JFrog (NASDAQ:FROG - Free Report) had its price target raised by Robert W. Baird from $32.00 to $36.00 in a report released on Friday,Benzinga reports. They currently have an outperform rating on the stock.

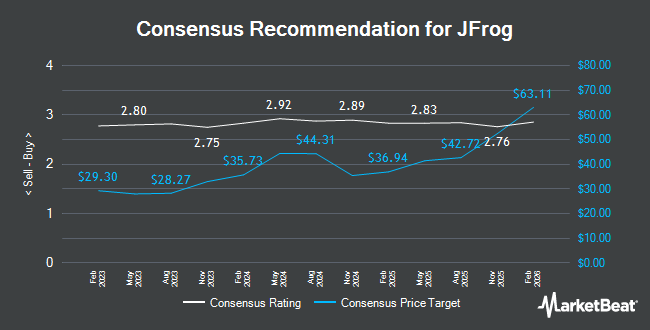

Several other analysts have also commented on FROG. KeyCorp increased their price target on shares of JFrog from $30.00 to $32.00 and gave the company an "overweight" rating in a research report on Thursday, September 12th. Cantor Fitzgerald reissued an "overweight" rating and issued a $35.00 price target on shares of JFrog in a research note on Tuesday, October 29th. Stifel Nicolaus lowered their price target on JFrog from $45.00 to $30.00 and set a "buy" rating for the company in a research report on Thursday, August 8th. Piper Sandler dropped their price objective on JFrog from $40.00 to $32.00 and set a "neutral" rating on the stock in a report on Thursday, August 8th. Finally, Needham & Company LLC reissued a "buy" rating and issued a $33.00 price target on shares of JFrog in a research report on Monday, September 16th. Three research analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $37.83.

Get Our Latest Stock Analysis on FROG

JFrog Stock Performance

Shares of NASDAQ FROG traded down $1.76 during midday trading on Friday, reaching $31.10. The stock had a trading volume of 2,390,712 shares, compared to its average volume of 1,276,065. The stock has a 50-day moving average of $29.07 and a 200-day moving average of $32.44. JFrog has a 12-month low of $22.91 and a 12-month high of $48.81. The company has a market capitalization of $3.17 billion, a price-to-earnings ratio of -67.80 and a beta of 0.93.

JFrog (NASDAQ:FROG - Get Free Report) last announced its earnings results on Wednesday, August 7th. The company reported ($0.09) EPS for the quarter, missing analysts' consensus estimates of ($0.06) by ($0.03). JFrog had a negative return on equity of 4.63% and a negative net margin of 12.35%. The company had revenue of $103.04 million during the quarter, compared to analysts' expectations of $103.53 million. As a group, analysts forecast that JFrog will post -0.28 EPS for the current fiscal year.

Insider Activity at JFrog

In related news, CEO Ben Haim Shlomi sold 20,606 shares of the stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $27.06, for a total transaction of $557,598.36. Following the sale, the chief executive officer now owns 5,027,493 shares of the company's stock, valued at approximately $136,043,960.58. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other news, CTO Yoav Landman sold 15,000 shares of the business's stock in a transaction that occurred on Friday, October 11th. The stock was sold at an average price of $30.85, for a total value of $462,750.00. Following the sale, the chief technology officer now directly owns 6,612,242 shares of the company's stock, valued at $203,987,665.70. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CEO Ben Haim Shlomi sold 20,606 shares of JFrog stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $27.06, for a total transaction of $557,598.36. Following the completion of the transaction, the chief executive officer now directly owns 5,027,493 shares of the company's stock, valued at $136,043,960.58. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 126,031 shares of company stock valued at $3,618,247. 15.70% of the stock is owned by insiders.

Institutional Investors Weigh In On JFrog

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Future Financial Wealth Managment LLC bought a new position in shares of JFrog in the 3rd quarter valued at about $29,000. Advisors Asset Management Inc. raised its position in shares of JFrog by 33.9% in the 1st quarter. Advisors Asset Management Inc. now owns 2,615 shares of the company's stock valued at $116,000 after purchasing an additional 662 shares during the last quarter. SG Americas Securities LLC purchased a new stake in JFrog during the 2nd quarter valued at about $187,000. Sanctuary Advisors LLC acquired a new position in JFrog during the second quarter valued at $188,000. Finally, US Bancorp DE increased its holdings in shares of JFrog by 13.6% during the 3rd quarter. US Bancorp DE now owns 6,687 shares of the company's stock valued at $194,000 after purchasing an additional 798 shares in the last quarter. 85.02% of the stock is currently owned by hedge funds and other institutional investors.

JFrog Company Profile

(

Get Free Report)

JFrog Ltd. provides end-to-end hybrid software supply chain platform in the United States, Israel, India, and internationally. The company offers JFrog Artifactory, a package repository that allows teams and organizations to store, update, and manage their software packages; JFrog Curation that functions as a guardian outside the software development pipeline, controlling the admission of packages into an organization, primarily from open source or public repositories; JFrog Xray, which scans JFrog Artifactory to secure all software packages; JFrog Advanced Security, an optional add-on for select JFrog subscriptions; and JFrog Distribution that provides software package distribution.

Read More

Before you consider JFrog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JFrog wasn't on the list.

While JFrog currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.