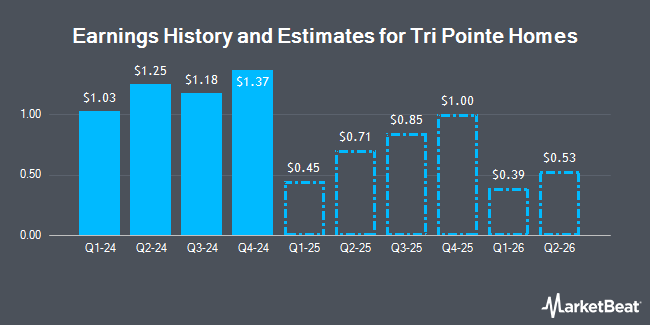

Tri Pointe Homes, Inc. (NYSE:TPH - Free Report) - Equities research analysts at Wedbush lowered their Q1 2025 earnings estimates for shares of Tri Pointe Homes in a report issued on Thursday, October 24th. Wedbush analyst J. Mccanless now anticipates that the construction company will earn $0.86 per share for the quarter, down from their previous estimate of $0.87. Wedbush has a "Neutral" rating and a $42.00 price target on the stock. The consensus estimate for Tri Pointe Homes' current full-year earnings is $4.68 per share. Wedbush also issued estimates for Tri Pointe Homes' Q1 2026 earnings at $0.93 EPS, Q2 2026 earnings at $1.44 EPS, Q3 2026 earnings at $1.61 EPS and FY2026 earnings at $5.92 EPS.

Tri Pointe Homes (NYSE:TPH - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The construction company reported $1.18 earnings per share for the quarter, topping the consensus estimate of $1.07 by $0.11. Tri Pointe Homes had a return on equity of 14.83% and a net margin of 10.41%. The business had revenue of $1.11 billion during the quarter, compared to the consensus estimate of $1.05 billion. During the same period in the prior year, the company posted $0.76 EPS. The firm's revenue for the quarter was up 34.9% compared to the same quarter last year.

A number of other analysts also recently issued reports on TPH. Zelman & Associates raised Tri Pointe Homes from an "underperform" rating to a "neutral" rating and set a $43.00 price objective on the stock in a research note on Tuesday, September 17th. Royal Bank of Canada cut their target price on shares of Tri Pointe Homes from $48.00 to $45.00 and set an "outperform" rating for the company in a report on Friday. Evercore ISI raised shares of Tri Pointe Homes to a "strong-buy" rating in a research note on Friday, July 26th. Finally, Oppenheimer dropped their price objective on shares of Tri Pointe Homes from $56.00 to $53.00 and set an "outperform" rating for the company in a research note on Friday. Two research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, Tri Pointe Homes has a consensus rating of "Moderate Buy" and an average price target of $45.75.

View Our Latest Research Report on TPH

Tri Pointe Homes Price Performance

Shares of TPH stock traded up $1.15 during trading hours on Monday, hitting $41.43. The stock had a trading volume of 1,177,545 shares, compared to its average volume of 905,975. The stock's 50-day moving average price is $43.98 and its two-hundred day moving average price is $40.89. Tri Pointe Homes has a one year low of $24.46 and a one year high of $47.78. The stock has a market capitalization of $3.88 billion, a price-to-earnings ratio of 8.36, a PEG ratio of 0.66 and a beta of 1.59. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.64 and a quick ratio of 1.64.

Institutional Trading of Tri Pointe Homes

Large investors have recently made changes to their positions in the stock. Fidelis Capital Partners LLC purchased a new position in Tri Pointe Homes in the 1st quarter worth about $25,000. Gradient Investments LLC bought a new position in Tri Pointe Homes in the 2nd quarter worth about $30,000. Reston Wealth Management LLC purchased a new position in shares of Tri Pointe Homes during the third quarter worth approximately $45,000. GAMMA Investing LLC increased its position in shares of Tri Pointe Homes by 63.1% during the second quarter. GAMMA Investing LLC now owns 1,520 shares of the construction company's stock worth $57,000 after acquiring an additional 588 shares during the period. Finally, Blue Trust Inc. raised its stake in shares of Tri Pointe Homes by 31.7% during the second quarter. Blue Trust Inc. now owns 1,774 shares of the construction company's stock valued at $69,000 after acquiring an additional 427 shares in the last quarter. 97.01% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Tri Pointe Homes

In related news, General Counsel David Ch Lee sold 5,000 shares of the company's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $44.28, for a total transaction of $221,400.00. Following the transaction, the general counsel now directly owns 85,792 shares in the company, valued at approximately $3,798,869.76. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 2.50% of the company's stock.

About Tri Pointe Homes

(

Get Free Report)

Tri Pointe Homes, Inc engages in the design, construction, and sale of single-family attached and detached homes in the United States. The company operates through a portfolio of six regional home building brands comprising Maracay in Arizona; Pardee Homes in California and Nevada; Quadrant Homes in Washington; Trendmaker Homes in Texas; TRI Pointe Homes in California, Colorado, and the Carolinas; and Winchester Homes in Maryland and Northern Virginia.

See Also

Before you consider Tri Pointe Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tri Pointe Homes wasn't on the list.

While Tri Pointe Homes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.