Principal Financial Group Inc. lowered its stake in World Acceptance Co. (NASDAQ:WRLD - Free Report) by 27.1% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 15,600 shares of the credit services provider's stock after selling 5,812 shares during the quarter. Principal Financial Group Inc. owned 0.27% of World Acceptance worth $1,840,000 at the end of the most recent quarter.

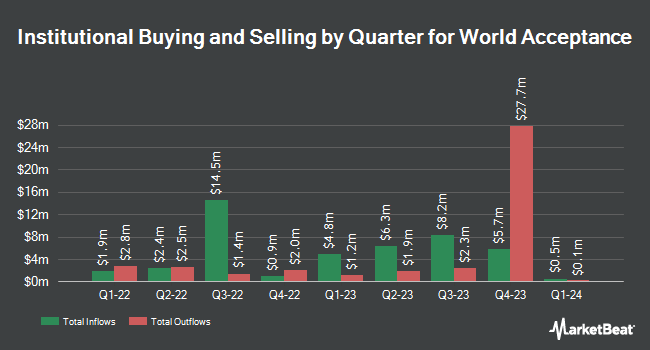

A number of other institutional investors have also recently made changes to their positions in the stock. Millennium Management LLC raised its holdings in World Acceptance by 125.2% during the 2nd quarter. Millennium Management LLC now owns 22,184 shares of the credit services provider's stock valued at $2,741,000 after buying an additional 12,333 shares during the last quarter. Comerica Bank raised its stake in shares of World Acceptance by 63.1% during the first quarter. Comerica Bank now owns 2,562 shares of the credit services provider's stock valued at $371,000 after acquiring an additional 991 shares during the last quarter. O Shaughnessy Asset Management LLC boosted its holdings in shares of World Acceptance by 2.5% during the first quarter. O Shaughnessy Asset Management LLC now owns 3,770 shares of the credit services provider's stock worth $547,000 after purchasing an additional 93 shares during the period. CWM LLC grew its stake in shares of World Acceptance by 122.4% in the second quarter. CWM LLC now owns 585 shares of the credit services provider's stock worth $72,000 after purchasing an additional 322 shares during the last quarter. Finally, AQR Capital Management LLC increased its holdings in World Acceptance by 38.0% during the 2nd quarter. AQR Capital Management LLC now owns 40,475 shares of the credit services provider's stock valued at $5,002,000 after purchasing an additional 11,135 shares during the period. Hedge funds and other institutional investors own 83.63% of the company's stock.

World Acceptance Stock Up 1.3 %

Shares of NASDAQ WRLD opened at $119.10 on Friday. The firm has a fifty day simple moving average of $117.41 and a two-hundred day simple moving average of $121.31. World Acceptance Co. has a 12 month low of $101.85 and a 12 month high of $149.31. The company has a current ratio of 19.53, a quick ratio of 19.53 and a debt-to-equity ratio of 1.21. The firm has a market capitalization of $684.83 million, a PE ratio of 8.10 and a beta of 1.40.

Analysts Set New Price Targets

Separately, Stephens assumed coverage on World Acceptance in a research report on Wednesday, November 13th. They issued an "equal weight" rating and a $10.00 price objective on the stock.

Get Our Latest Stock Report on World Acceptance

Insider Activity at World Acceptance

In other news, insider Luke J. Umstetter sold 550 shares of the firm's stock in a transaction that occurred on Friday, November 1st. The stock was sold at an average price of $114.30, for a total value of $62,865.00. Following the completion of the transaction, the insider now owns 11,370 shares in the company, valued at $1,299,591. This trade represents a 4.61 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 43.20% of the stock is owned by corporate insiders.

World Acceptance Company Profile

(

Free Report)

World Acceptance Corporation engages in consumer finance business in the United States. The company provides short-term small installment loans, medium-term larger installment loans, related credit insurance, and ancillary products and services to individuals. It offers income tax return preparation and filing services; and automobile club memberships.

Featured Stories

Before you consider World Acceptance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and World Acceptance wasn't on the list.

While World Acceptance currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.