Segall Bryant & Hamill LLC grew its holdings in Enpro Inc. (NYSE:NPO - Free Report) by 3.7% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 140,657 shares of the industrial products company's stock after acquiring an additional 5,051 shares during the quarter. Segall Bryant & Hamill LLC owned 0.67% of Enpro worth $22,812,000 at the end of the most recent reporting period.

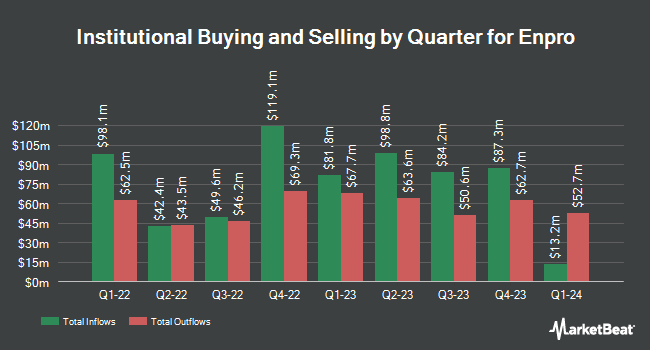

Several other large investors also recently modified their holdings of NPO. Swedbank AB bought a new stake in shares of Enpro in the first quarter worth about $28,691,000. F M Investments LLC acquired a new position in shares of Enpro during the second quarter worth about $14,315,000. Renaissance Technologies LLC boosted its position in shares of Enpro by 129.7% during the second quarter. Renaissance Technologies LLC now owns 29,400 shares of the industrial products company's stock worth $4,280,000 after buying an additional 16,600 shares during the period. Congress Asset Management Co. boosted its position in shares of Enpro by 4.2% during the third quarter. Congress Asset Management Co. now owns 309,042 shares of the industrial products company's stock worth $50,120,000 after buying an additional 12,316 shares during the period. Finally, Sei Investments Co. boosted its position in shares of Enpro by 24.8% during the second quarter. Sei Investments Co. now owns 40,897 shares of the industrial products company's stock worth $5,953,000 after buying an additional 8,125 shares during the period. 98.31% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Separately, StockNews.com cut Enpro from a "buy" rating to a "hold" rating in a research report on Wednesday, November 6th.

Read Our Latest Stock Analysis on NPO

Insider Transactions at Enpro

In other news, CAO Steven R. Bower sold 300 shares of the stock in a transaction that occurred on Thursday, November 14th. The stock was sold at an average price of $162.50, for a total transaction of $48,750.00. Following the transaction, the chief accounting officer now owns 130 shares in the company, valued at approximately $21,125. This trade represents a 69.77 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 1.70% of the stock is owned by corporate insiders.

Enpro Stock Performance

Shares of NPO traded down $0.51 during mid-day trading on Wednesday, reaching $172.99. The company's stock had a trading volume of 118,741 shares, compared to its average volume of 96,450. Enpro Inc. has a 1-year low of $124.06 and a 1-year high of $176.13. The stock has a market cap of $3.63 billion, a P/E ratio of 67.38 and a beta of 1.41. The business has a 50-day simple moving average of $157.25 and a two-hundred day simple moving average of $153.93. The company has a current ratio of 2.76, a quick ratio of 2.00 and a debt-to-equity ratio of 0.43.

Enpro (NYSE:NPO - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The industrial products company reported $1.74 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.87 by ($0.13). Enpro had a net margin of 5.20% and a return on equity of 9.71%. The business had revenue of $260.90 million during the quarter, compared to analyst estimates of $264.47 million. During the same period in the previous year, the business earned $1.58 earnings per share. The business's quarterly revenue was up 4.1% on a year-over-year basis. As a group, equities research analysts anticipate that Enpro Inc. will post 6.89 earnings per share for the current fiscal year.

Enpro Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, December 4th will be paid a dividend of $0.30 per share. The ex-dividend date is Wednesday, December 4th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 0.69%. Enpro's dividend payout ratio (DPR) is currently 46.69%.

Enpro Profile

(

Free Report)

Enpro Inc design, develops, manufactures, and markets proprietary, value-added products and solutions to safeguard critical environments in the United States, Europe, and internationally. It operates through two segments, Sealing Technologies and Advanced Surface Technologies. The Sealing Technologies segment offers single-use hygienic seals, tubing, components and assemblies; metallic, non-metallic, and composite material gaskets; dynamic seals; compression packing; hydraulic components; expansion joints; and wall penetration products for chemical and petrochemical processing, pulp and paper processing, nuclear energy, hydrogen, natural gas, food and biopharmaceutical processing, primary metal manufacturing, mining, water and waste treatment, commercial vehicle, aerospace, medical, filtration, and semiconductor fabrication industries.

Recommended Stories

Before you consider Enpro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enpro wasn't on the list.

While Enpro currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.