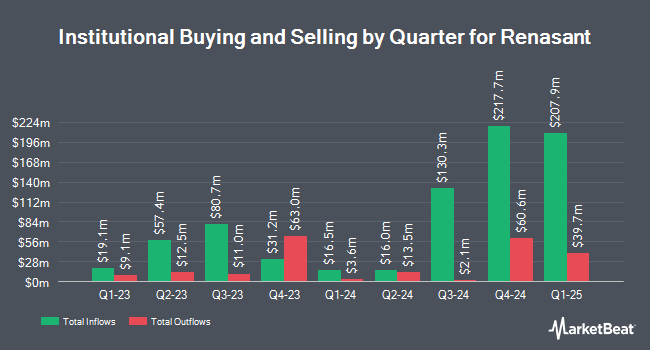

Quantbot Technologies LP acquired a new stake in Renasant Co. (NASDAQ:RNST - Free Report) in the 3rd quarter, according to its most recent filing with the SEC. The fund acquired 77,984 shares of the financial services provider's stock, valued at approximately $2,534,000. Quantbot Technologies LP owned 0.12% of Renasant as of its most recent filing with the SEC.

A number of other large investors have also bought and sold shares of the business. Jennison Associates LLC acquired a new position in shares of Renasant in the third quarter valued at approximately $12,514,000. Stieven Capital Advisors L.P. acquired a new position in Renasant in the 3rd quarter worth $11,981,000. Allspring Global Investments Holdings LLC increased its holdings in Renasant by 21.1% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 1,746,924 shares of the financial services provider's stock worth $56,775,000 after purchasing an additional 303,945 shares in the last quarter. Millennium Management LLC lifted its holdings in shares of Renasant by 189.3% in the second quarter. Millennium Management LLC now owns 419,765 shares of the financial services provider's stock valued at $12,820,000 after purchasing an additional 274,685 shares in the last quarter. Finally, The Manufacturers Life Insurance Company lifted its holdings in shares of Renasant by 61.9% in the third quarter. The Manufacturers Life Insurance Company now owns 652,292 shares of the financial services provider's stock valued at $21,199,000 after purchasing an additional 249,331 shares in the last quarter. 77.31% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of equities research analysts recently issued reports on the company. Hovde Group lowered Renasant from an "outperform" rating to a "market perform" rating in a research report on Wednesday, November 13th. Keefe, Bruyette & Woods raised shares of Renasant from a "market perform" rating to an "outperform" rating and raised their target price for the company from $36.00 to $40.00 in a research report on Friday, August 2nd. Piper Sandler raised shares of Renasant from a "neutral" rating to an "overweight" rating and boosted their price target for the stock from $34.00 to $40.00 in a research report on Monday, August 5th. Raymond James upgraded Renasant from a "market perform" rating to an "outperform" rating and set a $39.00 price objective for the company in a report on Wednesday, July 31st. Finally, Stephens upgraded Renasant from an "equal weight" rating to an "overweight" rating and upped their target price for the stock from $34.00 to $41.00 in a report on Wednesday, July 31st. Three equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, Renasant has a consensus rating of "Moderate Buy" and a consensus target price of $39.33.

View Our Latest Stock Analysis on Renasant

Renasant Stock Performance

NASDAQ:RNST traded down $0.29 during mid-day trading on Thursday, hitting $37.88. The stock had a trading volume of 354,190 shares, compared to its average volume of 403,686. Renasant Co. has a twelve month low of $26.28 and a twelve month high of $39.47. The company has a debt-to-equity ratio of 0.16, a quick ratio of 0.94 and a current ratio of 0.96. The stock has a market cap of $2.41 billion, a price-to-earnings ratio of 12.34 and a beta of 1.01. The company's 50 day simple moving average is $34.38 and its 200 day simple moving average is $32.77.

Renasant (NASDAQ:RNST - Get Free Report) last posted its earnings results on Tuesday, October 22nd. The financial services provider reported $0.70 earnings per share for the quarter, topping analysts' consensus estimates of $0.63 by $0.07. Renasant had a return on equity of 6.70% and a net margin of 16.83%. The business had revenue of $318.34 million for the quarter, compared to analyst estimates of $184.73 million. During the same period in the previous year, the firm earned $0.75 EPS. On average, equities research analysts forecast that Renasant Co. will post 2.65 earnings per share for the current year.

Renasant Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Wednesday, December 18th will be paid a dividend of $0.22 per share. This represents a $0.88 dividend on an annualized basis and a dividend yield of 2.32%. The ex-dividend date is Wednesday, December 18th. Renasant's dividend payout ratio is presently 28.66%.

Insider Buying and Selling

In other news, Director John Creekmore sold 3,000 shares of the business's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $38.00, for a total value of $114,000.00. Following the completion of the sale, the director now owns 24,057 shares of the company's stock, valued at approximately $914,166. The trade was a 11.09 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. 2.82% of the stock is currently owned by insiders.

About Renasant

(

Free Report)

Renasant Corporation operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers. The company operates through Community Banks, Insurance, and Wealth Management segments. The Community Banks segment offers checking and savings accounts, business and personal loans, asset-based lending, and factoring equipment leasing services, as well as safe deposit and night depository facilities.

Featured Stories

Before you consider Renasant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Renasant wasn't on the list.

While Renasant currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.