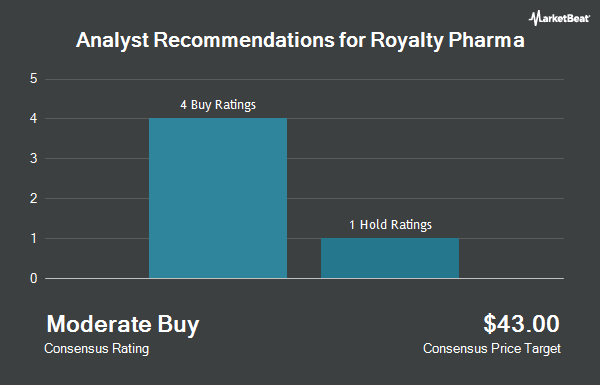

Royalty Pharma plc (NASDAQ:RPRX - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the six ratings firms that are presently covering the firm, MarketBeat reports. One research analyst has rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average 1-year price target among analysts that have covered the stock in the last year is $41.67.

RPRX has been the topic of several analyst reports. The Goldman Sachs Group increased their price objective on Royalty Pharma from $50.00 to $51.00 and gave the company a "buy" rating in a research note on Wednesday, August 14th. Citigroup reduced their price objective on Royalty Pharma from $60.00 to $40.00 and set a "buy" rating on the stock in a research note on Friday, October 25th. Finally, StockNews.com upgraded Royalty Pharma from a "hold" rating to a "buy" rating in a research note on Tuesday, November 5th.

Check Out Our Latest Analysis on Royalty Pharma

Hedge Funds Weigh In On Royalty Pharma

Hedge funds have recently made changes to their positions in the company. Versant Capital Management Inc grew its holdings in shares of Royalty Pharma by 5,215.0% during the second quarter. Versant Capital Management Inc now owns 1,063 shares of the biopharmaceutical company's stock worth $28,000 after purchasing an additional 1,043 shares during the last quarter. Gladius Capital Management LP purchased a new position in shares of Royalty Pharma during the second quarter worth about $32,000. Blue Trust Inc. grew its holdings in shares of Royalty Pharma by 362.7% during the third quarter. Blue Trust Inc. now owns 1,203 shares of the biopharmaceutical company's stock worth $32,000 after purchasing an additional 943 shares during the last quarter. EverSource Wealth Advisors LLC boosted its stake in shares of Royalty Pharma by 32.1% during the second quarter. EverSource Wealth Advisors LLC now owns 2,698 shares of the biopharmaceutical company's stock worth $76,000 after buying an additional 655 shares during the period. Finally, Transamerica Financial Advisors Inc. boosted its stake in shares of Royalty Pharma by 99.9% during the third quarter. Transamerica Financial Advisors Inc. now owns 3,459 shares of the biopharmaceutical company's stock worth $98,000 after buying an additional 1,729 shares during the period. Hedge funds and other institutional investors own 54.35% of the company's stock.

Royalty Pharma Trading Up 0.1 %

RPRX traded up $0.03 during trading hours on Friday, reaching $26.43. The company's stock had a trading volume of 2,461,722 shares, compared to its average volume of 3,097,993. The company has a debt-to-equity ratio of 0.64, a current ratio of 1.54 and a quick ratio of 1.54. The business's 50-day moving average is $27.30 and its 200-day moving average is $27.39. Royalty Pharma has a fifty-two week low of $25.10 and a fifty-two week high of $31.66. The stock has a market cap of $15.57 billion, a PE ratio of 13.69, a P/E/G ratio of 4.64 and a beta of 0.47.

Royalty Pharma Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Friday, November 15th will be issued a dividend of $0.21 per share. This represents a $0.84 annualized dividend and a dividend yield of 3.18%. The ex-dividend date is Friday, November 15th. Royalty Pharma's payout ratio is 43.52%.

About Royalty Pharma

(

Get Free ReportRoyalty Pharma plc operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States. It is also involved in the identification, evaluation, and acquisition of royalties on various biopharmaceutical therapies. In addition, the company collaborates with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

Featured Stories

Before you consider Royalty Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royalty Pharma wasn't on the list.

While Royalty Pharma currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.