Principal Financial Group Inc. reduced its stake in shares of Steel Dynamics, Inc. (NASDAQ:STLD - Free Report) by 6.8% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 176,812 shares of the basic materials company's stock after selling 12,901 shares during the quarter. Principal Financial Group Inc. owned approximately 0.11% of Steel Dynamics worth $22,292,000 at the end of the most recent quarter.

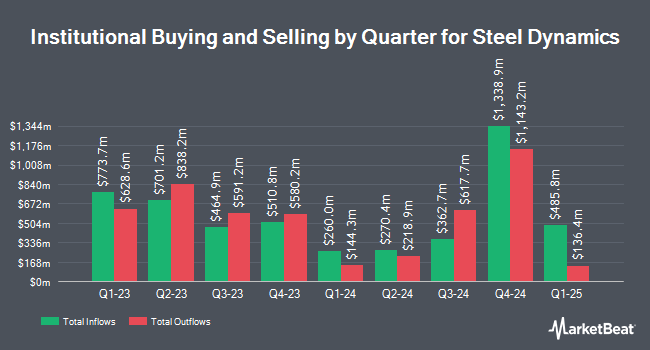

A number of other hedge funds have also recently made changes to their positions in STLD. Trustmark National Bank Trust Department boosted its position in Steel Dynamics by 126.6% in the 1st quarter. Trustmark National Bank Trust Department now owns 7,134 shares of the basic materials company's stock valued at $1,057,000 after buying an additional 3,986 shares during the period. Bessemer Group Inc. increased its holdings in Steel Dynamics by 2,679.3% during the 1st quarter. Bessemer Group Inc. now owns 10,867 shares of the basic materials company's stock worth $1,611,000 after purchasing an additional 10,476 shares during the period. LBP AM SA raised its position in Steel Dynamics by 26.5% during the 1st quarter. LBP AM SA now owns 21,966 shares of the basic materials company's stock valued at $3,256,000 after purchasing an additional 4,599 shares in the last quarter. M&G Plc purchased a new stake in shares of Steel Dynamics in the 1st quarter worth $9,478,000. Finally, UniSuper Management Pty Ltd lifted its holdings in shares of Steel Dynamics by 372.0% in the 1st quarter. UniSuper Management Pty Ltd now owns 8,906 shares of the basic materials company's stock worth $1,320,000 after buying an additional 7,019 shares during the period. 82.41% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, SVP Glenn Pushis sold 17,941 shares of Steel Dynamics stock in a transaction that occurred on Monday, October 21st. The stock was sold at an average price of $133.09, for a total value of $2,387,767.69. Following the sale, the senior vice president now directly owns 146,693 shares of the company's stock, valued at $19,523,371.37. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. In related news, SVP Glenn Pushis sold 17,941 shares of the business's stock in a transaction dated Monday, October 21st. The shares were sold at an average price of $133.09, for a total transaction of $2,387,767.69. Following the transaction, the senior vice president now directly owns 146,693 shares in the company, valued at approximately $19,523,371.37. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, VP Chad Bickford sold 2,000 shares of the stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $134.86, for a total transaction of $269,720.00. Following the completion of the sale, the vice president now owns 17,100 shares of the company's stock, valued at approximately $2,306,106. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 26,591 shares of company stock worth $3,608,438. Corporate insiders own 6.00% of the company's stock.

Analyst Upgrades and Downgrades

STLD has been the subject of several recent research reports. Morgan Stanley decreased their price objective on Steel Dynamics from $138.00 to $131.00 and set an "equal weight" rating for the company in a report on Wednesday, September 18th. BMO Capital Markets increased their price objective on shares of Steel Dynamics from $130.00 to $135.00 and gave the company a "market perform" rating in a research note on Friday, October 18th. JPMorgan Chase & Co. boosted their price objective on shares of Steel Dynamics from $129.00 to $134.00 and gave the stock a "neutral" rating in a research note on Friday, October 18th. Bank of America raised Steel Dynamics from a "neutral" rating to a "buy" rating and increased their target price for the company from $140.00 to $155.00 in a research report on Tuesday, October 1st. Finally, UBS Group upgraded Steel Dynamics from a "neutral" rating to a "buy" rating and lifted their price target for the company from $129.00 to $145.00 in a report on Tuesday, September 3rd. Four investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $144.29.

Read Our Latest Research Report on STLD

Steel Dynamics Stock Down 3.5 %

Shares of STLD traded down $4.94 during midday trading on Thursday, hitting $136.96. 804,228 shares of the company's stock traded hands, compared to its average volume of 1,265,356. The company has a current ratio of 2.39, a quick ratio of 1.26 and a debt-to-equity ratio of 0.31. The stock has a market capitalization of $20.85 billion, a price-to-earnings ratio of 12.84 and a beta of 1.31. Steel Dynamics, Inc. has a 1 year low of $104.60 and a 1 year high of $155.56. The firm's fifty day moving average is $127.88 and its 200-day moving average is $127.01.

Steel Dynamics (NASDAQ:STLD - Get Free Report) last announced its earnings results on Wednesday, October 16th. The basic materials company reported $2.05 earnings per share for the quarter, topping the consensus estimate of $1.98 by $0.07. The business had revenue of $4.34 billion during the quarter, compared to the consensus estimate of $4.18 billion. Steel Dynamics had a return on equity of 19.82% and a net margin of 9.80%. The business's quarterly revenue was down 5.4% on a year-over-year basis. During the same period in the prior year, the company posted $3.47 EPS. As a group, sell-side analysts anticipate that Steel Dynamics, Inc. will post 10.18 earnings per share for the current year.

Steel Dynamics Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, January 10th. Investors of record on Tuesday, December 31st will be paid a $0.46 dividend. This represents a $1.84 dividend on an annualized basis and a yield of 1.34%. The ex-dividend date is Tuesday, December 31st. Steel Dynamics's dividend payout ratio is presently 16.65%.

Steel Dynamics Profile

(

Free Report)

Steel Dynamics, Inc, together with its subsidiaries, operates as a steel producer and metal recycler in the United States. The Steel Operations segment offers hot rolled, cold rolled, and coated steel products; parallel flange beams and channel sections, flat bars, large unequal leg angles, and reinforcing steel bars, as well as standard strength carbon, intermediate alloy hardness, and premium grade rail products; engineered special-bar-quality products, merchant-bar-quality products, and other engineered round steel bars; channels, angles, flats, merchant rounds, and reinforcing steel bars; and specialty shapes and light structural steel products.

Recommended Stories

Before you consider Steel Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Steel Dynamics wasn't on the list.

While Steel Dynamics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report