Global Alpha Capital Management Ltd. lessened its stake in shares of Pacira BioSciences, Inc. (NASDAQ:PCRX - Free Report) by 56.8% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 37,740 shares of the company's stock after selling 49,560 shares during the quarter. Global Alpha Capital Management Ltd. owned about 0.08% of Pacira BioSciences worth $568,000 at the end of the most recent reporting period.

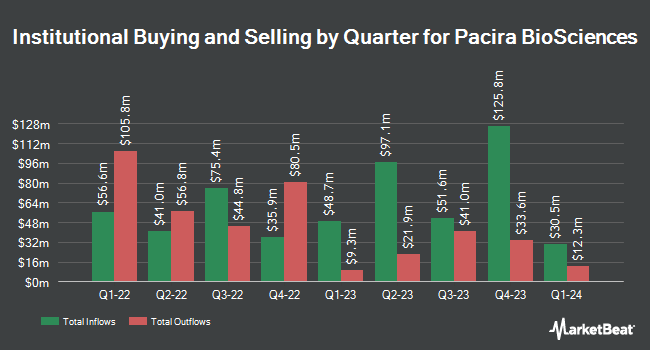

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in PCRX. Pacer Advisors Inc. increased its position in shares of Pacira BioSciences by 37.5% during the 2nd quarter. Pacer Advisors Inc. now owns 2,162,787 shares of the company's stock valued at $61,877,000 after purchasing an additional 590,082 shares during the period. Archon Capital Management LLC acquired a new stake in Pacira BioSciences in the 1st quarter valued at about $15,677,000. Fort Washington Investment Advisors Inc. OH bought a new position in shares of Pacira BioSciences during the 2nd quarter valued at about $13,240,000. Assenagon Asset Management S.A. grew its stake in shares of Pacira BioSciences by 314.4% in the 3rd quarter. Assenagon Asset Management S.A. now owns 553,114 shares of the company's stock worth $8,324,000 after purchasing an additional 419,656 shares during the last quarter. Finally, Doma Perpetual Capital Management LLC lifted its stake in Pacira BioSciences by 71.8% during the second quarter. Doma Perpetual Capital Management LLC now owns 1,000,761 shares of the company's stock valued at $28,632,000 after purchasing an additional 418,321 shares during the last quarter. Institutional investors own 99.73% of the company's stock.

Analyst Ratings Changes

Several research analysts have issued reports on the company. Truist Financial cut Pacira BioSciences from a "buy" rating to a "sell" rating and dropped their price target for the company from $30.00 to $8.00 in a report on Tuesday, August 13th. Raymond James downgraded Pacira BioSciences from an "outperform" rating to a "market perform" rating in a report on Monday, August 12th. Jefferies Financial Group lifted their price target on Pacira BioSciences from $15.00 to $18.00 and gave the stock a "buy" rating in a research note on Tuesday, September 24th. Piper Sandler lowered shares of Pacira BioSciences from an "overweight" rating to a "neutral" rating and reduced their price objective for the company from $42.00 to $11.00 in a research note on Monday, August 12th. Finally, Barclays dropped their target price on shares of Pacira BioSciences from $25.00 to $17.00 and set an "equal weight" rating on the stock in a research report on Tuesday, November 12th. Two analysts have rated the stock with a sell rating, four have issued a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, Pacira BioSciences has a consensus rating of "Hold" and an average price target of $23.50.

Read Our Latest Stock Report on Pacira BioSciences

Pacira BioSciences Stock Up 1.8 %

NASDAQ PCRX traded up $0.30 during trading on Wednesday, reaching $17.03. The company's stock had a trading volume of 466,592 shares, compared to its average volume of 854,617. The business has a 50-day moving average price of $15.94 and a 200-day moving average price of $20.45. Pacira BioSciences, Inc. has a 1-year low of $11.16 and a 1-year high of $35.95. The stock has a market capitalization of $786.28 million, a PE ratio of -8.24 and a beta of 0.82. The company has a current ratio of 2.25, a quick ratio of 1.89 and a debt-to-equity ratio of 0.51.

Pacira BioSciences Company Profile

(

Free Report)

Pacira BioSciences, Inc engages in the development, manufacture, marketing, distribution, and sale of non-opioid pain management and regenerative health solutions to healthcare practitioners in the United States. The company offers EXPAREL, a bupivacaine liposome injectable suspension; ZILRETTA, a triamcinolone acetonide extended-release injectable suspension; and iovera system, a non-opioid handheld cryoanalgesia device used to produce controlled doses of cold temperature to targeted nerves.

Read More

Before you consider Pacira BioSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pacira BioSciences wasn't on the list.

While Pacira BioSciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.