Oppenheimer & Co. Inc. lowered its position in shares of Celsius Holdings, Inc. (NASDAQ:CELH - Free Report) by 72.6% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 11,911 shares of the company's stock after selling 31,563 shares during the quarter. Oppenheimer & Co. Inc.'s holdings in Celsius were worth $374,000 at the end of the most recent quarter.

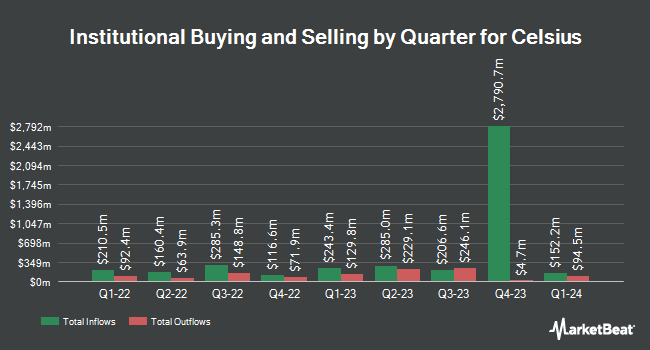

Other hedge funds have also modified their holdings of the company. EverSource Wealth Advisors LLC raised its stake in shares of Celsius by 3,116.7% in the 1st quarter. EverSource Wealth Advisors LLC now owns 386 shares of the company's stock valued at $32,000 after acquiring an additional 374 shares in the last quarter. Beacon Capital Management LLC acquired a new position in shares of Celsius in the 1st quarter valued at $40,000. S.A. Mason LLC bought a new stake in shares of Celsius in the 2nd quarter valued at approximately $30,000. Benjamin F. Edwards & Company Inc. increased its position in shares of Celsius by 353.1% during the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 648 shares of the company's stock worth $37,000 after purchasing an additional 505 shares in the last quarter. Finally, Newbridge Financial Services Group Inc. increased its holdings in Celsius by 3,150.0% during the 2nd quarter. Newbridge Financial Services Group Inc. now owns 650 shares of the company's stock valued at $37,000 after purchasing an additional 630 shares in the last quarter. 60.95% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on CELH shares. Maxim Group dropped their price objective on shares of Celsius from $65.00 to $50.00 and set a "buy" rating for the company in a research report on Thursday, September 5th. Morgan Stanley reissued an "equal weight" rating and set a $50.00 price target on shares of Celsius in a research report on Tuesday, August 20th. Piper Sandler cut their price objective on shares of Celsius from $50.00 to $47.00 and set an "overweight" rating for the company in a report on Tuesday, September 24th. Roth Mkm cut their target price on shares of Celsius from $43.00 to $40.00 and set a "buy" rating on the stock in a research note on Thursday, November 7th. Finally, Bank of America reduced their target price on Celsius from $32.00 to $26.00 and set an "underperform" rating for the company in a report on Thursday, September 5th. One analyst has rated the stock with a sell rating, three have issued a hold rating and eleven have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $54.40.

Read Our Latest Analysis on CELH

Celsius Price Performance

Celsius stock traded up $0.49 during mid-day trading on Friday, reaching $29.54. 3,722,430 shares of the stock traded hands, compared to its average volume of 6,044,835. Celsius Holdings, Inc. has a 12-month low of $25.23 and a 12-month high of $99.62. The stock has a market capitalization of $6.94 billion, a PE ratio of 40.35, a price-to-earnings-growth ratio of 3.13 and a beta of 1.86. The business's 50-day moving average is $30.97 and its 200-day moving average is $48.34.

Insider Transactions at Celsius

In related news, CEO John Fieldly sold 74,847 shares of the stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $32.80, for a total transaction of $2,454,981.60. Following the completion of the transaction, the chief executive officer now directly owns 1,812,490 shares of the company's stock, valued at approximately $59,449,672. This represents a 3.97 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 2.20% of the company's stock.

About Celsius

(

Free Report)

Celsius Holdings, Inc develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally. The company offers CELSIUS, a fitness drink or supplement designed to accelerate metabolism and burn body fat; various flavors and carbonated and non-carbonated functional energy drinks under the CELSIUS Originals and Vibe name, as well as functional energy drink under the CELSIUS Essentials and CELSIUS On-the-Go Powder names; and CELSIUS ready-to drink products.

See Also

Before you consider Celsius, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celsius wasn't on the list.

While Celsius currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.