Ontario Teachers Pension Plan Board trimmed its holdings in Imperial Oil Limited (NYSEAMERICAN:IMO - Free Report) TSE: IMO by 28.5% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 27,326 shares of the energy company's stock after selling 10,873 shares during the quarter. Ontario Teachers Pension Plan Board's holdings in Imperial Oil were worth $1,922,000 as of its most recent filing with the Securities and Exchange Commission.

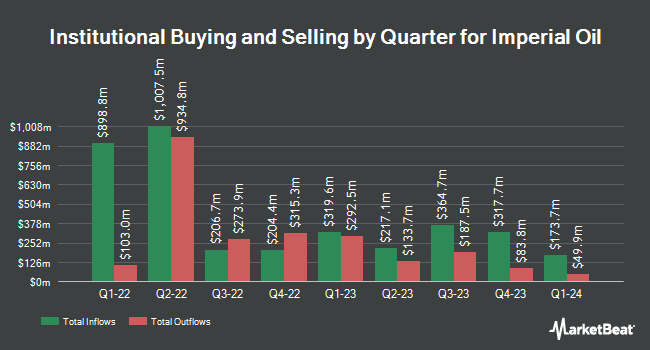

Several other hedge funds also recently made changes to their positions in the business. TD Asset Management Inc grew its position in Imperial Oil by 12.2% during the 2nd quarter. TD Asset Management Inc now owns 3,796,660 shares of the energy company's stock worth $258,817,000 after purchasing an additional 412,600 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. lifted its position in shares of Imperial Oil by 9.7% in the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 2,107,250 shares of the energy company's stock worth $148,235,000 after buying an additional 187,158 shares during the last quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp raised its position in shares of Imperial Oil by 10,896.4% in the second quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 867,174 shares of the energy company's stock valued at $59,135,000 after purchasing an additional 859,288 shares during the period. Toronto Dominion Bank lifted its position in Imperial Oil by 14.7% during the 2nd quarter. Toronto Dominion Bank now owns 822,478 shares of the energy company's stock worth $56,134,000 after acquiring an additional 105,205 shares during the last quarter. Finally, Capital World Investors lifted its position in shares of Imperial Oil by 134.0% during the 1st quarter. Capital World Investors now owns 747,929 shares of the energy company's stock worth $51,588,000 after purchasing an additional 428,252 shares during the last quarter. Institutional investors and hedge funds own 20.74% of the company's stock.

Wall Street Analysts Forecast Growth

IMO has been the subject of a number of recent research reports. Scotiabank reaffirmed a "sector perform" rating and set a $110.00 price objective on shares of Imperial Oil in a report on Wednesday, September 25th. StockNews.com cut Imperial Oil from a "buy" rating to a "hold" rating in a report on Wednesday, August 28th. Four analysts have rated the stock with a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $109.00.

Read Our Latest Analysis on IMO

Imperial Oil Stock Performance

Shares of IMO traded up $0.01 during trading hours on Wednesday, hitting $75.90. The stock had a trading volume of 237,598 shares, compared to its average volume of 397,011. The company has a market cap of $39.31 billion, a PE ratio of 11.31 and a beta of 1.44. The company has a debt-to-equity ratio of 0.17, a current ratio of 1.44 and a quick ratio of 1.23. Imperial Oil Limited has a 1-year low of $52.97 and a 1-year high of $80.17.

Imperial Oil Cuts Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 1st. Shareholders of record on Tuesday, December 3rd will be issued a dividend of $0.4304 per share. This represents a $1.72 dividend on an annualized basis and a yield of 2.27%. The ex-dividend date is Tuesday, December 3rd. Imperial Oil's payout ratio is presently 26.53%.

About Imperial Oil

(

Free Report)

Imperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Upstream segment explores and produces crude oil, natural gas, synthetic crude oil, and bitumen. The Downstream segment transports and refines crude oil, blends refined products, and distributes and markets of refined products.

Further Reading

Before you consider Imperial Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Imperial Oil wasn't on the list.

While Imperial Oil currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.