JFrog (NASDAQ:FROG - Free Report) had its price target increased by Scotiabank from $25.00 to $30.00 in a research report report published on Friday morning,Benzinga reports. Scotiabank currently has a sector perform rating on the stock.

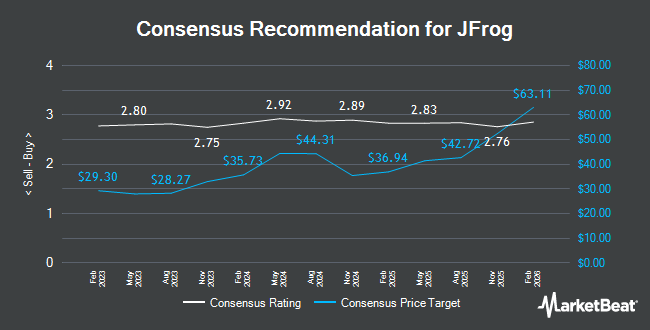

A number of other brokerages also recently weighed in on FROG. Stifel Nicolaus cut their price target on shares of JFrog from $45.00 to $30.00 and set a "buy" rating on the stock in a research report on Thursday, August 8th. Bank of America cut their price target on shares of JFrog from $54.00 to $44.00 and set a "buy" rating on the stock in a research report on Thursday, August 8th. KeyCorp increased their price target on shares of JFrog from $30.00 to $32.00 and gave the company an "overweight" rating in a research report on Thursday, September 12th. DA Davidson restated a "buy" rating and set a $40.00 target price on shares of JFrog in a report on Monday, October 14th. Finally, Barclays dropped their target price on shares of JFrog from $50.00 to $40.00 and set an "overweight" rating on the stock in a report on Friday, August 9th. Three investment analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $37.83.

Check Out Our Latest Stock Analysis on FROG

JFrog Price Performance

Shares of NASDAQ FROG traded down $1.76 during mid-day trading on Friday, hitting $31.10. The company's stock had a trading volume of 2,391,982 shares, compared to its average volume of 1,276,065. The stock has a market cap of $3.17 billion, a price-to-earnings ratio of -67.80 and a beta of 0.93. JFrog has a one year low of $22.91 and a one year high of $48.81. The company's fifty day simple moving average is $29.07 and its 200-day simple moving average is $32.44.

JFrog (NASDAQ:FROG - Get Free Report) last announced its quarterly earnings results on Wednesday, August 7th. The company reported ($0.09) earnings per share for the quarter, missing analysts' consensus estimates of ($0.06) by ($0.03). The firm had revenue of $103.04 million during the quarter, compared to analyst estimates of $103.53 million. JFrog had a negative net margin of 12.35% and a negative return on equity of 4.63%. On average, sell-side analysts predict that JFrog will post -0.28 EPS for the current year.

Insider Activity at JFrog

In related news, CTO Yoav Landman sold 15,000 shares of the firm's stock in a transaction on Friday, October 11th. The shares were sold at an average price of $30.85, for a total value of $462,750.00. Following the completion of the transaction, the chief technology officer now directly owns 6,612,242 shares of the company's stock, valued at approximately $203,987,665.70. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, CTO Yoav Landman sold 15,000 shares of the firm's stock in a transaction on Friday, October 11th. The shares were sold at an average price of $30.85, for a total value of $462,750.00. Following the completion of the transaction, the chief technology officer now directly owns 6,612,242 shares of the company's stock, valued at approximately $203,987,665.70. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CRO Tali Notman sold 10,699 shares of JFrog stock in a transaction on Monday, September 9th. The stock was sold at an average price of $28.29, for a total transaction of $302,674.71. Following the transaction, the executive now directly owns 536,714 shares of the company's stock, valued at approximately $15,183,639.06. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 126,031 shares of company stock valued at $3,618,247. 15.70% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On JFrog

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Vanguard Group Inc. boosted its position in JFrog by 7.4% during the first quarter. Vanguard Group Inc. now owns 7,578,951 shares of the company's stock worth $335,141,000 after purchasing an additional 523,432 shares during the period. Bank of New York Mellon Corp lifted its holdings in shares of JFrog by 22.3% during the second quarter. Bank of New York Mellon Corp now owns 3,083,650 shares of the company's stock worth $115,791,000 after buying an additional 561,897 shares in the last quarter. TimesSquare Capital Management LLC lifted its holdings in shares of JFrog by 114.1% during the third quarter. TimesSquare Capital Management LLC now owns 3,034,900 shares of the company's stock worth $88,133,000 after buying an additional 1,617,551 shares in the last quarter. Thrivent Financial for Lutherans lifted its holdings in shares of JFrog by 33.3% during the third quarter. Thrivent Financial for Lutherans now owns 2,374,972 shares of the company's stock worth $68,969,000 after buying an additional 593,478 shares in the last quarter. Finally, Lord Abbett & CO. LLC raised its stake in JFrog by 4.4% in the first quarter. Lord Abbett & CO. LLC now owns 1,722,312 shares of the company's stock valued at $76,160,000 after purchasing an additional 73,036 shares in the last quarter. 85.02% of the stock is owned by institutional investors.

JFrog Company Profile

(

Get Free Report)

JFrog Ltd. provides end-to-end hybrid software supply chain platform in the United States, Israel, India, and internationally. The company offers JFrog Artifactory, a package repository that allows teams and organizations to store, update, and manage their software packages; JFrog Curation that functions as a guardian outside the software development pipeline, controlling the admission of packages into an organization, primarily from open source or public repositories; JFrog Xray, which scans JFrog Artifactory to secure all software packages; JFrog Advanced Security, an optional add-on for select JFrog subscriptions; and JFrog Distribution that provides software package distribution.

See Also

Before you consider JFrog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JFrog wasn't on the list.

While JFrog currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.