its holdings in PROG by 4.2% during the third quarter. Inspire Advisors LLC now owns 12,884 shares of the company's stock worth $625,000 after acquiring an additional 525 shares during the period. Finally, nVerses Capital LLC raised its position in PROG by 66.7% in the third quarter. nVerses Capital LLC now owns 3,500 shares of the company's stock worth $170,000 after acquiring an additional 1,400 shares in the last quarter. Institutional investors and hedge funds own 97.92% of the company's stock.

PROG Trading Down 1.9 %

Shares of PROG stock traded down $0.81 during trading on Friday, hitting $42.09. The stock had a trading volume of 300,642 shares, compared to its average volume of 411,196. PROG Holdings, Inc. has a 1 year low of $26.39 and a 1 year high of $50.28. The stock has a 50 day simple moving average of $46.97 and a 200 day simple moving average of $39.92. The company has a quick ratio of 1.80, a current ratio of 3.87 and a debt-to-equity ratio of 1.02. The company has a market capitalization of $1.82 billion, a PE ratio of 17.18 and a beta of 2.11.

PROG (NYSE:PRG - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The company reported $0.77 earnings per share for the quarter, topping the consensus estimate of $0.76 by $0.01. The firm had revenue of $606.10 million for the quarter, compared to analysts' expectations of $601.86 million. PROG had a net margin of 4.57% and a return on equity of 26.30%. The company's quarterly revenue was up 4.0% compared to the same quarter last year. During the same period in the previous year, the company posted $0.90 EPS. On average, research analysts expect that PROG Holdings, Inc. will post 3.34 EPS for the current fiscal year.

PROG Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, September 3rd. Investors of record on Tuesday, August 20th were paid a $0.12 dividend. This represents a $0.48 annualized dividend and a yield of 1.14%. The ex-dividend date was Tuesday, August 20th. PROG's dividend payout ratio is currently 19.59%.

Wall Street Analyst Weigh In

PRG has been the subject of several research reports. TD Cowen raised their price objective on shares of PROG from $40.00 to $47.00 and gave the company a "buy" rating in a research report on Thursday, July 25th. Raymond James raised shares of PROG from a "market perform" rating to an "outperform" rating and set a $48.00 target price for the company in a research note on Thursday. Jefferies Financial Group lifted their price target on shares of PROG from $50.00 to $58.00 and gave the stock a "buy" rating in a research report on Tuesday, October 1st. Loop Capital upgraded PROG from a "hold" rating to a "buy" rating and increased their price objective for the company from $41.00 to $55.00 in a research report on Monday, August 19th. Finally, KeyCorp raised their price objective on PROG from $46.00 to $55.00 and gave the stock an "overweight" rating in a research note on Tuesday, September 10th. One equities research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $52.60.

Get Our Latest Stock Report on PRG

PROG Company Profile

(

Free Report)

PROG Holdings, Inc NYSE: PRG is a financial technology holding company based in Salt Lake City, Utah with three business segments: Progressive Leasing, which offers lease-to-own transactions primarily to credit-challenged consumers through e-commerce and point-of-sale retail partners, via online, mobile, and in-store solutions; Vive Financial, which provides consumers who may not qualify for traditional prime lending with a variety of second-look, revolving credit products through private label and branded credit cards; and Four Technologies, which provides consumers of all credit backgrounds Buy Now, Pay Later (BNPL) options through four interest-free installments via its platform, Four.

Further Reading

Before you consider PROG, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PROG wasn't on the list.

While PROG currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.