Semanteon Capital Management LP acquired a new stake in shares of Ubiquiti Inc. (NYSE:UI - Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 2,703 shares of the company's stock, valued at approximately $599,000.

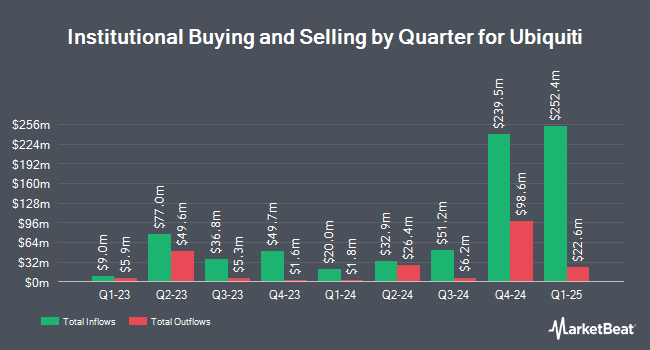

Several other large investors also recently bought and sold shares of the business. Vanguard Group Inc. grew its position in Ubiquiti by 24.1% in the 1st quarter. Vanguard Group Inc. now owns 97,817 shares of the company's stock worth $11,332,000 after purchasing an additional 18,986 shares during the period. Capstone Investment Advisors LLC raised its holdings in Ubiquiti by 188.1% in the 1st quarter. Capstone Investment Advisors LLC now owns 17,215 shares of the company's stock worth $1,994,000 after purchasing an additional 11,239 shares during the period. Catalytic Wealth RIA LLC purchased a new position in Ubiquiti during the first quarter valued at $356,000. Marshall Wace LLP lifted its position in Ubiquiti by 104.4% during the second quarter. Marshall Wace LLP now owns 5,980 shares of the company's stock valued at $871,000 after purchasing an additional 3,054 shares in the last quarter. Finally, Covestor Ltd increased its position in Ubiquiti by 29.0% in the first quarter. Covestor Ltd now owns 516 shares of the company's stock worth $60,000 after buying an additional 116 shares in the last quarter. 4.00% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on UI. StockNews.com downgraded Ubiquiti from a "buy" rating to a "hold" rating in a research report on Tuesday, September 3rd. Barclays lowered their price target on Ubiquiti from $108.00 to $104.00 and set an "underweight" rating on the stock in a report on Tuesday, August 27th. Finally, BWS Financial increased their price objective on shares of Ubiquiti from $160.00 to $240.00 and gave the company a "buy" rating in a report on Monday, August 26th.

Read Our Latest Research Report on Ubiquiti

Ubiquiti Trading Up 1.6 %

NYSE:UI traded up $4.12 during midday trading on Tuesday, hitting $262.73. 41,533 shares of the company traded hands, compared to its average volume of 75,606. The firm has a market capitalization of $15.89 billion, a P/E ratio of 44.66 and a beta of 1.16. The firm's fifty day moving average is $216.74 and its 200-day moving average is $170.57. Ubiquiti Inc. has a 12-month low of $103.00 and a 12-month high of $262.73. The company has a current ratio of 3.22, a quick ratio of 1.59 and a debt-to-equity ratio of 7.05.

Ubiquiti (NYSE:UI - Get Free Report) last issued its quarterly earnings results on Friday, August 23rd. The company reported $1.74 EPS for the quarter, missing the consensus estimate of $1.91 by ($0.17). The firm had revenue of $507.50 million for the quarter, compared to the consensus estimate of $538.23 million. Ubiquiti had a net margin of 18.15% and a return on equity of 3,321.33%. The company's revenue for the quarter was up 3.3% on a year-over-year basis. On average, sell-side analysts predict that Ubiquiti Inc. will post 7.09 EPS for the current year.

Ubiquiti Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, September 9th. Shareholders of record on Tuesday, September 3rd were paid a $0.60 dividend. The ex-dividend date of this dividend was Tuesday, September 3rd. This represents a $2.40 dividend on an annualized basis and a yield of 0.91%. Ubiquiti's dividend payout ratio is currently 41.45%.

Ubiquiti Profile

(

Free Report)

Ubiquiti Inc develops networking technology for service providers, enterprises, and consumers. The company develops technology platforms for high-capacity distributed Internet access, unified information technology, and consumer electronics for professional, home, and personal use. Its service provider product platforms offer carrier-class network infrastructure for fixed wireless broadband, wireless backhaul systems, and routing and related software; and enterprise product platforms provide wireless LAN infrastructure, video surveillance products, switching and routing solutions, security gateways, door access systems, and other WLAN products.

Recommended Stories

Before you consider Ubiquiti, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ubiquiti wasn't on the list.

While Ubiquiti currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.