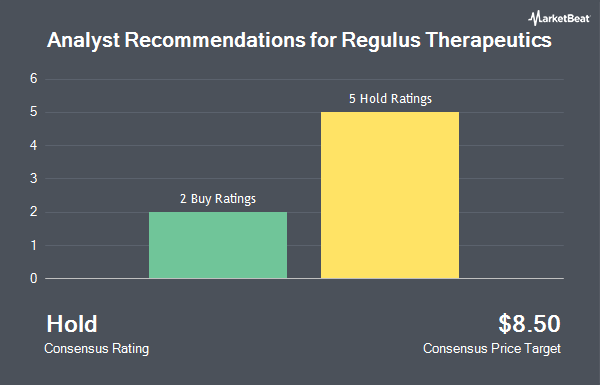

Shares of Regulus Therapeutics Inc. (NASDAQ:RGLS - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the six analysts that are currently covering the company, MarketBeat reports. One analyst has rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average 12 month target price among brokers that have covered the stock in the last year is $10.80.

A number of equities research analysts have recently issued reports on the company. HC Wainwright restated a "buy" rating and issued a $10.00 price target on shares of Regulus Therapeutics in a research report on Monday, November 11th. StockNews.com upgraded Regulus Therapeutics to a "sell" rating in a research report on Tuesday, September 17th. Finally, Oppenheimer reiterated an "outperform" rating and issued a $7.00 price objective on shares of Regulus Therapeutics in a research report on Wednesday, August 14th.

Get Our Latest Stock Analysis on Regulus Therapeutics

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of RGLS. Creative Planning purchased a new position in shares of Regulus Therapeutics during the third quarter worth $26,000. SG Americas Securities LLC purchased a new position in shares of Regulus Therapeutics during the third quarter worth $33,000. Jane Street Group LLC purchased a new position in shares of Regulus Therapeutics during the third quarter worth $46,000. Barclays PLC boosted its position in shares of Regulus Therapeutics by 285.2% during the third quarter. Barclays PLC now owns 84,477 shares of the biopharmaceutical company's stock worth $132,000 after buying an additional 62,549 shares during the period. Finally, Rhumbline Advisers purchased a new position in shares of Regulus Therapeutics during the second quarter worth $136,000. 92.38% of the stock is currently owned by hedge funds and other institutional investors.

Regulus Therapeutics Stock Performance

Shares of RGLS stock traded up $0.07 during trading hours on Friday, reaching $1.47. The company had a trading volume of 288,016 shares, compared to its average volume of 500,064. The stock has a fifty day moving average of $1.53 and a 200-day moving average of $1.76. The company has a market capitalization of $96.29 million, a price-to-earnings ratio of -1.37 and a beta of 1.63. Regulus Therapeutics has a 12-month low of $1.08 and a 12-month high of $3.79.

Regulus Therapeutics (NASDAQ:RGLS - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The biopharmaceutical company reported ($0.21) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.18) by ($0.03). On average, analysts forecast that Regulus Therapeutics will post -0.88 EPS for the current year.

About Regulus Therapeutics

(

Get Free ReportRegulus Therapeutics Inc, a clinical-stage biopharmaceutical company, focuses on discovery and development of drugs that targets microRNAs to treat a range of diseases in the United States. Its product candidates include RGLS8429, an anti-miR next generation oligonucleotide targeting miR-17, which is in Phase 1b clinical trial for the treatment of autosomal dominant polycystic kidney disease.

Featured Stories

Before you consider Regulus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regulus Therapeutics wasn't on the list.

While Regulus Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.