Primecap Management Co. CA trimmed its position in shares of Carrier Global Co. (NYSE:CARR - Free Report) by 15.0% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 2,083,232 shares of the company's stock after selling 366,559 shares during the quarter. Primecap Management Co. CA owned approximately 0.23% of Carrier Global worth $167,679,000 at the end of the most recent reporting period.

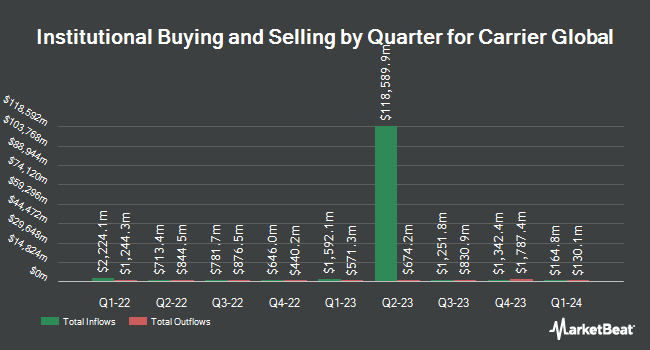

A number of other institutional investors also recently bought and sold shares of the company. Olistico Wealth LLC purchased a new stake in shares of Carrier Global in the second quarter valued at $25,000. Meeder Asset Management Inc. boosted its stake in shares of Carrier Global by 675.0% during the 2nd quarter. Meeder Asset Management Inc. now owns 465 shares of the company's stock worth $29,000 after purchasing an additional 405 shares during the last quarter. EdgeRock Capital LLC acquired a new stake in shares of Carrier Global during the 2nd quarter worth about $32,000. Hantz Financial Services Inc. purchased a new stake in shares of Carrier Global during the second quarter worth about $35,000. Finally, McClarren Financial Advisors Inc. lifted its stake in shares of Carrier Global by 246.0% during the third quarter. McClarren Financial Advisors Inc. now owns 436 shares of the company's stock valued at $35,000 after buying an additional 310 shares during the period. 91.00% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on CARR. Bank of America increased their price target on Carrier Global from $80.00 to $90.00 and gave the stock a "neutral" rating in a research note on Friday, October 18th. Northcoast Research assumed coverage on Carrier Global in a report on Friday. They issued a "neutral" rating for the company. Stephens cut their price objective on shares of Carrier Global from $85.00 to $80.00 and set an "equal weight" rating on the stock in a report on Monday, October 28th. JPMorgan Chase & Co. initiated coverage on shares of Carrier Global in a report on Thursday, October 10th. They issued a "neutral" rating and a $83.00 target price for the company. Finally, Mizuho increased their price target on shares of Carrier Global from $65.00 to $78.00 and gave the stock a "neutral" rating in a research note on Thursday, October 17th. Eight equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $82.31.

View Our Latest Stock Report on CARR

Carrier Global Stock Performance

Shares of NYSE CARR traded up $0.99 during trading on Friday, reaching $77.00. The stock had a trading volume of 4,465,562 shares, compared to its average volume of 4,212,257. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.82 and a current ratio of 1.08. The stock has a market cap of $69.09 billion, a PE ratio of 19.43, a P/E/G ratio of 2.67 and a beta of 1.34. Carrier Global Co. has a one year low of $51.20 and a one year high of $83.32. The firm's 50 day moving average price is $77.87 and its two-hundred day moving average price is $70.14.

Carrier Global declared that its Board of Directors has initiated a stock repurchase plan on Thursday, October 24th that permits the company to buyback $3.00 billion in shares. This buyback authorization permits the company to buy up to 4.6% of its shares through open market purchases. Shares buyback plans are usually an indication that the company's board believes its stock is undervalued.

Carrier Global Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, November 18th. Stockholders of record on Friday, October 25th were issued a $0.19 dividend. This represents a $0.76 annualized dividend and a dividend yield of 0.99%. The ex-dividend date was Friday, October 25th. Carrier Global's dividend payout ratio (DPR) is presently 19.24%.

Carrier Global Company Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Featured Articles

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.