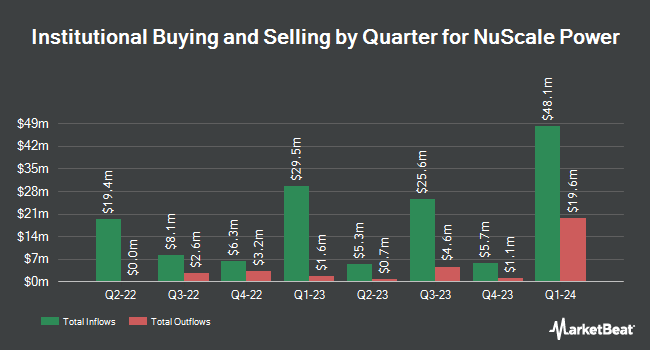

Philip James Wealth Mangement LLC bought a new stake in shares of NuScale Power Co. (NYSE:SMR - Free Report) during the 3rd quarter, according to its most recent filing with the SEC. The fund bought 143,034 shares of the company's stock, valued at approximately $1,656,000. Philip James Wealth Mangement LLC owned approximately 0.06% of NuScale Power as of its most recent filing with the SEC.

A number of other institutional investors and hedge funds have also added to or reduced their stakes in SMR. US Bancorp DE bought a new stake in shares of NuScale Power in the 3rd quarter valued at approximately $54,000. CWM LLC lifted its holdings in shares of NuScale Power by 4,593.8% during the third quarter. CWM LLC now owns 5,304 shares of the company's stock valued at $61,000 after acquiring an additional 5,191 shares during the period. International Assets Investment Management LLC acquired a new stake in shares of NuScale Power in the 2nd quarter valued at $64,000. TFC Financial Management Inc. bought a new stake in shares of NuScale Power in the 2nd quarter worth about $75,000. Finally, Fortitude Family Office LLC acquired a new stake in shares of NuScale Power during the 2nd quarter worth about $98,000. Institutional investors own 15.28% of the company's stock.

Insider Buying and Selling at NuScale Power

In related news, insider Robert K. Temple sold 115,866 shares of the business's stock in a transaction that occurred on Wednesday, October 16th. The shares were sold at an average price of $18.20, for a total transaction of $2,108,761.20. Following the completion of the sale, the insider now directly owns 14,054 shares of the company's stock, valued at $255,782.80. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. In other NuScale Power news, insider Robert K. Temple sold 68,558 shares of the firm's stock in a transaction dated Friday, October 4th. The stock was sold at an average price of $13.02, for a total transaction of $892,625.16. Following the transaction, the insider now owns 14,054 shares in the company, valued at approximately $182,983.08. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Robert K. Temple sold 115,866 shares of the company's stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $18.20, for a total value of $2,108,761.20. Following the completion of the sale, the insider now directly owns 14,054 shares of the company's stock, valued at approximately $255,782.80. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 478,293 shares of company stock worth $6,179,222. Company insiders own 1.96% of the company's stock.

NuScale Power Trading Up 13.1 %

SMR stock traded up $2.83 during trading on Friday, hitting $24.50. The company had a trading volume of 24,644,236 shares, compared to its average volume of 6,026,687. The stock has a market cap of $6.10 billion, a price-to-earnings ratio of -24.94 and a beta of 1.12. The company has a quick ratio of 2.66, a current ratio of 2.66 and a debt-to-equity ratio of 0.27. The firm has a 50-day moving average price of $13.55 and a 200-day moving average price of $10.60. NuScale Power Co. has a 12 month low of $1.81 and a 12 month high of $25.82.

NuScale Power (NYSE:SMR - Get Free Report) last issued its quarterly earnings results on Thursday, August 8th. The company reported ($0.31) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.13) by ($0.18). The firm had revenue of $0.97 million for the quarter, compared to analyst estimates of $1.43 million. NuScale Power had a negative net margin of 592.28% and a negative return on equity of 61.82%. During the same period last year, the company earned ($0.13) EPS.

Analysts Set New Price Targets

Several research firms have recently weighed in on SMR. Craig Hallum raised their price objective on shares of NuScale Power from $16.00 to $21.00 and gave the stock a "buy" rating in a report on Thursday, October 17th. CLSA began coverage on NuScale Power in a report on Friday, September 13th. They set an "outperform" rating and a $11.00 price target for the company. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $10.39.

Get Our Latest Stock Report on NuScale Power

NuScale Power Company Profile

(

Free Report)

NuScale Power Corporation engages in the development and sale of modular light water reactor nuclear power plants to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications. It offers NuScale Power Module (NPM), a water reactor that can generate 77 megawatts of electricity (MWe); and VOYGR power plant designs for three facility sizes that are capable of housing from one to four and six or twelve NPMs.

Featured Articles

Before you consider NuScale Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NuScale Power wasn't on the list.

While NuScale Power currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.