Principal Financial Group Inc. lifted its holdings in shares of Hubbell Incorporated (NYSE:HUBB - Free Report) by 7.1% during the third quarter, according to its most recent disclosure with the SEC. The fund owned 229,210 shares of the industrial products company's stock after acquiring an additional 15,215 shares during the period. Principal Financial Group Inc. owned approximately 0.43% of Hubbell worth $98,187,000 at the end of the most recent quarter.

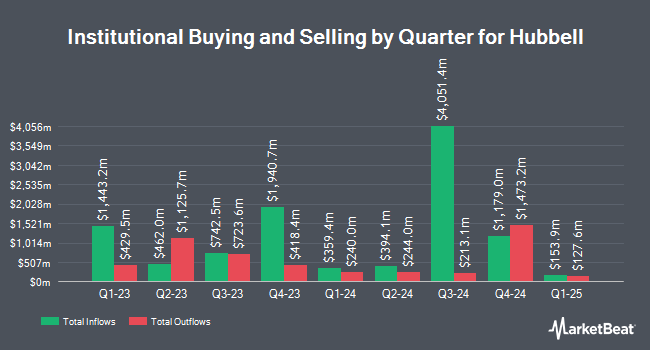

Several other hedge funds have also recently modified their holdings of the stock. Nvwm LLC purchased a new position in Hubbell in the 1st quarter worth $25,000. Quarry LP purchased a new position in shares of Hubbell in the second quarter worth about $49,000. Northwest Investment Counselors LLC acquired a new stake in shares of Hubbell during the third quarter worth about $58,000. Ashton Thomas Private Wealth LLC purchased a new stake in Hubbell in the second quarter valued at approximately $62,000. Finally, Massmutual Trust Co. FSB ADV increased its holdings in Hubbell by 23.5% in the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 184 shares of the industrial products company's stock worth $67,000 after buying an additional 35 shares during the period. Institutional investors and hedge funds own 88.16% of the company's stock.

Wall Street Analyst Weigh In

HUBB has been the subject of several research reports. Wells Fargo & Company lifted their price objective on shares of Hubbell from $445.00 to $455.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 30th. StockNews.com upgraded shares of Hubbell from a "hold" rating to a "buy" rating in a research report on Tuesday. Sanford C. Bernstein began coverage on Hubbell in a research report on Tuesday. They set an "outperform" rating and a $535.00 price target on the stock. Morgan Stanley lifted their price target on Hubbell from $407.00 to $445.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 30th. Finally, Stephens reissued an "overweight" rating and set a $450.00 price target on shares of Hubbell in a report on Friday, August 2nd. Four research analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $445.56.

Check Out Our Latest Research Report on Hubbell

Hubbell Price Performance

HUBB traded up $0.95 during midday trading on Friday, hitting $467.93. 387,617 shares of the company traded hands, compared to its average volume of 400,745. The business has a 50 day simple moving average of $427.99 and a two-hundred day simple moving average of $397.96. Hubbell Incorporated has a 52-week low of $281.45 and a 52-week high of $481.35. The company has a market capitalization of $25.11 billion, a price-to-earnings ratio of 33.71, a PEG ratio of 1.76 and a beta of 0.90. The company has a current ratio of 1.66, a quick ratio of 1.05 and a debt-to-equity ratio of 0.51.

Hubbell (NYSE:HUBB - Get Free Report) last announced its earnings results on Tuesday, October 29th. The industrial products company reported $4.49 EPS for the quarter, beating analysts' consensus estimates of $4.47 by $0.02. Hubbell had a return on equity of 28.81% and a net margin of 13.33%. The business had revenue of $1.44 billion during the quarter, compared to analysts' expectations of $1.48 billion. During the same quarter in the prior year, the firm earned $3.95 earnings per share. The business's revenue was up 4.9% compared to the same quarter last year. On average, equities analysts forecast that Hubbell Incorporated will post 16.47 earnings per share for the current fiscal year.

Hubbell Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 29th will be issued a dividend of $1.32 per share. This is a positive change from Hubbell's previous quarterly dividend of $1.22. The ex-dividend date is Friday, November 29th. This represents a $5.28 dividend on an annualized basis and a dividend yield of 1.13%. Hubbell's dividend payout ratio is presently 38.04%.

About Hubbell

(

Free Report)

Hubbell Incorporated, together with its subsidiaries, designs, manufactures, and sells electrical and utility solutions in the United States and internationally. It operates through two segments, Electrical Solutions and Utility Solutions. The Electrical Solution segment offers standard and special application wiring device products, rough-in electrical products, connector and grounding products, lighting fixtures, and other electrical equipment for use in industrial, commercial, and institutional facilities by electrical contractors, maintenance personnel, electricians, utilities, and telecommunications companies, as well as components and assemblies.

Featured Articles

Before you consider Hubbell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hubbell wasn't on the list.

While Hubbell currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.