QRG Capital Management Inc. decreased its stake in Corpay, Inc. (NYSE:CPAY - Free Report) by 63.7% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 13,962 shares of the company's stock after selling 24,507 shares during the period. QRG Capital Management Inc.'s holdings in Corpay were worth $4,367,000 as of its most recent filing with the Securities and Exchange Commission.

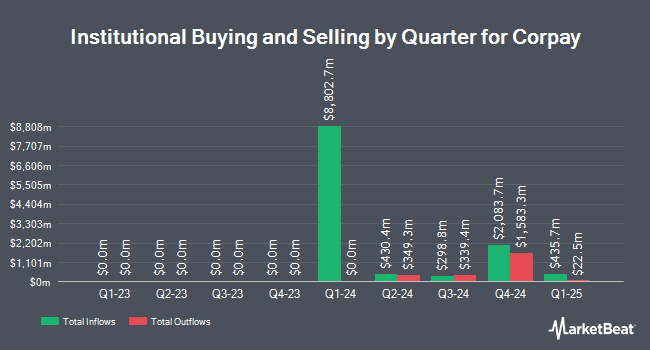

Several other large investors have also added to or reduced their stakes in CPAY. Vanguard Group Inc. acquired a new stake in Corpay in the first quarter valued at approximately $2,431,089,000. JPMorgan Chase & Co. acquired a new stake in Corpay in the first quarter valued at approximately $1,429,445,000. Price T Rowe Associates Inc. MD acquired a new stake in Corpay in the first quarter valued at approximately $1,355,377,000. Boston Partners acquired a new stake in Corpay in the first quarter valued at approximately $553,667,000. Finally, Sustainable Growth Advisers LP acquired a new stake in Corpay in the first quarter valued at approximately $553,279,000. Institutional investors and hedge funds own 98.84% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have commented on CPAY. Royal Bank of Canada reissued a "sector perform" rating and issued a $310.00 price objective on shares of Corpay in a research note on Thursday, August 8th. JPMorgan Chase & Co. raised their price objective on Corpay from $327.00 to $353.00 and gave the company an "overweight" rating in a research note on Tuesday, August 20th. BMO Capital Markets raised their target price on Corpay from $350.00 to $390.00 and gave the company an "outperform" rating in a report on Thursday, October 3rd. Raymond James dropped their target price on Corpay from $330.00 to $311.00 and set an "outperform" rating on the stock in a report on Thursday, August 8th. Finally, Wolfe Research upgraded Corpay from an "underperform" rating to a "peer perform" rating in a report on Tuesday, September 3rd. Four analysts have rated the stock with a hold rating, nine have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $353.46.

Read Our Latest Stock Analysis on Corpay

Corpay Stock Performance

Corpay stock traded up $18.16 during mid-day trading on Wednesday, reaching $348.97. 862,333 shares of the company's stock were exchanged, compared to its average volume of 468,464. The business's fifty day simple moving average is $323.31 and its 200 day simple moving average is $295.32. The firm has a market capitalization of $24.23 billion, a PE ratio of 24.04, a P/E/G ratio of 1.30 and a beta of 1.21. Corpay, Inc. has a one year low of $221.37 and a one year high of $355.47. The company has a quick ratio of 1.02, a current ratio of 1.02 and a debt-to-equity ratio of 1.74.

Corpay (NYSE:CPAY - Get Free Report) last issued its earnings results on Wednesday, August 7th. The company reported $4.55 earnings per share (EPS) for the quarter, beating the consensus estimate of $4.51 by $0.04. The firm had revenue of $975.70 million for the quarter, compared to analyst estimates of $973.84 million. Corpay had a return on equity of 38.93% and a net margin of 26.41%. The business's revenue was up 2.9% on a year-over-year basis. During the same period in the previous year, the company posted $3.85 earnings per share. On average, sell-side analysts expect that Corpay, Inc. will post 17.96 earnings per share for the current year.

Corpay Company Profile

(

Free Report)

Corpay, Inc operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally. The company offers vehicle payment solutions, which include fuel, tolls, parking, fleet maintenance, and long-haul transportation services, as well as prepaid food and transportation vouchers and cards.

Featured Articles

Before you consider Corpay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corpay wasn't on the list.

While Corpay currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.