Seizert Capital Partners LLC acquired a new position in Match Group, Inc. (NASDAQ:MTCH - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 260,620 shares of the technology company's stock, valued at approximately $9,862,000. Seizert Capital Partners LLC owned 0.10% of Match Group at the end of the most recent quarter.

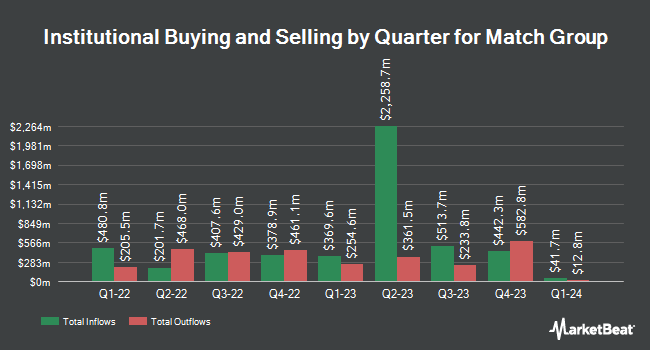

A number of other hedge funds have also bought and sold shares of MTCH. Venturi Wealth Management LLC boosted its stake in Match Group by 617.3% in the 3rd quarter. Venturi Wealth Management LLC now owns 703 shares of the technology company's stock worth $27,000 after purchasing an additional 605 shares during the period. Quarry LP grew its position in shares of Match Group by 54.5% during the 2nd quarter. Quarry LP now owns 1,307 shares of the technology company's stock valued at $40,000 after purchasing an additional 461 shares in the last quarter. Mather Group LLC. increased its holdings in shares of Match Group by 87.6% in the second quarter. Mather Group LLC. now owns 1,700 shares of the technology company's stock worth $52,000 after purchasing an additional 794 shares during the period. International Assets Investment Management LLC purchased a new stake in shares of Match Group in the second quarter worth $61,000. Finally, Livforsakringsbolaget Skandia Omsesidigt boosted its stake in Match Group by 433.5% during the third quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 1,846 shares of the technology company's stock valued at $70,000 after buying an additional 1,500 shares during the period. 94.05% of the stock is currently owned by hedge funds and other institutional investors.

Match Group Stock Performance

Shares of MTCH stock traded down $0.55 during trading hours on Friday, reaching $30.71. The company had a trading volume of 3,737,644 shares, compared to its average volume of 5,056,684. The firm has a market cap of $7.92 billion, a PE ratio of 13.71, a price-to-earnings-growth ratio of 0.85 and a beta of 1.51. The business has a fifty day moving average price of $36.15 and a 200-day moving average price of $33.96. Match Group, Inc. has a one year low of $27.66 and a one year high of $42.42.

Wall Street Analyst Weigh In

MTCH has been the topic of several recent analyst reports. Deutsche Bank Aktiengesellschaft reaffirmed a "buy" rating and issued a $38.00 price target on shares of Match Group in a report on Wednesday, July 31st. Citigroup lifted their target price on shares of Match Group from $33.00 to $39.00 and gave the stock a "neutral" rating in a research report on Thursday, August 1st. Bank of America reissued a "neutral" rating and set a $35.00 price objective (down previously from $50.00) on shares of Match Group in a research note on Thursday, November 7th. Barclays decreased their price target on shares of Match Group from $55.00 to $53.00 and set an "overweight" rating for the company in a research note on Friday, November 8th. Finally, Truist Financial reduced their price target on Match Group from $37.00 to $35.00 and set a "hold" rating on the stock in a research note on Friday, November 8th. Nine analysts have rated the stock with a hold rating, eleven have issued a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $40.73.

Read Our Latest Analysis on MTCH

Match Group Company Profile

(

Free Report)

Match Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

Further Reading

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.