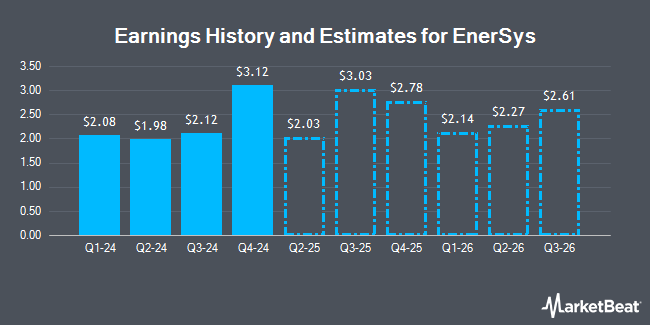

EnerSys (NYSE:ENS - Free Report) - Equities researchers at Roth Capital dropped their Q3 2025 earnings per share (EPS) estimates for EnerSys in a research report issued to clients and investors on Friday, November 8th. Roth Capital analyst C. Moore now anticipates that the industrial products company will post earnings of $2.20 per share for the quarter, down from their prior forecast of $2.27. Roth Capital currently has a "Strong-Buy" rating on the stock. The consensus estimate for EnerSys' current full-year earnings is $8.88 per share. Roth Capital also issued estimates for EnerSys' Q4 2025 earnings at $2.50 EPS, FY2025 earnings at $8.80 EPS, Q1 2026 earnings at $2.17 EPS, Q2 2026 earnings at $2.18 EPS, Q3 2026 earnings at $2.49 EPS, Q4 2026 earnings at $2.75 EPS and FY2026 earnings at $9.60 EPS.

A number of other research firms have also weighed in on ENS. StockNews.com lowered shares of EnerSys from a "strong-buy" rating to a "buy" rating in a report on Tuesday, October 15th. Roth Mkm reiterated a "buy" rating and issued a $120.00 price target on shares of EnerSys in a research note on Monday, September 23rd. Two investment analysts have rated the stock with a hold rating, two have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $118.00.

Get Our Latest Stock Analysis on EnerSys

EnerSys Stock Up 3.2 %

EnerSys stock traded up $3.13 during midday trading on Monday, hitting $100.57. 161,504 shares of the company were exchanged, compared to its average volume of 245,346. The company has a market cap of $4.00 billion, a PE ratio of 13.80, a price-to-earnings-growth ratio of 0.61 and a beta of 1.24. EnerSys has a fifty-two week low of $84.41 and a fifty-two week high of $112.53. The company's fifty day moving average price is $99.79 and its 200-day moving average price is $100.82. The company has a debt-to-equity ratio of 0.65, a current ratio of 2.97 and a quick ratio of 1.66.

EnerSys (NYSE:ENS - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The industrial products company reported $2.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.07 by $0.05. The firm had revenue of $883.70 million during the quarter, compared to the consensus estimate of $891.78 million. EnerSys had a return on equity of 20.04% and a net margin of 8.25%. The firm's quarterly revenue was down 1.9% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.84 EPS.

EnerSys Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, December 13th will be paid a $0.24 dividend. The ex-dividend date is Friday, December 13th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 0.95%. EnerSys's dividend payout ratio (DPR) is presently 13.60%.

Insider Transactions at EnerSys

In other EnerSys news, CEO David M. Shaffer sold 2,400 shares of the stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $100.00, for a total transaction of $240,000.00. Following the transaction, the chief executive officer now owns 244,140 shares of the company's stock, valued at $24,414,000. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In other EnerSys news, VP Joern Tinnemeyer sold 2,200 shares of the firm's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $100.00, for a total value of $220,000.00. Following the transaction, the vice president now owns 25,368 shares of the company's stock, valued at $2,536,800. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CEO David M. Shaffer sold 2,400 shares of EnerSys stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $100.00, for a total value of $240,000.00. Following the completion of the transaction, the chief executive officer now owns 244,140 shares of the company's stock, valued at approximately $24,414,000. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 22,700 shares of company stock valued at $2,271,843. Insiders own 1.61% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Thurston Springer Miller Herd & Titak Inc. acquired a new stake in shares of EnerSys in the second quarter valued at approximately $25,000. Covestor Ltd raised its stake in EnerSys by 231.6% during the 1st quarter. Covestor Ltd now owns 378 shares of the industrial products company's stock valued at $36,000 after acquiring an additional 264 shares in the last quarter. UMB Bank n.a. boosted its position in EnerSys by 36.2% during the 2nd quarter. UMB Bank n.a. now owns 354 shares of the industrial products company's stock worth $37,000 after acquiring an additional 94 shares during the period. GAMMA Investing LLC grew its stake in shares of EnerSys by 141.8% in the second quarter. GAMMA Investing LLC now owns 382 shares of the industrial products company's stock worth $40,000 after purchasing an additional 224 shares in the last quarter. Finally, Canada Pension Plan Investment Board acquired a new position in shares of EnerSys during the second quarter valued at $41,000. Institutional investors and hedge funds own 94.93% of the company's stock.

About EnerSys

(

Get Free Report)

EnerSys engages in the provision of stored energy solutions for industrial applications worldwide. It operates in four segments: Energy Systems, Motive Power, Specialty, and New Ventures. The Energy Systems segment offers uninterruptible power systems (UPS) applications for computer and computer-controlled systems, as well as telecommunications systems; switchgear and electrical control systems used in industrial facilities and electric utilities, large-scale energy storage, and energy pipelines; integrated power solutions and services to broadband, telecom, data center, and renewable and industrial customers; and thermally managed cabinets and enclosures for electronic equipment and batteries.

Featured Stories

Before you consider EnerSys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EnerSys wasn't on the list.

While EnerSys currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.