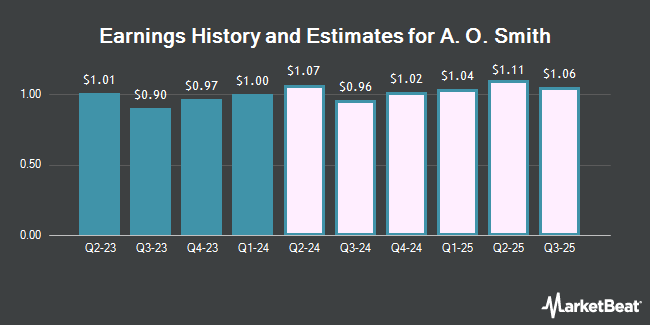

A. O. Smith Co. (NYSE:AOS - Free Report) - Research analysts at Zacks Research reduced their Q4 2024 earnings per share estimates for A. O. Smith in a report released on Tuesday, November 12th. Zacks Research analyst R. Department now anticipates that the industrial products company will earn $0.90 per share for the quarter, down from their previous forecast of $1.06. The consensus estimate for A. O. Smith's current full-year earnings is $3.78 per share. Zacks Research also issued estimates for A. O. Smith's Q2 2025 earnings at $1.10 EPS, Q3 2025 earnings at $0.92 EPS, FY2025 earnings at $3.98 EPS and Q3 2026 earnings at $1.05 EPS.

A. O. Smith (NYSE:AOS - Get Free Report) last posted its quarterly earnings results on Tuesday, October 22nd. The industrial products company reported $0.82 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.82. The company had revenue of $957.80 million for the quarter, compared to the consensus estimate of $960.36 million. A. O. Smith had a net margin of 14.41% and a return on equity of 30.09%. During the same period last year, the firm posted $0.90 EPS.

Other analysts also recently issued reports about the stock. StockNews.com upgraded shares of A. O. Smith from a "hold" rating to a "buy" rating in a research report on Thursday, November 7th. Robert W. Baird reduced their price objective on A. O. Smith from $82.00 to $81.00 and set a "neutral" rating for the company in a research report on Wednesday, October 23rd. DA Davidson cut A. O. Smith from a "buy" rating to a "neutral" rating and set a $80.00 target price on the stock. in a research report on Wednesday, October 23rd. UBS Group upgraded shares of A. O. Smith from a "sell" rating to a "neutral" rating and boosted their price target for the stock from $75.00 to $80.00 in a research report on Wednesday, October 23rd. Finally, Stifel Nicolaus cut their price objective on A. O. Smith from $92.00 to $91.00 and set a "buy" rating for the company in a report on Wednesday, October 23rd. Six research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, A. O. Smith has an average rating of "Hold" and a consensus price target of $86.71.

Get Our Latest Stock Report on AOS

A. O. Smith Stock Performance

NYSE AOS traded down $0.11 during trading hours on Thursday, hitting $73.00. The company had a trading volume of 922,494 shares, compared to its average volume of 972,271. A. O. Smith has a fifty-two week low of $72.62 and a fifty-two week high of $92.44. The firm has a market cap of $10.58 billion, a P/E ratio of 19.24, a price-to-earnings-growth ratio of 1.94 and a beta of 1.17. The company has a quick ratio of 1.02, a current ratio of 1.67 and a debt-to-equity ratio of 0.06. The business has a fifty day simple moving average of $80.78 and a 200-day simple moving average of $82.39.

Institutional Trading of A. O. Smith

A number of institutional investors have recently bought and sold shares of AOS. Public Sector Pension Investment Board grew its holdings in A. O. Smith by 10.8% during the third quarter. Public Sector Pension Investment Board now owns 5,149 shares of the industrial products company's stock valued at $463,000 after purchasing an additional 500 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in shares of A. O. Smith by 2.3% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 697,582 shares of the industrial products company's stock valued at $62,664,000 after buying an additional 15,447 shares in the last quarter. FORA Capital LLC acquired a new stake in A. O. Smith during the 3rd quarter worth $730,000. Glenmede Trust Co. NA lifted its holdings in A. O. Smith by 4.3% during the third quarter. Glenmede Trust Co. NA now owns 3,992 shares of the industrial products company's stock worth $359,000 after acquiring an additional 163 shares in the last quarter. Finally, Hardy Reed LLC bought a new stake in shares of A. O. Smith in the third quarter worth about $325,000. Institutional investors and hedge funds own 76.10% of the company's stock.

A. O. Smith Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, November 15th. Shareholders of record on Thursday, October 31st will be given a $0.34 dividend. This represents a $1.36 dividend on an annualized basis and a yield of 1.86%. This is a positive change from A. O. Smith's previous quarterly dividend of $0.32. The ex-dividend date of this dividend is Thursday, October 31st. A. O. Smith's dividend payout ratio (DPR) is presently 35.79%.

A. O. Smith Company Profile

(

Get Free Report)

A. O. Smith Corporation manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products in North America, China, Europe, and India. The company offers water heaters for residences, restaurants, hotels, office buildings, laundries, car washes, and small businesses; boilers for hospitals, schools, hotels, and other large commercial buildings, as well as homes, apartments, and condominiums; and water treatment products comprising point-of-entry water softeners, well water solutions, and whole-home water filtration products, and point-of-use carbon and reverse osmosis products for residences, restaurants, hotels, and offices.

Featured Stories

Before you consider A. O. Smith, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A. O. Smith wasn't on the list.

While A. O. Smith currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.