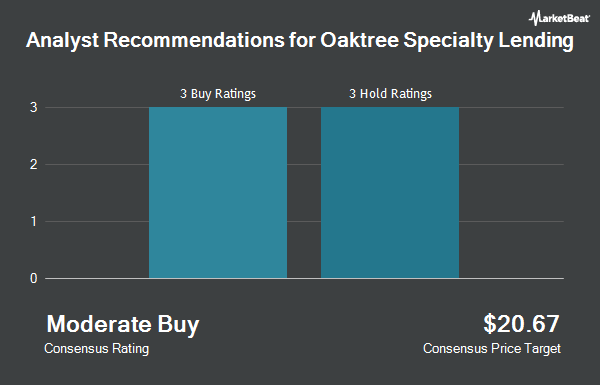

Oaktree Specialty Lending (NASDAQ:OCSL - Get Free Report)'s stock had its "market perform" rating reaffirmed by investment analysts at Oppenheimer in a report issued on Friday,Benzinga reports. They currently have a $18.00 price objective on the credit services provider's stock. Oppenheimer's price target indicates a potential upside of 14.00% from the stock's previous close.

OCSL has been the subject of several other reports. Keefe, Bruyette & Woods lowered their price target on shares of Oaktree Specialty Lending from $18.00 to $17.00 and set a "market perform" rating for the company in a report on Wednesday. JPMorgan Chase & Co. reiterated a "neutral" rating and issued a $15.00 target price (down from $17.00) on shares of Oaktree Specialty Lending in a research report on Wednesday. StockNews.com upgraded shares of Oaktree Specialty Lending from a "sell" rating to a "hold" rating in a report on Wednesday. Wells Fargo & Company reduced their target price on shares of Oaktree Specialty Lending from $17.00 to $15.50 and set an "equal weight" rating on the stock in a report on Tuesday, October 29th. Finally, JMP Securities cut shares of Oaktree Specialty Lending from an "outperform" rating to a "market perform" rating in a research note on Tuesday. Seven equities research analysts have rated the stock with a hold rating, According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $16.75.

Get Our Latest Stock Analysis on OCSL

Oaktree Specialty Lending Price Performance

OCSL stock traded up $0.23 during mid-day trading on Friday, hitting $15.79. The stock had a trading volume of 211,729 shares, compared to its average volume of 662,306. The firm has a fifty day simple moving average of $16.16 and a 200 day simple moving average of $17.47. Oaktree Specialty Lending has a 52 week low of $15.40 and a 52 week high of $21.64. The company has a current ratio of 0.17, a quick ratio of 0.17 and a debt-to-equity ratio of 0.61. The firm has a market capitalization of $1.30 billion, a P/E ratio of 21.85 and a beta of 1.09.

Institutional Trading of Oaktree Specialty Lending

A number of hedge funds and other institutional investors have recently made changes to their positions in OCSL. Private Management Group Inc. raised its position in shares of Oaktree Specialty Lending by 91.5% in the third quarter. Private Management Group Inc. now owns 1,407,573 shares of the credit services provider's stock worth $22,958,000 after buying an additional 672,561 shares in the last quarter. Van ECK Associates Corp increased its position in shares of Oaktree Specialty Lending by 21.0% in the second quarter. Van ECK Associates Corp now owns 1,885,293 shares of the credit services provider's stock worth $35,463,000 after purchasing an additional 327,416 shares during the last quarter. Harbor Capital Advisors Inc. increased its position in shares of Oaktree Specialty Lending by 148.2% in the third quarter. Harbor Capital Advisors Inc. now owns 408,612 shares of the credit services provider's stock worth $6,664,000 after purchasing an additional 243,963 shares during the last quarter. TrueMark Investments LLC purchased a new stake in Oaktree Specialty Lending in the second quarter valued at approximately $4,243,000. Finally, Kovitz Investment Group Partners LLC bought a new stake in Oaktree Specialty Lending during the third quarter valued at approximately $2,849,000. 36.79% of the stock is currently owned by institutional investors.

Oaktree Specialty Lending Company Profile

(

Get Free Report)

Oaktree Specialty Lending Corporation is a business development company. The fund specializing in investments in middle market, bridge financing, first and second lien debt financing, unsecured and mezzanine loan, mezzanine debt, senior and junior secured debt, expansions, sponsor-led acquisitions, preferred equity, and management buyouts in small and mid-sized companies.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Oaktree Specialty Lending, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oaktree Specialty Lending wasn't on the list.

While Oaktree Specialty Lending currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.