Olympiad Research LP acquired a new stake in Asana, Inc. (NYSE:ASAN - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund acquired 68,343 shares of the company's stock, valued at approximately $792,000.

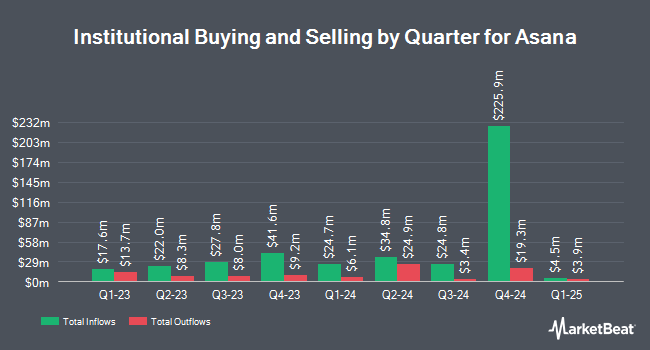

A number of other institutional investors have also recently made changes to their positions in the stock. Headlands Technologies LLC grew its stake in shares of Asana by 327.9% in the second quarter. Headlands Technologies LLC now owns 2,897 shares of the company's stock worth $41,000 after purchasing an additional 2,220 shares during the last quarter. Redwood Wealth Management Group LLC purchased a new stake in Asana in the 2nd quarter worth approximately $65,000. Daiwa Securities Group Inc. increased its position in Asana by 26.0% during the 2nd quarter. Daiwa Securities Group Inc. now owns 4,983 shares of the company's stock valued at $70,000 after purchasing an additional 1,028 shares during the period. Benjamin F. Edwards & Company Inc. raised its holdings in Asana by 139.3% in the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 6,673 shares of the company's stock worth $93,000 after purchasing an additional 3,885 shares in the last quarter. Finally, Scientech Research LLC purchased a new stake in shares of Asana in the 2nd quarter worth about $146,000. Hedge funds and other institutional investors own 26.21% of the company's stock.

Insider Activity

In related news, insider Eleanor B. Lacey sold 4,977 shares of the firm's stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $11.79, for a total value of $58,678.83. Following the transaction, the insider now directly owns 370,333 shares of the company's stock, valued at approximately $4,366,226.07. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In other Asana news, insider Eleanor B. Lacey sold 9,308 shares of Asana stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $11.99, for a total transaction of $111,602.92. Following the transaction, the insider now owns 375,310 shares of the company's stock, valued at $4,499,966.90. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Eleanor B. Lacey sold 4,977 shares of the firm's stock in a transaction on Monday, September 23rd. The shares were sold at an average price of $11.79, for a total transaction of $58,678.83. Following the sale, the insider now owns 370,333 shares in the company, valued at $4,366,226.07. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 44,092 shares of company stock valued at $527,668 in the last 90 days. Company insiders own 63.97% of the company's stock.

Asana Stock Performance

Shares of ASAN traded up $0.18 during trading hours on Thursday, hitting $14.05. The stock had a trading volume of 1,709,455 shares, compared to its average volume of 2,003,448. The firm has a market capitalization of $3.21 billion, a PE ratio of -12.17 and a beta of 1.13. The company has a debt-to-equity ratio of 0.14, a current ratio of 1.63 and a quick ratio of 1.63. Asana, Inc. has a 12 month low of $11.05 and a 12 month high of $23.44. The stock has a fifty day moving average price of $12.14 and a 200 day moving average price of $13.31.

Asana (NYSE:ASAN - Get Free Report) last released its quarterly earnings results on Tuesday, September 3rd. The company reported ($0.05) EPS for the quarter, beating the consensus estimate of ($0.08) by $0.03. Asana had a negative net margin of 37.73% and a negative return on equity of 81.88%. The firm had revenue of $179.21 million during the quarter, compared to analyst estimates of $177.68 million. During the same quarter in the prior year, the firm earned ($0.31) EPS. The business's revenue for the quarter was up 10.3% compared to the same quarter last year. Analysts anticipate that Asana, Inc. will post -1.14 EPS for the current year.

Analyst Ratings Changes

A number of research firms recently issued reports on ASAN. Oppenheimer decreased their price target on shares of Asana from $23.00 to $20.00 and set an "outperform" rating for the company in a research note on Wednesday, September 4th. Morgan Stanley lowered their target price on Asana from $19.00 to $15.00 and set an "equal weight" rating for the company in a research note on Tuesday, August 20th. JPMorgan Chase & Co. reduced their price target on Asana from $15.00 to $13.00 and set an "underweight" rating on the stock in a research note on Wednesday, September 4th. JMP Securities dropped their target price on shares of Asana from $27.00 to $21.00 and set a "market outperform" rating on the stock in a report on Wednesday, September 4th. Finally, Robert W. Baird reduced their target price on shares of Asana from $20.00 to $13.00 and set a "neutral" rating on the stock in a research report on Wednesday, September 4th. Three research analysts have rated the stock with a sell rating, eight have assigned a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and an average price target of $14.21.

Read Our Latest Analysis on ASAN

About Asana

(

Free Report)

Asana, Inc, together with its subsidiaries, operates a work management platform for individuals, team leads, and executives in the United States and internationally. Its platform helps organizations to orchestrate work from daily tasks to cross-functional strategic initiatives; manage work across a portfolio of projects or workflows, see progress against goals, identify bottlenecks, resource constraints, and milestones; and communicate company-wide goals, monitor status, and oversee work across projects and portfolios to gain real-time insights.

Read More

Before you consider Asana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Asana wasn't on the list.

While Asana currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.