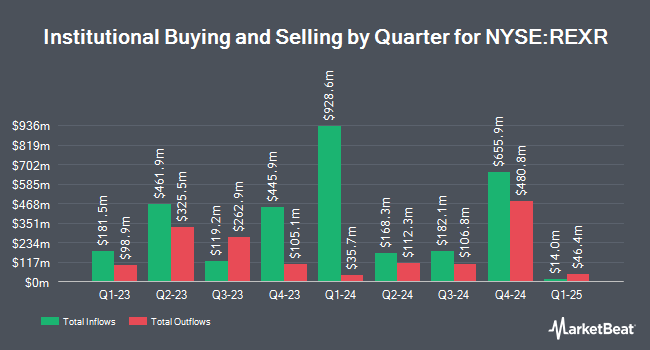

Sumitomo Mitsui Trust Group Inc. reduced its holdings in Rexford Industrial Realty, Inc. (NYSE:REXR - Free Report) by 34.2% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 238,553 shares of the real estate investment trust's stock after selling 123,934 shares during the period. Sumitomo Mitsui Trust Group Inc. owned approximately 0.11% of Rexford Industrial Realty worth $12,002,000 as of its most recent SEC filing.

Other large investors have also recently bought and sold shares of the company. Fulton Bank N.A. increased its position in shares of Rexford Industrial Realty by 4.7% during the third quarter. Fulton Bank N.A. now owns 5,038 shares of the real estate investment trust's stock worth $253,000 after acquiring an additional 224 shares in the last quarter. Hennion & Walsh Asset Management Inc. increased its position in shares of Rexford Industrial Realty by 2.4% during the second quarter. Hennion & Walsh Asset Management Inc. now owns 14,641 shares of the real estate investment trust's stock worth $653,000 after acquiring an additional 337 shares in the last quarter. Victory Capital Management Inc. increased its position in shares of Rexford Industrial Realty by 0.8% during the second quarter. Victory Capital Management Inc. now owns 46,066 shares of the real estate investment trust's stock worth $2,054,000 after acquiring an additional 345 shares in the last quarter. Massmutual Trust Co. FSB ADV increased its position in shares of Rexford Industrial Realty by 169.4% during the second quarter. Massmutual Trust Co. FSB ADV now owns 555 shares of the real estate investment trust's stock worth $25,000 after acquiring an additional 349 shares in the last quarter. Finally, Naviter Wealth LLC increased its position in shares of Rexford Industrial Realty by 2.6% during the third quarter. Naviter Wealth LLC now owns 14,907 shares of the real estate investment trust's stock worth $756,000 after acquiring an additional 382 shares in the last quarter. Institutional investors own 99.52% of the company's stock.

Insiders Place Their Bets

In other Rexford Industrial Realty news, CFO Laura E. Clark sold 14,185 shares of Rexford Industrial Realty stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $50.15, for a total value of $711,377.75. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Corporate insiders own 1.20% of the company's stock.

Rexford Industrial Realty Stock Performance

Shares of NYSE REXR traded up $0.69 during mid-day trading on Monday, reaching $42.70. 1,673,340 shares of the company were exchanged, compared to its average volume of 1,729,270. The company's 50-day simple moving average is $46.92 and its 200-day simple moving average is $47.08. The company has a quick ratio of 1.20, a current ratio of 1.20 and a debt-to-equity ratio of 0.40. The stock has a market capitalization of $9.50 billion, a P/E ratio of 33.98, a P/E/G ratio of 2.01 and a beta of 0.94. Rexford Industrial Realty, Inc. has a twelve month low of $41.16 and a twelve month high of $58.02.

Rexford Industrial Realty (NYSE:REXR - Get Free Report) last posted its earnings results on Wednesday, October 16th. The real estate investment trust reported $0.30 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.58 by ($0.28). The company had revenue of $241.84 million for the quarter, compared to analyst estimates of $235.81 million. Rexford Industrial Realty had a return on equity of 3.35% and a net margin of 30.40%. The business's quarterly revenue was up 17.7% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.56 EPS. As a group, research analysts predict that Rexford Industrial Realty, Inc. will post 2.34 earnings per share for the current year.

Rexford Industrial Realty Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be paid a $0.4175 dividend. This represents a $1.67 annualized dividend and a yield of 3.91%. The ex-dividend date is Tuesday, December 31st. Rexford Industrial Realty's dividend payout ratio (DPR) is 135.77%.

Wall Street Analyst Weigh In

Several equities research analysts have recently issued reports on the stock. Evercore ISI reissued an "outperform" rating on shares of Rexford Industrial Realty in a research report on Friday, October 18th. Truist Financial decreased their target price on shares of Rexford Industrial Realty from $54.00 to $50.00 and set a "buy" rating for the company in a research report on Tuesday, November 12th. Scotiabank downgraded shares of Rexford Industrial Realty from a "sector outperform" rating to a "sector perform" rating and decreased their target price for the company from $55.00 to $48.00 in a research report on Friday, October 25th. Wells Fargo & Company decreased their target price on shares of Rexford Industrial Realty from $66.00 to $61.00 and set an "overweight" rating for the company in a research report on Wednesday, August 28th. Finally, Bank of America downgraded shares of Rexford Industrial Realty from a "buy" rating to a "neutral" rating and decreased their target price for the company from $66.00 to $49.00 in a research report on Monday, October 21st. Two equities research analysts have rated the stock with a sell rating, six have issued a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, Rexford Industrial Realty has a consensus rating of "Hold" and a consensus price target of $51.09.

Read Our Latest Stock Analysis on REXR

About Rexford Industrial Realty

(

Free Report)

Rexford Industrial creates value by investing in, operating and redeveloping industrial properties throughout infill Southern California, the world's fourth largest industrial market and consistently the highest-demand with lowest-supply major market in the nation. The Company's highly differentiated strategy enables internal and external growth opportunities through its proprietary value creation and asset management capabilities.

Featured Articles

Before you consider Rexford Industrial Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rexford Industrial Realty wasn't on the list.

While Rexford Industrial Realty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.