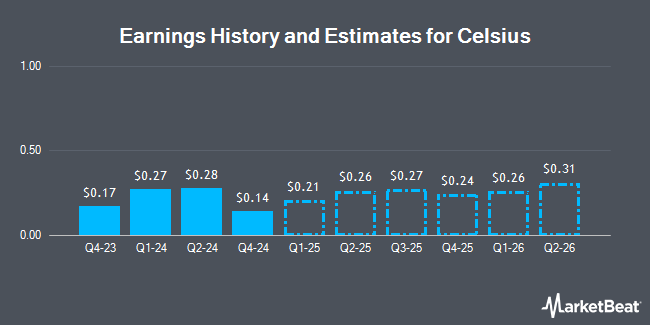

Celsius Holdings, Inc. (NASDAQ:CELH - Free Report) - Research analysts at Roth Capital dropped their Q1 2025 earnings per share (EPS) estimates for Celsius in a report issued on Wednesday, November 6th. Roth Capital analyst S. Mcgowan now anticipates that the company will post earnings of $0.21 per share for the quarter, down from their prior forecast of $0.25. The consensus estimate for Celsius' current full-year earnings is $0.70 per share. Roth Capital also issued estimates for Celsius' Q3 2025 earnings at $0.18 EPS, FY2025 earnings at $0.88 EPS, Q1 2026 earnings at $0.27 EPS, Q2 2026 earnings at $0.31 EPS, Q3 2026 earnings at $0.22 EPS and FY2026 earnings at $1.11 EPS.

CELH has been the topic of a number of other research reports. LADENBURG THALM/SH SH cut their price target on Celsius from $72.00 to $68.00 and set a "neutral" rating on the stock in a report on Monday, October 21st. Jefferies Financial Group reduced their price objective on shares of Celsius from $53.00 to $48.00 and set a "buy" rating for the company in a report on Thursday, October 10th. B. Riley dropped their price target on shares of Celsius from $50.00 to $47.00 and set a "buy" rating on the stock in a research report on Monday, November 4th. Roth Mkm lowered their price objective on shares of Celsius from $43.00 to $40.00 and set a "buy" rating on the stock in a research note on Thursday. Finally, UBS Group decreased their price target on Celsius from $50.00 to $45.00 and set a "buy" rating for the company in a research note on Thursday. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and eleven have given a buy rating to the stock. Based on data from MarketBeat.com, Celsius currently has an average rating of "Moderate Buy" and a consensus price target of $54.40.

Check Out Our Latest Report on Celsius

Celsius Stock Down 4.8 %

CELH stock traded down $1.38 during mid-day trading on Monday, reaching $27.52. The company had a trading volume of 5,525,767 shares, compared to its average volume of 5,947,910. The stock has a market capitalization of $6.47 billion, a P/E ratio of 38.60, a P/E/G ratio of 2.52 and a beta of 1.86. The stock's 50-day simple moving average is $32.15 and its two-hundred day simple moving average is $50.92. Celsius has a one year low of $27.37 and a one year high of $99.62.

Institutional Investors Weigh In On Celsius

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Vanguard Group Inc. boosted its stake in Celsius by 18.7% in the first quarter. Vanguard Group Inc. now owns 16,313,762 shares of the company's stock worth $1,352,737,000 after purchasing an additional 2,567,290 shares in the last quarter. Capital International Investors lifted its position in shares of Celsius by 50.6% during the first quarter. Capital International Investors now owns 3,966,194 shares of the company's stock worth $328,877,000 after purchasing an additional 1,333,217 shares in the last quarter. Massachusetts Financial Services Co. MA grew its stake in shares of Celsius by 231.2% during the second quarter. Massachusetts Financial Services Co. MA now owns 3,946,208 shares of the company's stock valued at $225,289,000 after purchasing an additional 2,754,722 shares during the last quarter. Bank of New York Mellon Corp increased its holdings in shares of Celsius by 36.7% in the second quarter. Bank of New York Mellon Corp now owns 2,942,433 shares of the company's stock valued at $167,983,000 after purchasing an additional 790,014 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD raised its position in Celsius by 0.3% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 2,802,264 shares of the company's stock worth $232,365,000 after purchasing an additional 9,054 shares during the last quarter. Institutional investors and hedge funds own 60.95% of the company's stock.

Insider Activity

In other news, CEO John Fieldly sold 74,847 shares of the firm's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $32.80, for a total transaction of $2,454,981.60. Following the completion of the sale, the chief executive officer now directly owns 1,812,490 shares of the company's stock, valued at $59,449,672. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. 2.20% of the stock is owned by corporate insiders.

Celsius Company Profile

(

Get Free Report)

Celsius Holdings, Inc develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally. The company offers CELSIUS, a fitness drink or supplement designed to accelerate metabolism and burn body fat; various flavors and carbonated and non-carbonated functional energy drinks under the CELSIUS Originals and Vibe name, as well as functional energy drink under the CELSIUS Essentials and CELSIUS On-the-Go Powder names; and CELSIUS ready-to drink products.

See Also

Before you consider Celsius, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celsius wasn't on the list.

While Celsius currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.