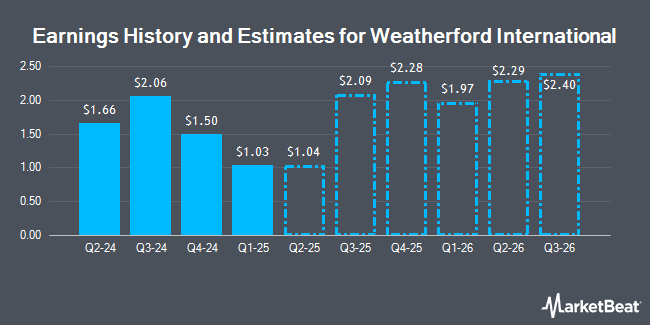

Weatherford International plc (NASDAQ:WFRD - Free Report) - Equities research analysts at Capital One Financial issued their Q1 2026 earnings per share estimates for shares of Weatherford International in a research report issued to clients and investors on Wednesday, November 20th. Capital One Financial analyst D. Becker forecasts that the company will earn $1.63 per share for the quarter. The consensus estimate for Weatherford International's current full-year earnings is $6.91 per share. Capital One Financial also issued estimates for Weatherford International's Q2 2026 earnings at $1.89 EPS, Q3 2026 earnings at $2.00 EPS and FY2026 earnings at $7.65 EPS.

WFRD has been the topic of several other reports. Citigroup dropped their price target on shares of Weatherford International from $130.00 to $115.00 and set a "buy" rating on the stock in a research report on Thursday, November 14th. Bank of America dropped their target price on shares of Weatherford International from $145.00 to $130.00 and set a "buy" rating on the stock in a report on Monday, October 14th. Evercore ISI reduced their price target on Weatherford International from $149.00 to $142.00 and set an "outperform" rating for the company in a report on Thursday, October 24th. Barclays dropped their price objective on Weatherford International from $154.00 to $147.00 and set an "overweight" rating on the stock in a research note on Friday, October 25th. Finally, Raymond James reduced their target price on Weatherford International from $161.00 to $158.00 and set a "strong-buy" rating for the company in a research note on Thursday, July 25th. Six investment analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, Weatherford International currently has an average rating of "Buy" and a consensus price target of $147.29.

View Our Latest Stock Report on WFRD

Weatherford International Stock Up 0.6 %

Shares of Weatherford International stock traded up $0.51 on Friday, reaching $85.83. 1,055,725 shares of the company were exchanged, compared to its average volume of 913,745. The company has a market capitalization of $6.24 billion, a price-to-earnings ratio of 12.10, a PEG ratio of 0.69 and a beta of 0.60. The company has a current ratio of 2.04, a quick ratio of 1.49 and a debt-to-equity ratio of 1.20. Weatherford International has a one year low of $77.00 and a one year high of $135.00. The company has a 50-day moving average of $87.08 and a 200 day moving average of $105.10.

Weatherford International (NASDAQ:WFRD - Get Free Report) last released its earnings results on Tuesday, October 22nd. The company reported $2.06 earnings per share for the quarter, beating analysts' consensus estimates of $1.65 by $0.41. Weatherford International had a net margin of 9.65% and a return on equity of 46.25%. The business had revenue of $1.41 billion during the quarter, compared to the consensus estimate of $1.42 billion. During the same quarter last year, the firm earned $1.66 earnings per share. The firm's revenue for the quarter was up 7.3% compared to the same quarter last year.

Institutional Trading of Weatherford International

Institutional investors have recently bought and sold shares of the company. Pacer Advisors Inc. increased its position in shares of Weatherford International by 551.1% during the third quarter. Pacer Advisors Inc. now owns 1,440,837 shares of the company's stock worth $122,356,000 after acquiring an additional 1,219,553 shares in the last quarter. FMR LLC increased its holdings in Weatherford International by 36.7% during the 3rd quarter. FMR LLC now owns 3,573,003 shares of the company's stock worth $303,419,000 after purchasing an additional 959,783 shares in the last quarter. Boston Partners raised its stake in shares of Weatherford International by 19.3% in the first quarter. Boston Partners now owns 2,722,281 shares of the company's stock worth $315,240,000 after purchasing an additional 439,700 shares during the last quarter. William Blair Investment Management LLC bought a new position in shares of Weatherford International in the second quarter valued at approximately $51,287,000. Finally, Westwood Holdings Group Inc. lifted its holdings in shares of Weatherford International by 5,525.3% in the first quarter. Westwood Holdings Group Inc. now owns 359,569 shares of the company's stock valued at $41,501,000 after purchasing an additional 353,177 shares in the last quarter. Institutional investors own 97.23% of the company's stock.

Insider Buying and Selling

In related news, CAO Desmond J. Mills sold 6,531 shares of the company's stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $79.86, for a total transaction of $521,565.66. Following the completion of the sale, the chief accounting officer now owns 11,680 shares of the company's stock, valued at $932,764.80. This represents a 35.86 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, EVP David John Reed sold 6,805 shares of the stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $93.96, for a total transaction of $639,397.80. The disclosure for this sale can be found here. 1.60% of the stock is owned by insiders.

Weatherford International Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, December 5th. Shareholders of record on Wednesday, November 6th will be issued a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 1.17%. The ex-dividend date of this dividend is Wednesday, November 6th. Weatherford International's dividend payout ratio is 14.04%.

About Weatherford International

(

Get Free Report)

Weatherford International plc, an energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide. The company operates through three segments: Drilling and Evaluation; Well Construction and Completions; and Production and Intervention.

Further Reading

Before you consider Weatherford International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weatherford International wasn't on the list.

While Weatherford International currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.