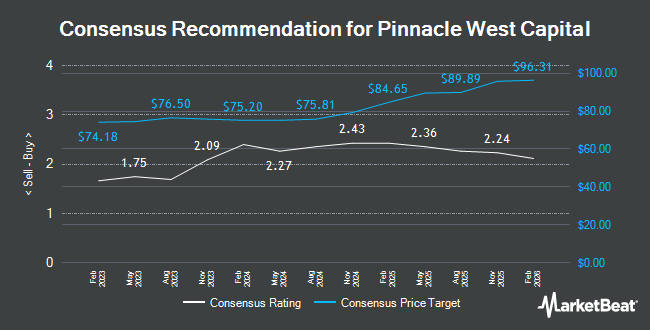

Pinnacle West Capital (NYSE:PNW - Get Free Report) was downgraded by equities research analysts at Barclays from an "overweight" rating to an "equal weight" rating in a research note issued on Monday, Marketbeat Ratings reports. They currently have a $91.00 price objective on the utilities provider's stock, down from their previous price objective of $93.00. Barclays's price target indicates a potential downside of 0.63% from the stock's previous close.

Several other research analysts also recently weighed in on the stock. Morgan Stanley upped their price objective on shares of Pinnacle West Capital from $78.00 to $83.00 and gave the stock an "equal weight" rating in a report on Wednesday, September 25th. Jefferies Financial Group started coverage on Pinnacle West Capital in a research note on Thursday, September 19th. They issued a "buy" rating and a $104.00 target price for the company. Wells Fargo & Company raised their price target on Pinnacle West Capital from $90.00 to $92.00 and gave the company an "equal weight" rating in a research report on Thursday, November 7th. Finally, StockNews.com upgraded shares of Pinnacle West Capital from a "sell" rating to a "hold" rating in a report on Monday, August 5th. Eight equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, Pinnacle West Capital presently has a consensus rating of "Hold" and a consensus target price of $82.04.

Get Our Latest Report on PNW

Pinnacle West Capital Stock Performance

Shares of PNW traded down $0.30 during mid-day trading on Monday, hitting $91.58. 1,645,389 shares of the company's stock were exchanged, compared to its average volume of 1,163,277. The stock's 50-day simple moving average is $88.75 and its 200-day simple moving average is $83.44. The firm has a market cap of $10.41 billion, a price-to-earnings ratio of 17.40, a price-to-earnings-growth ratio of 2.15 and a beta of 0.52. The company has a quick ratio of 0.54, a current ratio of 0.71 and a debt-to-equity ratio of 1.20. Pinnacle West Capital has a 52 week low of $65.20 and a 52 week high of $93.12.

Institutional Investors Weigh In On Pinnacle West Capital

Institutional investors and hedge funds have recently modified their holdings of the stock. Capital Research Global Investors raised its holdings in Pinnacle West Capital by 97.5% in the first quarter. Capital Research Global Investors now owns 12,851,930 shares of the utilities provider's stock valued at $960,425,000 after acquiring an additional 6,344,121 shares in the last quarter. Lazard Asset Management LLC lifted its stake in Pinnacle West Capital by 72.7% in the first quarter. Lazard Asset Management LLC now owns 6,719,397 shares of the utilities provider's stock valued at $502,139,000 after buying an additional 2,828,450 shares during the last quarter. Zimmer Partners LP acquired a new stake in shares of Pinnacle West Capital in the first quarter valued at approximately $198,409,000. Barrow Hanley Mewhinney & Strauss LLC raised its holdings in shares of Pinnacle West Capital by 24.6% during the second quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 6,985,619 shares of the utilities provider's stock valued at $533,562,000 after buying an additional 1,379,368 shares during the last quarter. Finally, International Assets Investment Management LLC grew its holdings in Pinnacle West Capital by 152,118.2% in the 3rd quarter. International Assets Investment Management LLC now owns 258,771 shares of the utilities provider's stock worth $22,925,000 after buying an additional 258,601 shares in the last quarter. Hedge funds and other institutional investors own 91.51% of the company's stock.

Pinnacle West Capital Company Profile

(

Get Free Report)

Pinnacle West Capital Corporation, through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona. The company engages in the generation, transmission, and distribution of electricity using coal, nuclear, gas, oil, and solar generating facilities. Its transmission facilities include overhead lines and underground lines; and distribution facilities consist of overhead lines and underground primary cables.

Featured Articles

Before you consider Pinnacle West Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinnacle West Capital wasn't on the list.

While Pinnacle West Capital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.