Quest Partners LLC bought a new position in shares of Anterix Inc. (NASDAQ:ATEX - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund bought 20,166 shares of the company's stock, valued at approximately $759,000. Quest Partners LLC owned 0.11% of Anterix as of its most recent filing with the Securities and Exchange Commission.

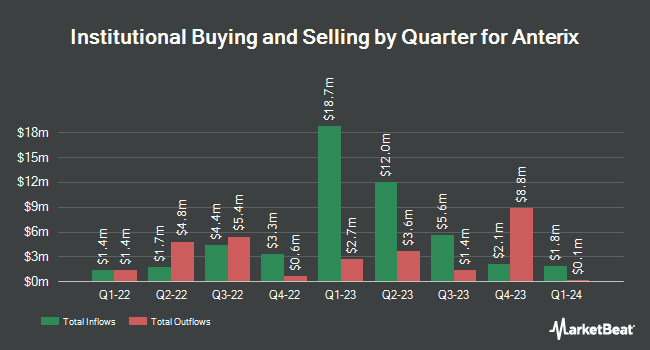

Other institutional investors have also recently bought and sold shares of the company. Allspring Global Investments Holdings LLC bought a new stake in Anterix in the 2nd quarter valued at $28,000. nVerses Capital LLC bought a new stake in Anterix in the 3rd quarter valued at $45,000. Point72 Asia Singapore Pte. Ltd. bought a new stake in Anterix in the 2nd quarter valued at $92,000. Jupiter Asset Management Ltd. bought a new stake in Anterix in the 2nd quarter valued at $200,000. Finally, The Manufacturers Life Insurance Company bought a new stake in Anterix in the 2nd quarter valued at $203,000. Institutional investors and hedge funds own 87.67% of the company's stock.

Analyst Ratings Changes

Several brokerages have commented on ATEX. JPMorgan Chase & Co. boosted their price target on shares of Anterix from $60.00 to $61.00 and gave the stock an "overweight" rating in a research report on Thursday, August 8th. Craig Hallum upgraded shares of Anterix to a "strong-buy" rating in a research note on Wednesday, October 9th.

Check Out Our Latest Report on Anterix

Insider Buying and Selling at Anterix

In other Anterix news, Director Leslie B. Daniels purchased 2,000 shares of the company's stock in a transaction dated Wednesday, November 20th. The stock was purchased at an average price of $32.75 per share, with a total value of $65,500.00. Following the completion of the purchase, the director now owns 2,000 shares of the company's stock, valued at approximately $65,500. The trade was a ∞ increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this link. Company insiders own 45.61% of the company's stock.

Anterix Trading Up 1.5 %

NASDAQ:ATEX traded up $0.49 on Friday, hitting $33.72. The company had a trading volume of 107,873 shares, compared to its average volume of 153,084. Anterix Inc. has a 52 week low of $29.12 and a 52 week high of $42.41. The stock has a market capitalization of $627.80 million, a price-to-earnings ratio of -16.69 and a beta of 0.85. The firm has a 50 day moving average of $34.79 and a two-hundred day moving average of $35.50.

Anterix Company Profile

(

Free Report)

Anterix Inc operates as a wireless communications company. The company focuses on commercializing its spectrum assets to enable the targeted utility and critical infrastructure customers to deploy private broadband networks and innovative broadband solutions. It holds licensed spectrum in the 900 MHz band with coverage throughout the United States, Alaska, Hawaii, and Puerto Rico.

Recommended Stories

Before you consider Anterix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anterix wasn't on the list.

While Anterix currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.