Principal Financial Group Inc. grew its stake in shares of Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report) by 22.1% in the third quarter, according to the company in its most recent filing with the SEC. The firm owned 1,247,838 shares of the medical research company's stock after acquiring an additional 225,568 shares during the quarter. Principal Financial Group Inc. owned about 0.33% of Thermo Fisher Scientific worth $771,876,000 as of its most recent SEC filing.

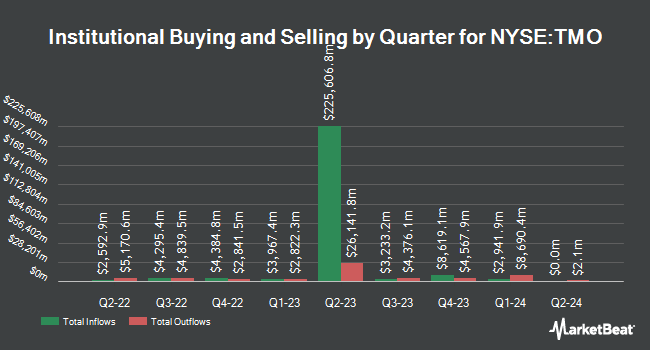

Other hedge funds and other institutional investors have also bought and sold shares of the company. Vanguard Group Inc. boosted its holdings in shares of Thermo Fisher Scientific by 0.4% in the 1st quarter. Vanguard Group Inc. now owns 33,095,791 shares of the medical research company's stock valued at $19,235,605,000 after purchasing an additional 117,353 shares in the last quarter. Capital World Investors boosted its position in Thermo Fisher Scientific by 10.0% in the first quarter. Capital World Investors now owns 13,493,852 shares of the medical research company's stock valued at $7,842,762,000 after buying an additional 1,231,059 shares in the last quarter. Price T Rowe Associates Inc. MD increased its holdings in Thermo Fisher Scientific by 1.6% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 10,054,621 shares of the medical research company's stock worth $5,843,848,000 after purchasing an additional 156,675 shares in the last quarter. Capital Research Global Investors boosted its position in Thermo Fisher Scientific by 1.5% during the 1st quarter. Capital Research Global Investors now owns 8,113,137 shares of the medical research company's stock worth $4,715,436,000 after buying an additional 123,523 shares during the period. Finally, Ameriprise Financial Inc. raised its position in Thermo Fisher Scientific by 32.2% during the 2nd quarter. Ameriprise Financial Inc. now owns 2,481,257 shares of the medical research company's stock worth $1,372,157,000 after purchasing an additional 604,895 shares during the last quarter. Institutional investors and hedge funds own 89.23% of the company's stock.

Thermo Fisher Scientific Stock Performance

NYSE:TMO traded down $3.03 during trading hours on Thursday, reaching $556.65. The stock had a trading volume of 844,679 shares, compared to its average volume of 1,458,220. Thermo Fisher Scientific Inc. has a 12-month low of $437.26 and a 12-month high of $627.88. The stock has a 50 day simple moving average of $596.33 and a 200 day simple moving average of $583.80. The stock has a market cap of $212.92 billion, a P/E ratio of 34.92, a price-to-earnings-growth ratio of 3.67 and a beta of 0.79. The company has a debt-to-equity ratio of 0.64, a quick ratio of 1.26 and a current ratio of 1.63.

Thermo Fisher Scientific (NYSE:TMO - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The medical research company reported $5.28 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $5.25 by $0.03. The business had revenue of $10.60 billion for the quarter, compared to analysts' expectations of $10.63 billion. Thermo Fisher Scientific had a net margin of 14.48% and a return on equity of 17.49%. The business's revenue for the quarter was up .2% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $5.69 EPS. On average, research analysts forecast that Thermo Fisher Scientific Inc. will post 21.68 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on TMO. Redburn Atlantic initiated coverage on Thermo Fisher Scientific in a research report on Monday, October 14th. They set a "buy" rating and a $680.00 price objective for the company. Barclays reduced their price objective on shares of Thermo Fisher Scientific from $620.00 to $610.00 and set an "equal weight" rating on the stock in a research note on Wednesday, October 23rd. Evercore ISI cut their price target on shares of Thermo Fisher Scientific from $630.00 to $620.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. Raymond James boosted their price target on Thermo Fisher Scientific from $650.00 to $660.00 and gave the company an "outperform" rating in a research note on Thursday, July 25th. Finally, Bank of America boosted their target price on shares of Thermo Fisher Scientific from $600.00 to $675.00 and gave the company a "buy" rating in a research report on Monday, September 16th. Four analysts have rated the stock with a hold rating, seventeen have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $649.33.

Read Our Latest Analysis on Thermo Fisher Scientific

Insider Transactions at Thermo Fisher Scientific

In other Thermo Fisher Scientific news, CEO Marc N. Casper sold 10,000 shares of the business's stock in a transaction that occurred on Monday, October 28th. The shares were sold at an average price of $554.29, for a total value of $5,542,900.00. Following the completion of the transaction, the chief executive officer now owns 121,192 shares of the company's stock, valued at $67,175,513.68. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In other news, CEO Marc N. Casper sold 10,000 shares of the firm's stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $554.29, for a total value of $5,542,900.00. Following the completion of the sale, the chief executive officer now directly owns 121,192 shares of the company's stock, valued at approximately $67,175,513.68. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, SVP Michael A. Boxer sold 2,000 shares of the stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $560.16, for a total value of $1,120,320.00. Following the completion of the transaction, the senior vice president now directly owns 12,736 shares of the company's stock, valued at $7,134,197.76. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 18,150 shares of company stock valued at $10,094,925. 0.34% of the stock is owned by corporate insiders.

Thermo Fisher Scientific Profile

(

Free Report)

Thermo Fisher Scientific Inc provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally. The company's Life Sciences Solutions segment offers reagents, instruments, and consumables for biological and medical research, discovery, and production of drugs and vaccines, as well as diagnosis of infections and diseases; and solutions include biosciences, genetic sciences, and bio production to pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets.

Further Reading

Before you consider Thermo Fisher Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thermo Fisher Scientific wasn't on the list.

While Thermo Fisher Scientific currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report