Portfolio Design Labs LLC acquired a new position in SEI Investments (NASDAQ:SEIC - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 24,580 shares of the asset manager's stock, valued at approximately $1,701,000.

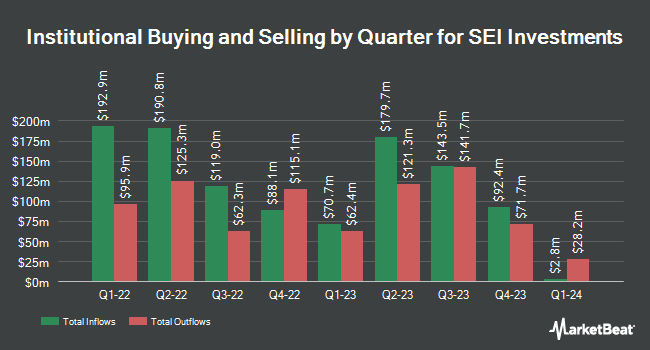

Other hedge funds have also recently bought and sold shares of the company. Fairfield Financial Advisors LTD acquired a new position in shares of SEI Investments during the 2nd quarter worth $30,000. First Horizon Advisors Inc. increased its stake in SEI Investments by 101.3% during the third quarter. First Horizon Advisors Inc. now owns 461 shares of the asset manager's stock valued at $32,000 after acquiring an additional 232 shares during the period. Livforsakringsbolaget Skandia Omsesidigt increased its stake in SEI Investments by 925.9% during the third quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 554 shares of the asset manager's stock valued at $38,000 after acquiring an additional 500 shares during the period. EverSource Wealth Advisors LLC boosted its holdings in SEI Investments by 78.3% during the first quarter. EverSource Wealth Advisors LLC now owns 626 shares of the asset manager's stock valued at $41,000 after purchasing an additional 275 shares in the last quarter. Finally, Bessemer Group Inc. boosted its holdings in SEI Investments by 184.7% during the first quarter. Bessemer Group Inc. now owns 595 shares of the asset manager's stock valued at $43,000 after purchasing an additional 386 shares in the last quarter. 70.59% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on the company. Oppenheimer boosted their target price on SEI Investments from $81.00 to $85.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Piper Sandler upped their target price on shares of SEI Investments from $74.00 to $77.00 and gave the company a "neutral" rating in a research report on Thursday, October 24th. Morgan Stanley upped their price objective on shares of SEI Investments from $70.00 to $75.00 and gave the company an "underweight" rating in a research report on Thursday, October 24th. Finally, Keefe, Bruyette & Woods restated a "market perform" rating and issued a $73.00 price objective (down previously from $74.00) on shares of SEI Investments in a research report on Thursday, July 25th. One analyst has rated the stock with a sell rating, two have assigned a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $77.50.

Get Our Latest Analysis on SEI Investments

SEI Investments Price Performance

SEI Investments stock traded up $0.45 during trading hours on Wednesday, hitting $79.91. The company had a trading volume of 531,378 shares, compared to its average volume of 589,214. The firm has a market cap of $10.30 billion, a PE ratio of 19.30, a PEG ratio of 1.52 and a beta of 0.97. SEI Investments has a one year low of $57.43 and a one year high of $81.97. The firm has a 50-day moving average of $73.17 and a 200 day moving average of $68.86.

SEI Investments (NASDAQ:SEIC - Get Free Report) last released its quarterly earnings results on Wednesday, October 23rd. The asset manager reported $1.19 earnings per share for the quarter, beating the consensus estimate of $1.07 by $0.12. The firm had revenue of $537.40 million for the quarter, compared to analysts' expectations of $534.08 million. SEI Investments had a net margin of 26.60% and a return on equity of 24.29%. The business's revenue was up 12.7% on a year-over-year basis. During the same period in the prior year, the firm earned $0.87 EPS. As a group, research analysts expect that SEI Investments will post 4.41 earnings per share for the current year.

SEI Investments declared that its Board of Directors has approved a share repurchase program on Tuesday, October 22nd that allows the company to buyback $400.00 million in outstanding shares. This buyback authorization allows the asset manager to reacquire up to 4.3% of its stock through open market purchases. Stock buyback programs are usually an indication that the company's board believes its shares are undervalued.

Insider Buying and Selling at SEI Investments

In related news, EVP Michael Peterson sold 10,000 shares of the stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $79.14, for a total transaction of $791,400.00. Following the sale, the executive vice president now owns 6,500 shares in the company, valued at approximately $514,410. This trade represents a 60.61 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Chairman Alfred P. West, Jr. sold 44,163 shares of the stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $67.55, for a total transaction of $2,983,210.65. Following the sale, the chairman now owns 7,605,414 shares in the company, valued at $513,745,715.70. This represents a 0.58 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 200,646 shares of company stock valued at $14,115,934 in the last three months. 14.30% of the stock is currently owned by company insiders.

About SEI Investments

(

Free Report)

SEI Investments Company is a publicly owned asset management holding company. Through its subsidiaries, the firm provides wealth management, retirement and investment solutions, asset management, asset administration, investment processing outsourcing solutions, financial services, and investment advisory services to its clients.

See Also

Before you consider SEI Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEI Investments wasn't on the list.

While SEI Investments currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.