Seizert Capital Partners LLC lifted its stake in Elevance Health, Inc. (NYSE:ELV - Free Report) by 26.3% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 104,229 shares of the company's stock after acquiring an additional 21,708 shares during the quarter. Elevance Health makes up approximately 2.4% of Seizert Capital Partners LLC's investment portfolio, making the stock its 9th largest position. Seizert Capital Partners LLC's holdings in Elevance Health were worth $54,199,000 as of its most recent SEC filing.

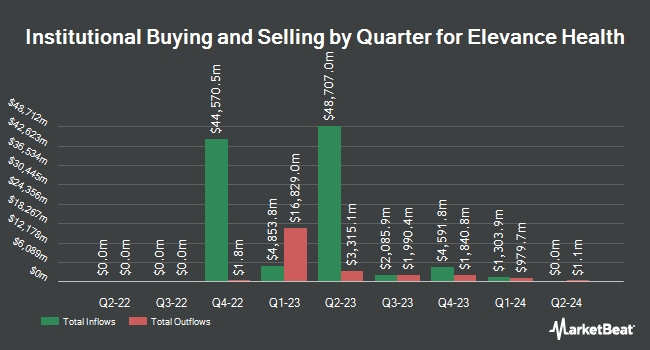

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Ameriprise Financial Inc. increased its position in shares of Elevance Health by 5.3% in the second quarter. Ameriprise Financial Inc. now owns 3,791,793 shares of the company's stock valued at $2,054,641,000 after acquiring an additional 190,118 shares during the last quarter. Capital International Investors grew its holdings in Elevance Health by 3.7% during the first quarter. Capital International Investors now owns 3,498,511 shares of the company's stock worth $1,814,118,000 after purchasing an additional 123,802 shares during the period. Legal & General Group Plc grew its holdings in Elevance Health by 2.9% during the second quarter. Legal & General Group Plc now owns 2,247,091 shares of the company's stock worth $1,217,607,000 after purchasing an additional 64,376 shares during the period. Massachusetts Financial Services Co. MA grew its holdings in Elevance Health by 34.0% during the second quarter. Massachusetts Financial Services Co. MA now owns 2,062,706 shares of the company's stock worth $1,117,698,000 after purchasing an additional 523,910 shares during the period. Finally, First Eagle Investment Management LLC grew its holdings in Elevance Health by 15.5% during the second quarter. First Eagle Investment Management LLC now owns 2,058,283 shares of the company's stock worth $1,115,301,000 after purchasing an additional 275,708 shares during the period. Institutional investors and hedge funds own 89.24% of the company's stock.

Analysts Set New Price Targets

ELV has been the subject of a number of research analyst reports. Wells Fargo & Company reduced their price target on Elevance Health from $593.00 to $495.00 and set an "overweight" rating for the company in a report on Monday, November 4th. Mizuho reduced their price objective on Elevance Health from $585.00 to $505.00 and set an "outperform" rating for the company in a report on Tuesday, November 5th. Cantor Fitzgerald reduced their price objective on Elevance Health from $600.00 to $485.00 and set an "overweight" rating for the company in a report on Friday, October 18th. Stephens restated an "underperform" rating on shares of Elevance Health in a report on Friday, October 18th. Finally, Raymond James set a $485.00 price objective on Elevance Health in a report on Friday, October 18th. One research analyst has rated the stock with a sell rating, two have issued a hold rating, thirteen have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $539.20.

Get Our Latest Stock Report on Elevance Health

Elevance Health Price Performance

ELV traded down $6.35 during trading on Friday, hitting $400.69. 2,616,673 shares of the stock traded hands, compared to its average volume of 2,071,922. Elevance Health, Inc. has a twelve month low of $397.98 and a twelve month high of $567.26. The company has a market cap of $92.93 billion, a price-to-earnings ratio of 14.61, a PEG ratio of 1.19 and a beta of 0.85. The company has a debt-to-equity ratio of 0.56, a current ratio of 1.50 and a quick ratio of 1.50. The business has a 50 day moving average price of $475.29 and a 200 day moving average price of $513.52.

Elevance Health (NYSE:ELV - Get Free Report) last announced its quarterly earnings data on Thursday, October 17th. The company reported $8.37 EPS for the quarter, missing the consensus estimate of $9.66 by ($1.29). Elevance Health had a net margin of 3.68% and a return on equity of 19.56%. The firm had revenue of $44.72 billion for the quarter, compared to analyst estimates of $43.47 billion. During the same quarter in the prior year, the firm earned $8.99 earnings per share. The firm's revenue for the quarter was up 5.3% on a year-over-year basis. Equities research analysts forecast that Elevance Health, Inc. will post 32.96 earnings per share for the current fiscal year.

Elevance Health Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 20th. Shareholders of record on Thursday, December 5th will be given a dividend of $1.63 per share. The ex-dividend date of this dividend is Thursday, December 5th. This represents a $6.52 annualized dividend and a yield of 1.63%. Elevance Health's dividend payout ratio is currently 23.77%.

Insider Buying and Selling at Elevance Health

In other news, EVP Charles Morgan Kendrick, Jr. sold 7,417 shares of the company's stock in a transaction on Friday, October 18th. The shares were sold at an average price of $432.14, for a total transaction of $3,205,182.38. Following the completion of the transaction, the executive vice president now directly owns 8,423 shares in the company, valued at approximately $3,639,915.22. This represents a 46.82 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 0.35% of the company's stock.

Elevance Health Company Profile

(

Free Report)

Elevance Health, Inc, together with its subsidiaries, operates as a health benefits company in the United States. The company operates through four segments: Health Benefits, CarelonRx, Carelon Services, and Corporate & Other. It offers a variety of health plans and services to program members; health products; an array of fee-based administrative managed care services; and specialty and other insurance products and services, such as stop loss, dental, vision, life, disability, and supplemental health insurance benefits.

See Also

Before you consider Elevance Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elevance Health wasn't on the list.

While Elevance Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report