Oppenheimer & Co. Inc. bought a new position in BILL Holdings, Inc. (NYSE:BILL - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 5,743 shares of the company's stock, valued at approximately $303,000.

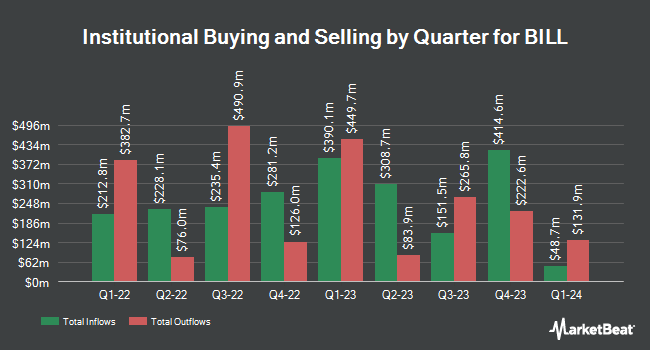

A number of other hedge funds have also recently modified their holdings of BILL. Vanguard Group Inc. boosted its stake in shares of BILL by 1.0% in the first quarter. Vanguard Group Inc. now owns 9,976,318 shares of the company's stock worth $685,573,000 after buying an additional 94,786 shares during the last quarter. UniSuper Management Pty Ltd raised its holdings in BILL by 100.0% in the 1st quarter. UniSuper Management Pty Ltd now owns 1,400 shares of the company's stock worth $96,000 after purchasing an additional 700 shares during the period. CANADA LIFE ASSURANCE Co raised its holdings in BILL by 59.7% in the 1st quarter. CANADA LIFE ASSURANCE Co now owns 125,297 shares of the company's stock worth $8,612,000 after purchasing an additional 46,834 shares during the period. Advisors Asset Management Inc. raised its holdings in BILL by 75.0% in the 1st quarter. Advisors Asset Management Inc. now owns 658 shares of the company's stock worth $45,000 after purchasing an additional 282 shares during the period. Finally, Bayesian Capital Management LP acquired a new position in BILL in the 1st quarter worth about $4,776,000. Hedge funds and other institutional investors own 97.99% of the company's stock.

Insider Transactions at BILL

In related news, Director Alison Wagonfeld sold 779 shares of BILL stock in a transaction on Tuesday, November 12th. The stock was sold at an average price of $90.00, for a total value of $70,110.00. Following the completion of the transaction, the director now directly owns 259 shares in the company, valued at approximately $23,310. This trade represents a 75.05 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO Rene A. Lacerte bought 42,248 shares of the firm's stock in a transaction that occurred on Monday, August 26th. The stock was bought at an average price of $49.60 per share, with a total value of $2,095,500.80. Following the completion of the acquisition, the chief executive officer now owns 184,249 shares of the company's stock, valued at $9,138,750.40. This trade represents a 29.75 % increase in their position. The disclosure for this purchase can be found here. Over the last ninety days, insiders bought 68,372 shares of company stock worth $3,404,826 and sold 6,112 shares worth $398,910. Company insiders own 4.20% of the company's stock.

BILL Trading Up 1.4 %

BILL stock traded up $1.23 during mid-day trading on Friday, hitting $91.21. The company's stock had a trading volume of 920,489 shares, compared to its average volume of 1,921,929. The firm has a market capitalization of $9.44 billion, a PE ratio of -272.67 and a beta of 1.59. BILL Holdings, Inc. has a 1 year low of $43.11 and a 1 year high of $92.16. The company has a current ratio of 1.53, a quick ratio of 1.53 and a debt-to-equity ratio of 0.23. The stock's fifty day moving average is $61.45 and its two-hundred day moving average is $55.23.

BILL (NYSE:BILL - Get Free Report) last released its quarterly earnings results on Thursday, August 22nd. The company reported $0.57 EPS for the quarter, topping the consensus estimate of $0.46 by $0.11. BILL had a return on equity of 1.54% and a net margin of 0.59%. The business had revenue of $343.67 million during the quarter, compared to analyst estimates of $328.27 million. During the same period last year, the business posted $0.10 earnings per share. The company's quarterly revenue was up 16.1% on a year-over-year basis. On average, analysts anticipate that BILL Holdings, Inc. will post -0.18 EPS for the current year.

Analyst Upgrades and Downgrades

BILL has been the subject of a number of analyst reports. JPMorgan Chase & Co. reduced their price target on BILL from $80.00 to $60.00 and set an "overweight" rating for the company in a report on Tuesday, August 20th. BMO Capital Markets reduced their target price on BILL from $75.00 to $57.00 and set a "market perform" rating for the company in a report on Monday, August 26th. UBS Group reduced their target price on BILL from $85.00 to $65.00 and set a "buy" rating for the company in a report on Thursday, August 15th. Piper Sandler increased their target price on BILL from $60.00 to $85.00 and gave the company an "overweight" rating in a report on Friday, November 8th. Finally, The Goldman Sachs Group increased their target price on BILL from $60.00 to $77.00 and gave the company a "neutral" rating in a report on Tuesday, November 12th. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating and ten have issued a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $74.65.

Get Our Latest Stock Analysis on BILL

BILL Profile

(

Free Report)

BILL Holdings, Inc provides financial automation software for small and midsize businesses worldwide. The company provides software-as-a-service, cloud-based payments, and spend management products, which allow users to automate accounts payable and accounts receivable transactions, as well as enable users to connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve office efficiency.

Recommended Stories

Before you consider BILL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BILL wasn't on the list.

While BILL currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.