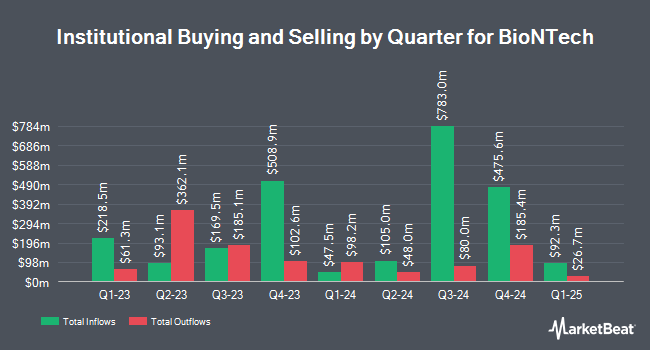

Point72 Europe London LLP acquired a new stake in BioNTech SE (NASDAQ:BNTX - Free Report) during the third quarter, according to its most recent 13F filing with the SEC. The fund acquired 27,231 shares of the company's stock, valued at approximately $3,234,000.

Other institutional investors have also added to or reduced their stakes in the company. FMR LLC raised its holdings in BioNTech by 797.8% during the 3rd quarter. FMR LLC now owns 6,299,929 shares of the company's stock valued at $748,243,000 after acquiring an additional 5,598,190 shares during the period. Fred Alger Management LLC purchased a new position in shares of BioNTech in the third quarter valued at $59,485,000. Candriam S.C.A. raised its stake in shares of BioNTech by 261.2% during the 2nd quarter. Candriam S.C.A. now owns 578,998 shares of the company's stock valued at $46,526,000 after purchasing an additional 418,695 shares during the period. Point72 Asset Management L.P. lifted its holdings in BioNTech by 283.5% during the 2nd quarter. Point72 Asset Management L.P. now owns 461,711 shares of the company's stock worth $37,103,000 after purchasing an additional 341,311 shares in the last quarter. Finally, Braidwell LP bought a new position in BioNTech in the 3rd quarter worth about $29,425,000. 15.52% of the stock is owned by hedge funds and other institutional investors.

BioNTech Trading Down 1.9 %

NASDAQ:BNTX traded down $2.33 during trading hours on Friday, reaching $118.39. The company's stock had a trading volume of 518,891 shares, compared to its average volume of 815,877. The firm has a market capitalization of $28.38 billion, a price-to-earnings ratio of -56.38 and a beta of 0.26. The firm has a 50-day simple moving average of $113.81 and a 200-day simple moving average of $98.68. The company has a debt-to-equity ratio of 0.01, a quick ratio of 7.21 and a current ratio of 7.33. BioNTech SE has a 1 year low of $76.53 and a 1 year high of $131.49.

BioNTech (NASDAQ:BNTX - Get Free Report) last issued its earnings results on Monday, November 4th. The company reported $0.81 earnings per share for the quarter, beating the consensus estimate of ($1.26) by $2.07. BioNTech had a negative return on equity of 2.35% and a negative net margin of 15.16%. The company had revenue of $1.24 billion during the quarter, compared to analysts' expectations of $514.08 million. During the same period in the prior year, the business posted $0.73 EPS. BioNTech's quarterly revenue was up 38.9% compared to the same quarter last year. Research analysts expect that BioNTech SE will post -3.68 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities research analysts have recently issued reports on the stock. JPMorgan Chase & Co. lowered their price target on shares of BioNTech from $124.00 to $122.00 and set a "neutral" rating on the stock in a report on Tuesday. The Goldman Sachs Group upgraded shares of BioNTech from a "neutral" rating to a "buy" rating and increased their target price for the stock from $90.00 to $137.00 in a research note on Friday, November 8th. Evercore ISI raised shares of BioNTech from an "in-line" rating to an "outperform" rating and raised their price target for the company from $110.00 to $125.00 in a report on Tuesday, November 19th. TD Cowen decreased their price target on shares of BioNTech from $132.00 to $122.00 and set a "hold" rating on the stock in a report on Tuesday, November 5th. Finally, Hsbc Global Res raised BioNTech from a "hold" rating to a "strong-buy" rating in a research note on Friday, August 2nd. Four analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, BioNTech presently has a consensus rating of "Moderate Buy" and an average target price of $138.67.

Check Out Our Latest Analysis on BioNTech

About BioNTech

(

Free Report)

BioNTech SE, a biotechnology company, develops and commercializes immunotherapies for cancer and other infectious diseases. The company is developing FixVac product candidates, including BNT111, which is in Phase II clinical trial for advance melanoma; BNT112 that is in Phase I/IIa clinical trial for prostate cancer; BNT113, which is in Phase II clinical trial to treat HPV 16+ head and neck cancers; BNT114 to treat triple negative breast cancer; BNT115, which is in Phase I clinical trial in ovarian cancer; and BNT116, which is in Phase I clinical trial for non-small cell lung cancer.

Recommended Stories

Before you consider BioNTech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioNTech wasn't on the list.

While BioNTech currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.