Prospera Private Wealth LLC bought a new stake in shares of AAR Corp. (NYSE:AIR - Free Report) in the third quarter, according to its most recent Form 13F filing with the SEC. The fund bought 7,850 shares of the aerospace company's stock, valued at approximately $513,000.

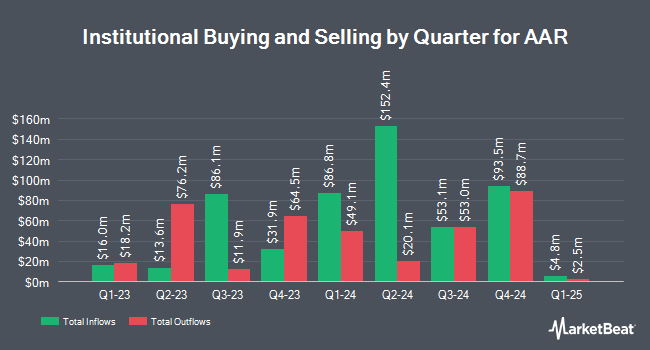

Several other large investors also recently made changes to their positions in AIR. EverSource Wealth Advisors LLC increased its position in shares of AAR by 283.1% during the 1st quarter. EverSource Wealth Advisors LLC now owns 544 shares of the aerospace company's stock valued at $33,000 after purchasing an additional 402 shares during the period. Quest Partners LLC purchased a new position in AAR during the 2nd quarter worth approximately $33,000. Innealta Capital LLC purchased a new stake in shares of AAR in the second quarter valued at $49,000. KBC Group NV boosted its position in shares of AAR by 32.9% in the third quarter. KBC Group NV now owns 1,324 shares of the aerospace company's stock worth $87,000 after buying an additional 328 shares during the period. Finally, Harel Insurance Investments & Financial Services Ltd. grew its holdings in shares of AAR by 348.1% during the second quarter. Harel Insurance Investments & Financial Services Ltd. now owns 1,416 shares of the aerospace company's stock valued at $103,000 after buying an additional 1,100 shares in the last quarter. Institutional investors and hedge funds own 90.74% of the company's stock.

AAR Stock Up 0.6 %

Shares of AIR traded up $0.39 during trading hours on Thursday, hitting $67.94. 95,611 shares of the company were exchanged, compared to its average volume of 303,132. The firm's 50 day moving average is $64.18 and its 200-day moving average is $66.60. AAR Corp. has a 52 week low of $54.71 and a 52 week high of $76.34. The company has a debt-to-equity ratio of 0.81, a quick ratio of 1.45 and a current ratio of 3.06. The company has a market cap of $2.44 billion, a PE ratio of 37.20 and a beta of 1.57.

AAR (NYSE:AIR - Get Free Report) last released its earnings results on Monday, September 23rd. The aerospace company reported $0.85 earnings per share for the quarter, topping analysts' consensus estimates of $0.82 by $0.03. AAR had a net margin of 2.67% and a return on equity of 10.22%. The firm had revenue of $661.70 million during the quarter, compared to analyst estimates of $645.60 million. During the same quarter in the previous year, the business earned $0.78 EPS. The business's revenue was up 20.4% on a year-over-year basis. On average, equities research analysts forecast that AAR Corp. will post 3.63 EPS for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts have weighed in on AIR shares. Royal Bank of Canada reaffirmed an "outperform" rating and set a $75.00 target price on shares of AAR in a research note on Monday, November 4th. StockNews.com raised shares of AAR from a "sell" rating to a "hold" rating in a research note on Monday, October 21st. Finally, Benchmark reiterated a "buy" rating and set a $83.00 price objective on shares of AAR in a report on Friday, October 4th. One analyst has rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $81.00.

Read Our Latest Analysis on AIR

AAR Profile

(

Free Report)

AAR Corp. provides products and services to commercial aviation, government, and defense markets worldwide. The Parts Supply segment leases and sells aircraft components and replacement parts. The Repair & Engineering segment provides airframe maintenance services, such as airframe inspection, painting, line maintenance, airframe modification, structural repair, avionics service and installation, exterior and interior refurbishment, and engineering and support services; component repair services comprising maintenance, repair, and overhaul (MRO) services, engine and airframe accessories, and interior refurbishment; and landing gear overhaul services, including repair services on wheels and brakes.

Further Reading

Before you consider AAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAR wasn't on the list.

While AAR currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.