Pacer Advisors Inc. lessened its holdings in Harmony Biosciences Holdings, Inc. (NASDAQ:HRMY - Free Report) by 23.2% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,928,336 shares of the company's stock after selling 581,273 shares during the quarter. Pacer Advisors Inc. owned 3.38% of Harmony Biosciences worth $77,133,000 as of its most recent SEC filing.

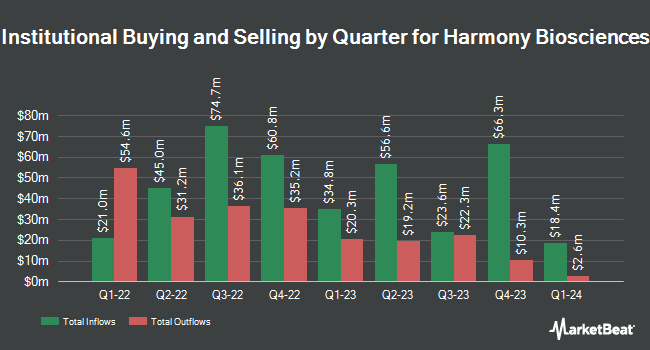

Other large investors have also added to or reduced their stakes in the company. nVerses Capital LLC acquired a new position in shares of Harmony Biosciences during the 2nd quarter worth about $36,000. CWM LLC grew its stake in Harmony Biosciences by 111.7% in the third quarter. CWM LLC now owns 1,469 shares of the company's stock valued at $59,000 after purchasing an additional 775 shares in the last quarter. Quarry LP acquired a new position in shares of Harmony Biosciences during the 2nd quarter worth approximately $62,000. Headlands Technologies LLC raised its position in Harmony Biosciences by 1,608.1% during the second quarter. Headlands Technologies LLC now owns 2,545 shares of the company's stock worth $77,000 after acquiring an additional 2,396 shares in the last quarter. Finally, Mirae Asset Global Investments Co. Ltd. lifted its stake in Harmony Biosciences by 21.2% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,056 shares of the company's stock valued at $80,000 after purchasing an additional 360 shares during the last quarter. Institutional investors and hedge funds own 86.23% of the company's stock.

Harmony Biosciences Stock Up 2.5 %

NASDAQ HRMY traded up $0.84 on Friday, hitting $34.07. 517,893 shares of the company were exchanged, compared to its average volume of 477,812. Harmony Biosciences Holdings, Inc. has a 12 month low of $28.14 and a 12 month high of $41.61. The company has a current ratio of 3.24, a quick ratio of 3.20 and a debt-to-equity ratio of 0.28. The company has a market cap of $1.94 billion, a PE ratio of 15.75, a PEG ratio of 0.60 and a beta of 0.77. The stock has a fifty day moving average of $35.62 and a 200-day moving average of $33.52.

Harmony Biosciences (NASDAQ:HRMY - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The company reported $0.79 earnings per share for the quarter, topping analysts' consensus estimates of $0.64 by $0.15. Harmony Biosciences had a return on equity of 23.16% and a net margin of 17.98%. The business had revenue of $186.00 million for the quarter, compared to the consensus estimate of $184.07 million. During the same period in the prior year, the business earned $0.63 EPS. The firm's revenue for the quarter was up 16.0% on a year-over-year basis. As a group, analysts forecast that Harmony Biosciences Holdings, Inc. will post 2.36 earnings per share for the current year.

Analyst Ratings Changes

Several brokerages recently commented on HRMY. Oppenheimer reaffirmed an "outperform" rating and set a $59.00 target price (up previously from $56.00) on shares of Harmony Biosciences in a report on Wednesday, October 30th. Mizuho upped their target price on Harmony Biosciences from $42.00 to $52.00 and gave the company an "outperform" rating in a research report on Thursday, October 10th. Raymond James reissued an "outperform" rating and issued a $40.00 price objective on shares of Harmony Biosciences in a research note on Thursday, October 10th. Needham & Company LLC reissued a "buy" rating and issued a $52.00 target price on shares of Harmony Biosciences in a report on Tuesday, October 29th. Finally, UBS Group started coverage on shares of Harmony Biosciences in a report on Tuesday, September 10th. They set a "buy" rating and a $56.00 price target for the company. Two investment analysts have rated the stock with a sell rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $47.00.

Get Our Latest Report on Harmony Biosciences

Insider Buying and Selling

In related news, insider Jeffrey Dierks sold 21,496 shares of the firm's stock in a transaction dated Tuesday, October 29th. The shares were sold at an average price of $40.47, for a total value of $869,943.12. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. 30.80% of the stock is owned by company insiders.

Harmony Biosciences Profile

(

Free Report)

Harmony Biosciences Holdings, Inc, a commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States. The company offers WAKIX (pitolisant), a molecule with a novel mechanism of action for the treatment of excessive daytime sleepiness in adult patients with narcolepsy.

Featured Articles

Before you consider Harmony Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harmony Biosciences wasn't on the list.

While Harmony Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.