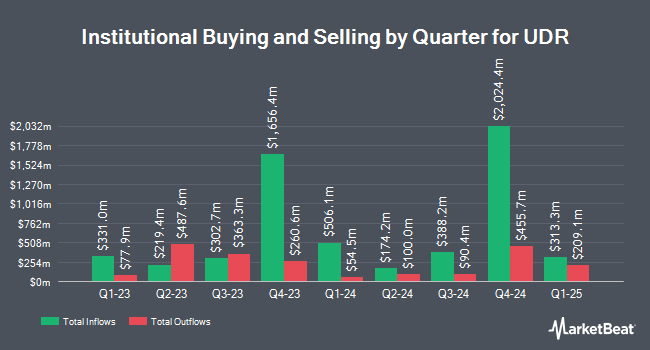

OVERSEA CHINESE BANKING Corp Ltd acquired a new position in shares of UDR, Inc. (NYSE:UDR - Free Report) in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 143,816 shares of the real estate investment trust's stock, valued at approximately $6,521,000.

Other hedge funds have also recently bought and sold shares of the company. Family Firm Inc. bought a new position in UDR in the second quarter valued at about $26,000. UMB Bank n.a. acquired a new stake in UDR in the second quarter worth about $33,000. Rothschild Investment LLC acquired a new stake in UDR in the second quarter worth about $35,000. Quest Partners LLC acquired a new stake in UDR in the second quarter worth about $37,000. Finally, Blue Trust Inc. increased its position in UDR by 1,018.3% in the second quarter. Blue Trust Inc. now owns 1,040 shares of the real estate investment trust's stock worth $39,000 after purchasing an additional 947 shares during the period. 97.84% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

UDR has been the subject of several analyst reports. UBS Group boosted their target price on UDR from $48.00 to $52.00 and gave the stock a "buy" rating in a research report on Thursday, September 12th. The Goldman Sachs Group initiated coverage on UDR in a research report on Wednesday, September 4th. They set a "sell" rating and a $42.00 target price for the company. Deutsche Bank Aktiengesellschaft boosted their target price on UDR from $40.00 to $44.00 and gave the stock a "hold" rating in a research report on Tuesday, September 10th. Wedbush lifted their price objective on UDR from $45.00 to $49.00 and gave the company an "outperform" rating in a report on Monday, August 5th. Finally, Wells Fargo & Company lifted their price objective on UDR from $41.00 to $48.00 and gave the company an "overweight" rating in a report on Monday, August 26th. Two research analysts have rated the stock with a sell rating, eight have assigned a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $45.24.

Get Our Latest Stock Report on UDR

UDR Stock Performance

Shares of UDR stock traded down $0.18 during trading on Tuesday, reaching $44.46. 540,032 shares of the company's stock were exchanged, compared to its average volume of 2,501,189. The company has a quick ratio of 5.91, a current ratio of 5.91 and a debt-to-equity ratio of 1.69. The stock has a market capitalization of $14.67 billion, a PE ratio of 120.68, a PEG ratio of 9.72 and a beta of 0.85. UDR, Inc. has a twelve month low of $31.94 and a twelve month high of $47.55. The firm's fifty day moving average price is $44.62 and its 200-day moving average price is $41.95.

UDR Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, October 31st. Shareholders of record on Thursday, October 10th were issued a $0.425 dividend. This represents a $1.70 dividend on an annualized basis and a yield of 3.82%. The ex-dividend date was Thursday, October 10th. UDR's dividend payout ratio is 459.46%.

About UDR

(

Free Report)

UDR, Inc NYSE: UDR, an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

Featured Articles

Before you consider UDR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UDR wasn't on the list.

While UDR currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.