Paragon 28 (NYSE:FNA - Get Free Report) had its price target hoisted by research analysts at Needham & Company LLC from $11.00 to $13.00 in a report released on Wednesday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Needham & Company LLC's price objective points to a potential upside of 27.20% from the stock's previous close.

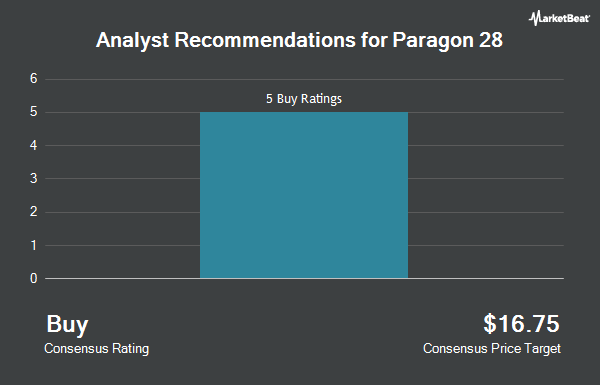

Separately, Piper Sandler reissued an "overweight" rating and issued a $12.00 target price (down from $15.00) on shares of Paragon 28 in a report on Friday, August 9th. Five investment analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, Paragon 28 presently has an average rating of "Buy" and an average price target of $15.60.

Get Our Latest Stock Report on FNA

Paragon 28 Price Performance

Shares of NYSE:FNA traded up $2.72 during trading on Wednesday, hitting $10.22. 2,405,417 shares of the stock were exchanged, compared to its average volume of 602,492. The company has a debt-to-equity ratio of 0.75, a current ratio of 3.57 and a quick ratio of 1.70. Paragon 28 has a 1-year low of $4.65 and a 1-year high of $14.79. The company's fifty day simple moving average is $6.28 and its 200-day simple moving average is $7.19.

Paragon 28 (NYSE:FNA - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The company reported ($0.15) earnings per share for the quarter, topping analysts' consensus estimates of ($0.16) by $0.01. Paragon 28 had a negative net margin of 25.31% and a negative return on equity of 36.84%. The firm had revenue of $62.30 million for the quarter, compared to the consensus estimate of $60.58 million. During the same quarter in the previous year, the company earned ($0.10) earnings per share. The business's revenue was up 18.0% compared to the same quarter last year. Analysts forecast that Paragon 28 will post -0.68 earnings per share for the current year.

Hedge Funds Weigh In On Paragon 28

A number of large investors have recently modified their holdings of the stock. Nisa Investment Advisors LLC raised its position in shares of Paragon 28 by 46,660.0% during the 2nd quarter. Nisa Investment Advisors LLC now owns 4,676 shares of the company's stock valued at $32,000 after acquiring an additional 4,666 shares during the last quarter. Levin Capital Strategies L.P. bought a new stake in Paragon 28 in the second quarter valued at about $68,000. Intech Investment Management LLC acquired a new position in Paragon 28 in the third quarter valued at about $70,000. Ballentine Partners LLC bought a new position in Paragon 28 during the third quarter worth about $91,000. Finally, Creative Planning acquired a new position in shares of Paragon 28 during the 3rd quarter worth about $91,000. 63.57% of the stock is currently owned by institutional investors and hedge funds.

About Paragon 28

(

Get Free Report)

Paragon 28, Inc develops, distributes, and sells foot and ankle surgical systems in the United States and internationally. It offers plating systems, including gorilla plating systems, such as lisfranc, lapidus, lateral column, calcaneus slide, and naviculocuneiform (NC) fusion plating systems; baby gorilla plate-specific screws, navicular fracture plates, and 5th metatarsal hook plates; and silverback plating systems.

Featured Stories

Before you consider Paragon 28, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paragon 28 wasn't on the list.

While Paragon 28 currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.