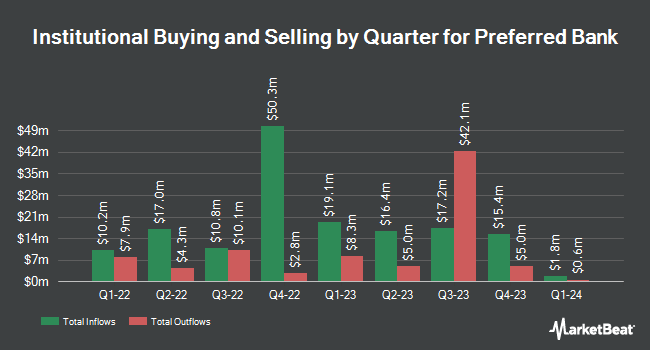

Robeco Institutional Asset Management B.V. reduced its stake in shares of Preferred Bank (NASDAQ:PFBC - Free Report) by 52.3% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 5,685 shares of the bank's stock after selling 6,225 shares during the quarter. Robeco Institutional Asset Management B.V.'s holdings in Preferred Bank were worth $456,000 at the end of the most recent quarter.

Other hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. lifted its position in Preferred Bank by 1.3% in the first quarter. Vanguard Group Inc. now owns 868,073 shares of the bank's stock worth $66,642,000 after purchasing an additional 10,931 shares during the period. Dimensional Fund Advisors LP lifted its holdings in shares of Preferred Bank by 0.7% during the 2nd quarter. Dimensional Fund Advisors LP now owns 680,337 shares of the bank's stock worth $51,357,000 after acquiring an additional 4,539 shares during the period. LSV Asset Management boosted its position in shares of Preferred Bank by 121.0% during the 2nd quarter. LSV Asset Management now owns 171,330 shares of the bank's stock valued at $12,934,000 after acquiring an additional 93,815 shares in the last quarter. Dana Investment Advisors Inc. increased its stake in Preferred Bank by 7.4% in the second quarter. Dana Investment Advisors Inc. now owns 98,591 shares of the bank's stock valued at $7,443,000 after acquiring an additional 6,809 shares during the period. Finally, AQR Capital Management LLC raised its position in Preferred Bank by 24.7% in the second quarter. AQR Capital Management LLC now owns 77,745 shares of the bank's stock worth $5,869,000 after purchasing an additional 15,391 shares in the last quarter. 72.77% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several equities research analysts have recently weighed in on the company. Stephens upped their price objective on Preferred Bank from $90.00 to $94.00 and gave the company an "overweight" rating in a research note on Tuesday, October 22nd. Piper Sandler upped their price target on Preferred Bank from $88.00 to $105.00 and gave the company an "overweight" rating in a research report on Monday, July 29th.

Check Out Our Latest Stock Report on Preferred Bank

Preferred Bank Price Performance

PFBC stock traded up $2.82 during trading on Monday, hitting $96.21. 88,381 shares of the stock traded hands, compared to its average volume of 82,397. The stock has a market cap of $1.39 billion, a price-to-earnings ratio of 9.71 and a beta of 0.94. Preferred Bank has a one year low of $60.20 and a one year high of $97.21. The company has a current ratio of 1.08, a quick ratio of 1.08 and a debt-to-equity ratio of 0.20. The company has a 50 day simple moving average of $82.12 and a 200 day simple moving average of $79.38.

Preferred Bank (NASDAQ:PFBC - Get Free Report) last posted its earnings results on Monday, October 21st. The bank reported $2.46 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.39 by $0.07. The company had revenue of $132.88 million during the quarter, compared to analysts' expectations of $68.80 million. Preferred Bank had a net margin of 26.20% and a return on equity of 19.01%. During the same quarter in the previous year, the company posted $2.71 earnings per share. Equities analysts expect that Preferred Bank will post 9.75 EPS for the current fiscal year.

Preferred Bank Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, October 21st. Stockholders of record on Monday, October 7th were issued a dividend of $0.70 per share. This represents a $2.80 annualized dividend and a dividend yield of 2.91%. The ex-dividend date of this dividend was Monday, October 7th. Preferred Bank's payout ratio is presently 28.06%.

About Preferred Bank

(

Free Report)

Preferred Bank provides various commercial banking products and services to small and mid-sized businesses and their owners, entrepreneurs, real estate developers and investors, professionals, and high net worth individuals. The company accepts checking, savings, and money market deposit accounts; fixed-rate and fixed maturity retail, and non-retail certificates of deposit; and individual retirement accounts.

Featured Articles

Before you consider Preferred Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Preferred Bank wasn't on the list.

While Preferred Bank currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.