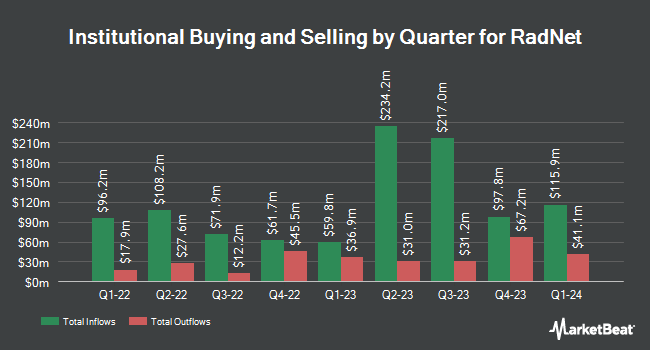

Eagle Asset Management Inc. increased its stake in RadNet, Inc. (NASDAQ:RDNT - Free Report) by 9.7% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 262,899 shares of the medical research company's stock after purchasing an additional 23,300 shares during the period. Eagle Asset Management Inc. owned 0.36% of RadNet worth $19,068,000 at the end of the most recent reporting period.

Other hedge funds have also made changes to their positions in the company. Covestor Ltd increased its position in RadNet by 10,875.0% in the 3rd quarter. Covestor Ltd now owns 439 shares of the medical research company's stock valued at $30,000 after acquiring an additional 435 shares during the period. Nisa Investment Advisors LLC increased its position in RadNet by 774.2% in the 2nd quarter. Nisa Investment Advisors LLC now owns 848 shares of the medical research company's stock valued at $50,000 after acquiring an additional 751 shares during the period. GAMMA Investing LLC increased its position in RadNet by 74.7% in the 2nd quarter. GAMMA Investing LLC now owns 865 shares of the medical research company's stock valued at $51,000 after acquiring an additional 370 shares during the period. Highline Wealth Partners LLC acquired a new stake in RadNet in the 3rd quarter valued at approximately $68,000. Finally, Peterson Financial Group Inc. acquired a new stake in RadNet in the 3rd quarter valued at approximately $90,000. Institutional investors own 77.90% of the company's stock.

RadNet Stock Up 0.9 %

Shares of RDNT stock opened at $82.04 on Friday. RadNet, Inc. has a 1 year low of $32.01 and a 1 year high of $93.65. The stock has a market cap of $6.07 billion, a PE ratio of -1,165.94 and a beta of 1.75. The business's fifty day moving average is $70.73 and its 200-day moving average is $63.83. The company has a debt-to-equity ratio of 0.89, a quick ratio of 2.16 and a current ratio of 2.16.

Wall Street Analyst Weigh In

RDNT has been the topic of several analyst reports. Jefferies Financial Group raised their target price on RadNet from $75.00 to $80.00 and gave the company a "buy" rating in a research report on Thursday, September 19th. Truist Financial raised their target price on RadNet from $70.00 to $80.00 and gave the company a "buy" rating in a research report on Monday, September 23rd. Barclays upgraded RadNet from an "equal weight" rating to an "overweight" rating and lifted their price target for the company from $57.00 to $79.00 in a research report on Friday, September 6th. Finally, Sidoti upgraded RadNet to a "strong-buy" rating in a research report on Friday, October 4th. One equities research analyst has rated the stock with a sell rating, four have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, RadNet currently has a consensus rating of "Moderate Buy" and a consensus price target of $74.75.

Check Out Our Latest Stock Analysis on RDNT

Insider Activity

In related news, insider Ranjan Jayanathan sold 38,557 shares of RadNet stock in a transaction on Tuesday, November 19th. The stock was sold at an average price of $80.00, for a total value of $3,084,560.00. Following the transaction, the insider now directly owns 192,724 shares in the company, valued at $15,417,920. The trade was a 16.67 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. 5.12% of the stock is owned by insiders.

RadNet Profile

(

Free Report)

RadNet, Inc, together with its subsidiaries, provides outpatient diagnostic imaging services in the United States. The company operates in two segments: Imaging Centers and Artificial Intelligence. Its services include magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, diagnostic radiology, fluoroscopy, and other related procedures, as well as multi-modality imaging services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider RadNet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RadNet wasn't on the list.

While RadNet currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.