Pathstone Holdings LLC cut its stake in shares of Mohawk Industries, Inc. (NYSE:MHK - Free Report) by 8.3% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 46,507 shares of the company's stock after selling 4,186 shares during the period. Pathstone Holdings LLC owned about 0.07% of Mohawk Industries worth $7,473,000 as of its most recent SEC filing.

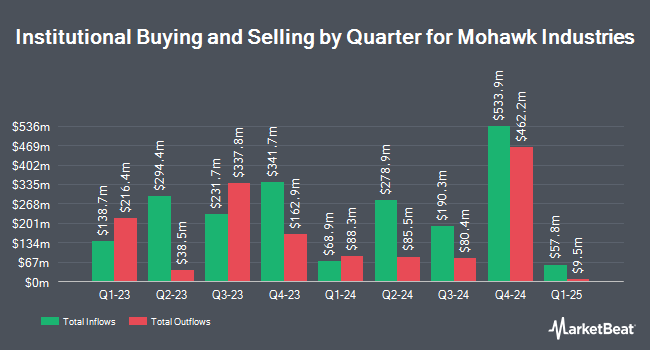

Several other institutional investors and hedge funds have also bought and sold shares of MHK. Signaturefd LLC increased its stake in shares of Mohawk Industries by 12.5% in the 3rd quarter. Signaturefd LLC now owns 683 shares of the company's stock worth $110,000 after purchasing an additional 76 shares in the last quarter. Quest Partners LLC grew its stake in shares of Mohawk Industries by 40.0% during the 2nd quarter. Quest Partners LLC now owns 294 shares of the company's stock valued at $33,000 after acquiring an additional 84 shares during the period. State of Michigan Retirement System increased its holdings in Mohawk Industries by 0.7% in the 2nd quarter. State of Michigan Retirement System now owns 14,545 shares of the company's stock worth $1,652,000 after acquiring an additional 100 shares in the last quarter. Allworth Financial LP raised its stake in Mohawk Industries by 20.6% during the 3rd quarter. Allworth Financial LP now owns 626 shares of the company's stock worth $101,000 after acquiring an additional 107 shares during the period. Finally, US Bancorp DE lifted its holdings in Mohawk Industries by 3.9% during the third quarter. US Bancorp DE now owns 3,920 shares of the company's stock valued at $630,000 after purchasing an additional 146 shares in the last quarter. 78.98% of the stock is owned by hedge funds and other institutional investors.

Mohawk Industries Trading Up 0.9 %

Shares of NYSE MHK traded up $1.28 during midday trading on Friday, reaching $138.77. 434,974 shares of the stock were exchanged, compared to its average volume of 718,454. The company has a 50 day simple moving average of $149.80 and a 200 day simple moving average of $136.98. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.09 and a current ratio of 2.03. The stock has a market capitalization of $8.76 billion, a P/E ratio of 15.81, a PEG ratio of 1.50 and a beta of 1.38. Mohawk Industries, Inc. has a twelve month low of $82.71 and a twelve month high of $164.29.

Wall Street Analyst Weigh In

MHK has been the topic of a number of research analyst reports. Robert W. Baird raised Mohawk Industries from a "neutral" rating to an "overweight" rating and boosted their price target for the stock from $160.00 to $196.00 in a report on Monday, October 21st. The Goldman Sachs Group upped their target price on shares of Mohawk Industries from $141.00 to $185.00 and gave the company a "buy" rating in a research report on Monday, July 29th. Jefferies Financial Group upped their price objective on Mohawk Industries from $150.00 to $160.00 and gave the company a "hold" rating in a research report on Wednesday, October 9th. Loop Capital lifted their price objective on shares of Mohawk Industries from $145.00 to $185.00 and gave the stock a "buy" rating in a research note on Monday, July 29th. Finally, Bank of America raised shares of Mohawk Industries from an "underperform" rating to a "buy" rating and increased their price objective for the stock from $120.00 to $177.00 in a research report on Friday, July 26th. Five research analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $162.08.

Read Our Latest Research Report on MHK

Insider Activity at Mohawk Industries

In other news, insider Suzanne L. Helen sold 660 shares of the firm's stock in a transaction on Monday, September 9th. The shares were sold at an average price of $151.46, for a total value of $99,963.60. Following the sale, the insider now directly owns 118,709 shares in the company, valued at approximately $17,979,665.14. This trade represents a 0.55 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Company insiders own 17.10% of the company's stock.

Mohawk Industries Profile

(

Free Report)

Mohawk Industries, Inc designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally. It operates through three segments: Global Ceramic, Flooring North America, and Flooring Rest of the World.

Further Reading

Before you consider Mohawk Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mohawk Industries wasn't on the list.

While Mohawk Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.