Principal Financial Group Inc. raised its position in shares of Avery Dennison Co. (NYSE:AVY - Free Report) by 0.8% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 617,611 shares of the industrial products company's stock after buying an additional 4,670 shares during the quarter. Principal Financial Group Inc. owned about 0.77% of Avery Dennison worth $136,338,000 at the end of the most recent reporting period.

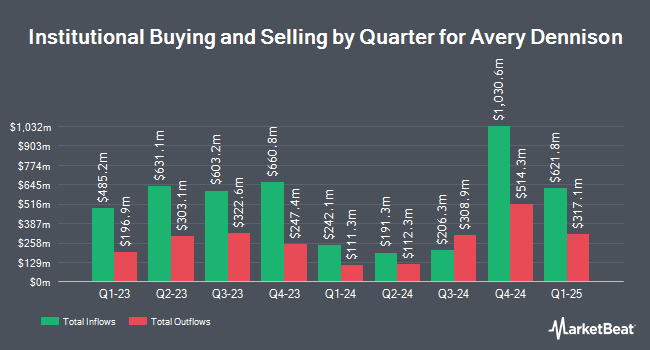

Other hedge funds have also modified their holdings of the company. Cetera Investment Advisers lifted its position in shares of Avery Dennison by 195.2% during the first quarter. Cetera Investment Advisers now owns 17,863 shares of the industrial products company's stock valued at $3,988,000 after buying an additional 11,811 shares during the last quarter. Natixis lifted its position in shares of Avery Dennison by 365.9% during the first quarter. Natixis now owns 4,552 shares of the industrial products company's stock valued at $1,016,000 after buying an additional 3,575 shares during the last quarter. SG Americas Securities LLC lifted its position in shares of Avery Dennison by 86.5% during the second quarter. SG Americas Securities LLC now owns 32,538 shares of the industrial products company's stock valued at $7,114,000 after buying an additional 15,092 shares during the last quarter. McElhenny Sheffield Capital Management LLC purchased a new stake in shares of Avery Dennison during the second quarter valued at about $543,000. Finally, Swedbank AB lifted its position in shares of Avery Dennison by 1.0% during the second quarter. Swedbank AB now owns 462,083 shares of the industrial products company's stock valued at $101,034,000 after buying an additional 4,673 shares during the last quarter. 94.17% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Avery Dennison

In related news, Chairman Mitchell R. Butier sold 3,000 shares of the business's stock in a transaction on Monday, August 12th. The shares were sold at an average price of $206.82, for a total value of $620,460.00. Following the completion of the sale, the chairman now owns 304,114 shares of the company's stock, valued at approximately $62,896,857.48. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In related news, Chairman Mitchell R. Butier sold 3,000 shares of Avery Dennison stock in a transaction dated Monday, August 12th. The stock was sold at an average price of $206.82, for a total value of $620,460.00. Following the sale, the chairman now directly owns 304,114 shares in the company, valued at approximately $62,896,857.48. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Chairman Mitchell R. Butier sold 7,108 shares of the business's stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $218.12, for a total value of $1,550,396.96. Following the sale, the chairman now owns 304,114 shares of the company's stock, valued at approximately $66,333,345.68. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 40,108 shares of company stock valued at $8,561,057 in the last three months. 1.10% of the stock is currently owned by company insiders.

Avery Dennison Stock Performance

AVY traded down $0.34 during trading on Friday, reaching $205.11. 376,702 shares of the company's stock were exchanged, compared to its average volume of 542,400. Avery Dennison Co. has a 1 year low of $176.78 and a 1 year high of $233.48. The company has a debt-to-equity ratio of 0.85, a current ratio of 0.92 and a quick ratio of 0.62. The stock has a market capitalization of $16.48 billion, a P/E ratio of 24.62, a price-to-earnings-growth ratio of 1.57 and a beta of 0.89. The company's fifty day simple moving average is $214.56 and its 200-day simple moving average is $218.05.

Avery Dennison (NYSE:AVY - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The industrial products company reported $2.33 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.32 by $0.01. The firm had revenue of $2.18 billion for the quarter, compared to the consensus estimate of $2.20 billion. Avery Dennison had a net margin of 7.76% and a return on equity of 33.01%. The firm's quarterly revenue was up 4.1% compared to the same quarter last year. During the same period in the prior year, the firm posted $2.10 earnings per share. As a group, research analysts predict that Avery Dennison Co. will post 9.41 earnings per share for the current fiscal year.

Avery Dennison Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, December 4th will be given a $0.88 dividend. This represents a $3.52 dividend on an annualized basis and a dividend yield of 1.72%. The ex-dividend date of this dividend is Wednesday, December 4th. Avery Dennison's dividend payout ratio (DPR) is presently 42.26%.

Analysts Set New Price Targets

Several equities analysts recently commented on AVY shares. Truist Financial increased their price objective on shares of Avery Dennison from $253.00 to $258.00 and gave the company a "buy" rating in a research report on Wednesday, July 24th. StockNews.com lowered shares of Avery Dennison from a "buy" rating to a "hold" rating in a research report on Thursday, October 24th. JPMorgan Chase & Co. lowered shares of Avery Dennison from an "overweight" rating to a "neutral" rating and decreased their price objective for the company from $230.00 to $210.00 in a research report on Thursday, October 24th. Barclays decreased their price objective on shares of Avery Dennison from $250.00 to $245.00 and set an "overweight" rating for the company in a research report on Monday, October 28th. Finally, BMO Capital Markets decreased their price objective on shares of Avery Dennison from $252.00 to $247.00 and set an "outperform" rating for the company in a research report on Thursday, October 24th. Four investment analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $244.96.

Check Out Our Latest Stock Report on Avery Dennison

Avery Dennison Profile

(

Free Report)

Avery Dennison Corporation operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin, America, and internationally. It provides pressure-sensitive materials comprising papers, plastic films, metal foils, and fabrics; performance tapes products, including tapes for wire harnessing, as well as cable wrapping for automotive, electrical, and general industrial applications; mechanical fasteners, which are precision-extruded and injection-molded plastic devices used in various automotive, general industrial, and retail applications; and other pressure-sensitive adhesive-based materials and converted products under the Fasson, JAC, Yongle, and Avery Dennison brands.

Further Reading

Before you consider Avery Dennison, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avery Dennison wasn't on the list.

While Avery Dennison currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report