Quest Partners LLC bought a new position in Easterly Government Properties, Inc. (NYSE:DEA - Free Report) during the third quarter, according to its most recent filing with the SEC. The firm bought 253,977 shares of the real estate investment trust's stock, valued at approximately $3,449,000. Easterly Government Properties makes up 0.3% of Quest Partners LLC's investment portfolio, making the stock its 29th largest holding. Quest Partners LLC owned approximately 0.25% of Easterly Government Properties at the end of the most recent quarter.

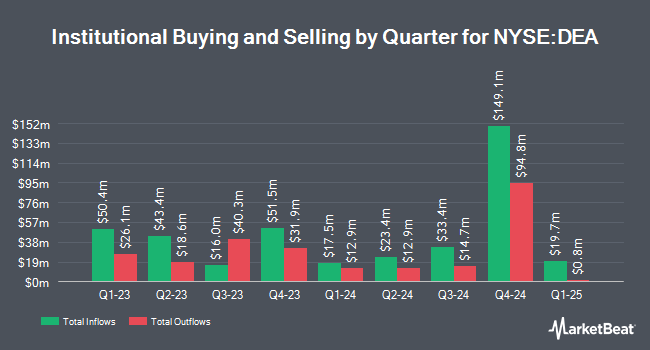

Other hedge funds have also bought and sold shares of the company. Daiwa Securities Group Inc. lifted its position in shares of Easterly Government Properties by 2.7% during the second quarter. Daiwa Securities Group Inc. now owns 31,873 shares of the real estate investment trust's stock valued at $394,000 after purchasing an additional 842 shares in the last quarter. Arizona State Retirement System lifted its position in shares of Easterly Government Properties by 3.3% during the 2nd quarter. Arizona State Retirement System now owns 27,221 shares of the real estate investment trust's stock worth $337,000 after buying an additional 859 shares in the last quarter. Amalgamated Bank boosted its stake in shares of Easterly Government Properties by 2.8% in the 2nd quarter. Amalgamated Bank now owns 31,221 shares of the real estate investment trust's stock worth $386,000 after buying an additional 860 shares during the last quarter. GAMMA Investing LLC grew its holdings in shares of Easterly Government Properties by 29.1% in the third quarter. GAMMA Investing LLC now owns 3,881 shares of the real estate investment trust's stock valued at $53,000 after acquiring an additional 875 shares in the last quarter. Finally, Mirae Asset Global Investments Co. Ltd. increased its position in shares of Easterly Government Properties by 35.6% during the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 3,798 shares of the real estate investment trust's stock valued at $51,000 after acquiring an additional 997 shares during the last quarter. Institutional investors and hedge funds own 86.51% of the company's stock.

Easterly Government Properties Stock Performance

NYSE DEA traded down $0.08 on Monday, hitting $11.99. 2,377,099 shares of the stock traded hands, compared to its average volume of 917,301. The company has a debt-to-equity ratio of 1.07, a quick ratio of 4.01 and a current ratio of 4.01. The business's fifty day moving average is $13.52 and its two-hundred day moving average is $13.01. Easterly Government Properties, Inc. has a 12 month low of $10.94 and a 12 month high of $14.52. The firm has a market capitalization of $1.27 billion, a price-to-earnings ratio of 66.58 and a beta of 0.72.

Easterly Government Properties (NYSE:DEA - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The real estate investment trust reported $0.05 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.29 by ($0.24). The firm had revenue of $74.78 million during the quarter, compared to the consensus estimate of $74.98 million. Easterly Government Properties had a net margin of 6.25% and a return on equity of 1.34%. The company's revenue was up 3.8% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.29 earnings per share. As a group, equities analysts anticipate that Easterly Government Properties, Inc. will post 1.15 EPS for the current fiscal year.

Easterly Government Properties Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, November 27th. Stockholders of record on Friday, November 15th will be given a dividend of $0.265 per share. This represents a $1.06 annualized dividend and a dividend yield of 8.84%. The ex-dividend date is Friday, November 15th. Easterly Government Properties's dividend payout ratio is presently 588.89%.

Wall Street Analyst Weigh In

DEA has been the subject of a number of recent analyst reports. Truist Financial upped their price objective on Easterly Government Properties from $13.00 to $14.00 and gave the company a "hold" rating in a research note on Thursday, August 29th. StockNews.com upgraded shares of Easterly Government Properties from a "sell" rating to a "hold" rating in a research report on Thursday, October 10th. Finally, Jefferies Financial Group upgraded shares of Easterly Government Properties from a "hold" rating to a "buy" rating and raised their price objective for the stock from $13.00 to $15.00 in a report on Monday, October 14th.

Check Out Our Latest Report on Easterly Government Properties

Easterly Government Properties Company Profile

(

Free Report)

Easterly Government Properties, Inc NYSE: DEA is based in Washington, DC, and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S. Government. Easterly's experienced management team brings specialized insight into the strategy and needs of mission-critical U.S.

Featured Stories

Before you consider Easterly Government Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Easterly Government Properties wasn't on the list.

While Easterly Government Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.