Pathstone Holdings LLC increased its stake in American Water Works Company, Inc. (NYSE:AWK - Free Report) by 11.3% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 48,618 shares of the utilities provider's stock after acquiring an additional 4,944 shares during the quarter. Pathstone Holdings LLC's holdings in American Water Works were worth $7,110,000 at the end of the most recent reporting period.

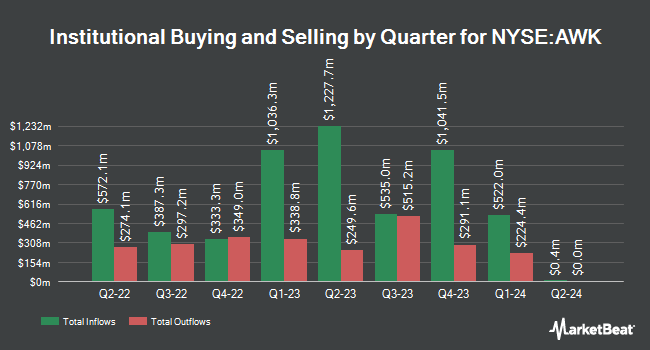

A number of other large investors also recently added to or reduced their stakes in AWK. Impax Asset Management Group plc boosted its stake in American Water Works by 3.7% during the second quarter. Impax Asset Management Group plc now owns 6,902,257 shares of the utilities provider's stock worth $890,422,000 after buying an additional 247,745 shares during the last quarter. Allspring Global Investments Holdings LLC increased its position in American Water Works by 6.8% during the third quarter. Allspring Global Investments Holdings LLC now owns 2,245,306 shares of the utilities provider's stock worth $328,354,000 after purchasing an additional 143,914 shares during the last quarter. Mirova US LLC boosted its holdings in American Water Works by 2.1% in the 2nd quarter. Mirova US LLC now owns 1,588,109 shares of the utilities provider's stock valued at $205,120,000 after purchasing an additional 32,764 shares during the last quarter. Wulff Hansen & CO. grew its stake in shares of American Water Works by 12,816.0% in the 2nd quarter. Wulff Hansen & CO. now owns 1,464,674 shares of the utilities provider's stock valued at $189,177,000 after buying an additional 1,453,334 shares during the period. Finally, Victory Capital Management Inc. increased its holdings in shares of American Water Works by 1,131.1% during the 3rd quarter. Victory Capital Management Inc. now owns 1,438,137 shares of the utilities provider's stock worth $210,313,000 after buying an additional 1,321,320 shares during the last quarter. 86.58% of the stock is currently owned by institutional investors and hedge funds.

American Water Works Stock Down 1.1 %

Shares of NYSE:AWK traded down $1.48 during trading hours on Friday, reaching $137.31. The stock had a trading volume of 1,196,596 shares, compared to its average volume of 1,198,966. The stock has a market capitalization of $26.76 billion, a price-to-earnings ratio of 27.46, a P/E/G ratio of 3.22 and a beta of 0.70. The firm's 50 day moving average is $140.27 and its 200-day moving average is $137.64. American Water Works Company, Inc. has a 1 year low of $113.34 and a 1 year high of $150.68. The company has a debt-to-equity ratio of 1.21, a quick ratio of 0.53 and a current ratio of 0.58.

American Water Works Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 3rd. Stockholders of record on Tuesday, November 12th will be given a dividend of $0.765 per share. The ex-dividend date is Tuesday, November 12th. This represents a $3.06 annualized dividend and a dividend yield of 2.23%. American Water Works's dividend payout ratio is presently 60.59%.

Analyst Upgrades and Downgrades

Several brokerages recently weighed in on AWK. Jefferies Financial Group started coverage on American Water Works in a research report on Monday, October 7th. They issued an "underperform" rating and a $124.00 price objective for the company. Mizuho downgraded shares of American Water Works from an "outperform" rating to a "neutral" rating and boosted their price target for the company from $131.00 to $140.00 in a research note on Tuesday, October 15th. Bank of America reissued an "underperform" rating and issued a $140.00 target price on shares of American Water Works in a research report on Friday, September 20th. UBS Group raised American Water Works from a "neutral" rating to a "buy" rating and lifted their price objective for the company from $151.00 to $155.00 in a research note on Tuesday. Finally, Wells Fargo & Company cut American Water Works from an "equal weight" rating to an "underweight" rating and raised their target price for the company from $127.00 to $138.00 in a report on Wednesday, July 31st. Four equities research analysts have rated the stock with a sell rating, three have given a hold rating and two have assigned a buy rating to the company. According to data from MarketBeat, American Water Works presently has an average rating of "Hold" and an average target price of $142.29.

View Our Latest Analysis on AWK

Insider Activity

In related news, Director Martha Clark Goss sold 710 shares of the company's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $142.85, for a total value of $101,423.50. Following the completion of the sale, the director now owns 36,880 shares in the company, valued at $5,268,308. This represents a 1.89 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 0.08% of the company's stock.

American Water Works Profile

(

Free Report)

American Water Works Company, Inc, through its subsidiaries, provides water and wastewater services in the United States. It offers water and wastewater services to approximately 1,700 communities in 14 states serving approximately 3.5 million active customers. The company serves residential customers; commercial customers, including food and beverage providers, commercial property developers and proprietors, and energy suppliers; fire service and private fire customers; industrial customers, such as large-scale manufacturers, mining, and production operations; public authorities comprising government buildings and other public sector facilities, such as schools and universities; and other utilities and community water and wastewater systems.

Read More

Before you consider American Water Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Water Works wasn't on the list.

While American Water Works currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.