Principal Financial Group Inc. decreased its stake in shares of Sealed Air Co. (NYSE:SEE - Free Report) by 4.1% during the third quarter, according to the company in its most recent filing with the SEC. The fund owned 693,886 shares of the industrial products company's stock after selling 29,364 shares during the period. Principal Financial Group Inc. owned 0.48% of Sealed Air worth $25,188,000 as of its most recent filing with the SEC.

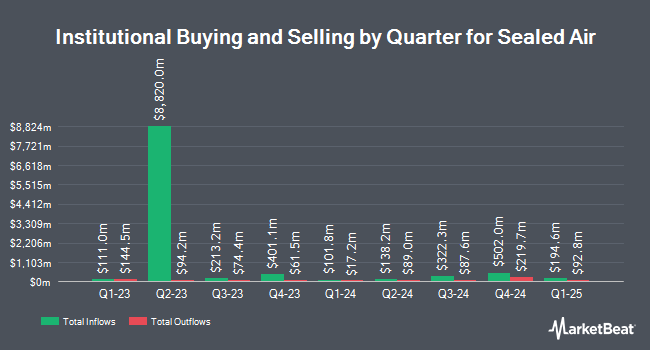

A number of other hedge funds have also made changes to their positions in the stock. Vanguard Group Inc. increased its holdings in shares of Sealed Air by 3.7% during the 1st quarter. Vanguard Group Inc. now owns 16,703,769 shares of the industrial products company's stock valued at $621,380,000 after acquiring an additional 600,146 shares during the last quarter. Millennium Management LLC lifted its position in shares of Sealed Air by 38.2% during the 2nd quarter. Millennium Management LLC now owns 4,114,281 shares of the industrial products company's stock worth $143,136,000 after buying an additional 1,136,985 shares during the period. Earnest Partners LLC lifted its position in shares of Sealed Air by 7.3% during the 1st quarter. Earnest Partners LLC now owns 2,500,378 shares of the industrial products company's stock worth $93,014,000 after buying an additional 170,846 shares during the period. Dimensional Fund Advisors LP lifted its position in shares of Sealed Air by 33.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,910,647 shares of the industrial products company's stock worth $66,475,000 after buying an additional 479,675 shares during the period. Finally, Deprince Race & Zollo Inc. lifted its position in shares of Sealed Air by 1.4% during the 2nd quarter. Deprince Race & Zollo Inc. now owns 1,856,020 shares of the industrial products company's stock worth $64,571,000 after buying an additional 24,940 shares during the period. Institutional investors and hedge funds own 94.40% of the company's stock.

Sealed Air Price Performance

Shares of SEE stock traded up $0.27 during trading hours on Wednesday, reaching $35.85. The company's stock had a trading volume of 518,339 shares, compared to its average volume of 1,516,568. The firm's 50 day simple moving average is $35.38 and its 200-day simple moving average is $35.79. The company has a market capitalization of $5.22 billion, a price-to-earnings ratio of 13.13, a PEG ratio of 4.92 and a beta of 1.34. Sealed Air Co. has a fifty-two week low of $30.87 and a fifty-two week high of $41.14. The company has a quick ratio of 0.79, a current ratio of 1.29 and a debt-to-equity ratio of 5.62.

Sealed Air (NYSE:SEE - Get Free Report) last issued its earnings results on Thursday, November 7th. The industrial products company reported $0.79 earnings per share for the quarter, beating analysts' consensus estimates of $0.67 by $0.12. The firm had revenue of $1.35 billion for the quarter, compared to the consensus estimate of $1.34 billion. Sealed Air had a return on equity of 74.21% and a net margin of 7.34%. The company's revenue was down 2.7% compared to the same quarter last year. During the same quarter last year, the business posted $0.77 EPS. Sell-side analysts forecast that Sealed Air Co. will post 3.06 earnings per share for the current year.

Sealed Air Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 20th. Investors of record on Friday, December 6th will be given a dividend of $0.20 per share. This represents a $0.80 annualized dividend and a yield of 2.23%. The ex-dividend date of this dividend is Friday, December 6th. Sealed Air's dividend payout ratio is currently 29.41%.

Analyst Ratings Changes

SEE has been the subject of a number of recent analyst reports. Truist Financial dropped their price target on Sealed Air from $44.00 to $41.00 and set a "buy" rating for the company in a report on Tuesday, October 15th. Wells Fargo & Company raised their price target on Sealed Air from $43.00 to $44.00 and gave the company an "overweight" rating in a report on Friday, August 9th. Jefferies Financial Group lowered Sealed Air from a "buy" rating to a "hold" rating and reduced their price target for the stock from $47.00 to $35.00 in a research report on Friday, August 9th. Morgan Stanley began coverage on Sealed Air in a report on Wednesday, September 4th. They issued an "equal weight" rating and a $39.00 price target on the stock. Finally, JPMorgan Chase & Co. lowered their target price on Sealed Air from $35.00 to $33.00 and set a "neutral" rating on the stock in a research report on Thursday, August 15th. Eight investment analysts have rated the stock with a hold rating, five have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Sealed Air currently has an average rating of "Moderate Buy" and a consensus target price of $41.00.

View Our Latest Analysis on SEE

Sealed Air Company Profile

(

Free Report)

Sealed Air Corporation provides packaging solutions in the Americas, Europe, the Middle East, Africa, Asia, Australia, and New Zealand. It operates through two segments, Food and Protective. The Food segment offers integrated packaging materials and automation equipment solutions to provide food safety, shelf life extension, reduce food waste, automate processes, and optimize total cost for food processors in the fresh red meat, smoked and processed meats, poultry, seafood, plant-based, fluids and liquids and cheese markets under the CRYOVAC, CRYOVAC Grip & Tear, CRYOVAC Darfresh, LIQUIBOX, Simple Steps, and Optidure brands.

Read More

Before you consider Sealed Air, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sealed Air wasn't on the list.

While Sealed Air currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.