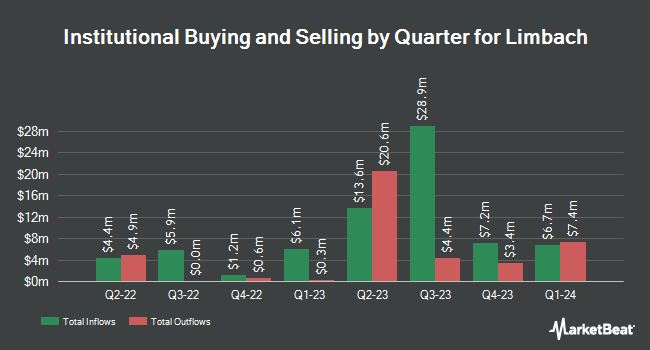

Segall Bryant & Hamill LLC boosted its stake in Limbach Holdings, Inc. (NASDAQ:LMB - Free Report) by 37.1% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 103,008 shares of the construction company's stock after purchasing an additional 27,855 shares during the period. Segall Bryant & Hamill LLC owned approximately 0.91% of Limbach worth $7,804,000 at the end of the most recent quarter.

A number of other large investors have also added to or reduced their stakes in LMB. American Capital Advisory LLC bought a new stake in Limbach in the 3rd quarter worth approximately $25,000. nVerses Capital LLC bought a new stake in Limbach in the 3rd quarter worth approximately $53,000. Harbor Capital Advisors Inc. grew its position in Limbach by 6.3% in the 3rd quarter. Harbor Capital Advisors Inc. now owns 2,736 shares of the construction company's stock worth $207,000 after purchasing an additional 162 shares during the period. Quest Partners LLC bought a new stake in Limbach in the 3rd quarter worth approximately $207,000. Finally, The Manufacturers Life Insurance Company bought a new stake in shares of Limbach during the 2nd quarter valued at $223,000. Institutional investors own 55.85% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on LMB. Roth Mkm boosted their price objective on shares of Limbach from $67.00 to $80.00 and gave the company a "buy" rating in a research report on Monday, November 4th. Stifel Nicolaus began coverage on shares of Limbach in a research report on Friday, November 15th. They set a "buy" rating and a $108.00 price objective for the company. Finally, StockNews.com downgraded shares of Limbach from a "buy" rating to a "hold" rating in a research report on Thursday, November 14th.

Get Our Latest Analysis on LMB

Insider Activity at Limbach

In other Limbach news, Director Joshua Horowitz sold 5,000 shares of the business's stock in a transaction on Monday, September 9th. The shares were sold at an average price of $64.02, for a total value of $320,100.00. Following the sale, the director now owns 190,000 shares in the company, valued at $12,163,800. The trade was a 2.56 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 10.20% of the stock is owned by corporate insiders.

Limbach Price Performance

Shares of LMB traded up $3.64 during trading hours on Friday, reaching $102.64. 100,999 shares of the stock traded hands, compared to its average volume of 162,137. The company has a current ratio of 1.57, a quick ratio of 1.57 and a debt-to-equity ratio of 0.14. Limbach Holdings, Inc. has a 52-week low of $35.24 and a 52-week high of $103.20. The company's 50-day moving average price is $81.74 and its two-hundred day moving average price is $66.41. The company has a market cap of $1.16 billion, a P/E ratio of 45.73, a price-to-earnings-growth ratio of 3.27 and a beta of 0.97.

Limbach (NASDAQ:LMB - Get Free Report) last released its earnings results on Tuesday, November 5th. The construction company reported $0.62 earnings per share for the quarter, beating analysts' consensus estimates of $0.57 by $0.05. Limbach had a net margin of 5.08% and a return on equity of 20.16%. The company had revenue of $133.90 million for the quarter, compared to analysts' expectations of $129.50 million. During the same quarter in the previous year, the company earned $0.61 EPS. Limbach's revenue for the quarter was up 4.9% on a year-over-year basis. On average, analysts anticipate that Limbach Holdings, Inc. will post 2.54 earnings per share for the current year.

Limbach Profile

(

Free Report)

Limbach Holdings, Inc operates as a building systems solution company in the United States. It operates through two segments, General Contractor Relationships and Owner Direct Relationships. The company engages in the construction and renovation projects that involve primarily include mechanical, plumbing, and electrical services.

Further Reading

Before you consider Limbach, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Limbach wasn't on the list.

While Limbach currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.